Tradeweb Results Presentation Deck

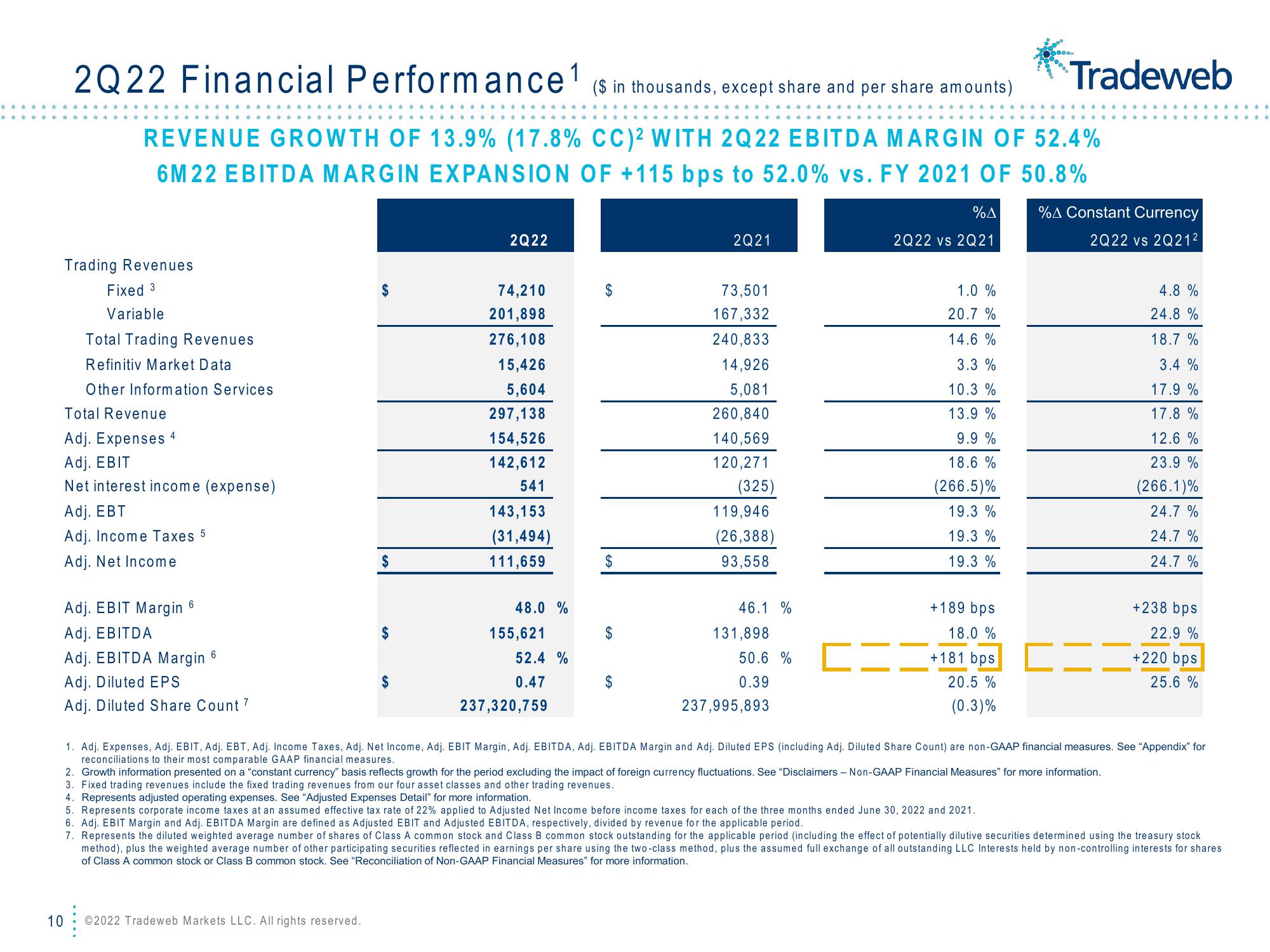

2Q22 Financial Performance ¹ ($ in thousands, except share and per share amounts) Tradeweb

REVENUE GROWTH OF 13.9% (17.8% CC)2 WITH 2Q22 EBITDA MARGIN OF 52.4%

6M 22 EBITDA MARGIN EXPANSION OF +115 bps to 52.0% vs. FY 2021 OF 50.8%

Trading Revenues

Fixed 3

Variable

10

Total Trading Revenues

Refinitiv Market Data

Other Information Services

Total Revenue

Adj. Expenses 4

Adj. EBIT

Net interest income (expense)

Adj. EBT

Adj. Income Taxes 5

Adj. Net Income

Adj. EBIT Margin 6

Adj. EBITDA

Adj. EBITDA Margin 6

Adj. Diluted EPS

Adj. Diluted Share Count 7

$

$

$

$

©2022 Tradeweb Markets LLC. All rights reserved.

2Q22

74,210

201,898

276,108

15,426

5,604

297,138

154,526

142,612

541

143,153

(31,494)

111,659

48.0 %

155,621

52.4 %

0.47

237,320,759

$

$

$

2Q21

73,501

167,332

240,833

14,926

5,081

260,840

140,569

120,271

(325)

119,946

(26,388)

93,558

46.1 %

131,898

50.6 %

0.39

237,995,893

%A

2Q22 vs 2Q21

1.0 %

20.7 %

14.6%

3.3 %

10.3 %

13.9%

9.9 %

18.6%

(266.5)%

19.3%

19.3 %

19.3%

+189 bps

18.0 %

+181 bps

20.5%

(0.3)%

000.

4. Represents adjusted operating expenses. See "Adjusted Expenses Detail" for more information.

5. Represents corporate income taxes at an assumed effective tax rate of 22% applied to Adjusted Net Income before income taxes for each of the three months ended June 30, 2022 and 2021.

0000

%A Constant Currency

2Q22 vs 2Q21²

2. Growth information presented on a "constant currency" basis reflects growth for the period excluding the impact of foreign currency fluctuations. See "Disclaimers - Non-GAAP Financial Measures" for more information.

3. Fixed trading revenues include the fixed trading revenues from our four asset classes and other trading revenues.

4.8 %

24.8%

18.7%

3.4 %

17.9 %

17.8 %

12.6 %

23.9 %

(266.1)%

24.7%

24.7%

24.7%

1. Adj. Expenses, Adj. EBIT, Adj. EBT, Adj. Income Taxes, Adj. Net Income, Adj. EBIT Margin, Adj. EBITDA, Adj. EBITDA Margin and Adj. Diluted EPS (including Adj. Diluted Share Count) are non-GAAP financial measures. See "Appendix" for

reconciliations to their most comparable GAAP financial measures.

+238 bps

22.9%

+220 bps

25.6 %

6. Adj. EBIT Margin and Adj. EBITDA Margin are defined as Adjusted EBIT and Adjusted EBITDA, respectively, divided by revenue for the applicable period.

7. Represents the diluted weighted average number of shares of Class A common stock and Class B common stock outstanding for the applicable period (including the effect of potentially dilutive securities determined using the treasury stock

method), plus the weighted average number of other participating securities reflected in earnings per share using the two-class method, plus the assumed full exchange of all outstanding LLC Interests held by non-controlling interests for shares

of Class A common stock or Class B common stock. See "Reconciliation of Non-GAAP Financial Measures" for more information.View entire presentation