Rocket Lab SPAC Presentation Deck

FINANCIAL MODEL SUMMARY

37

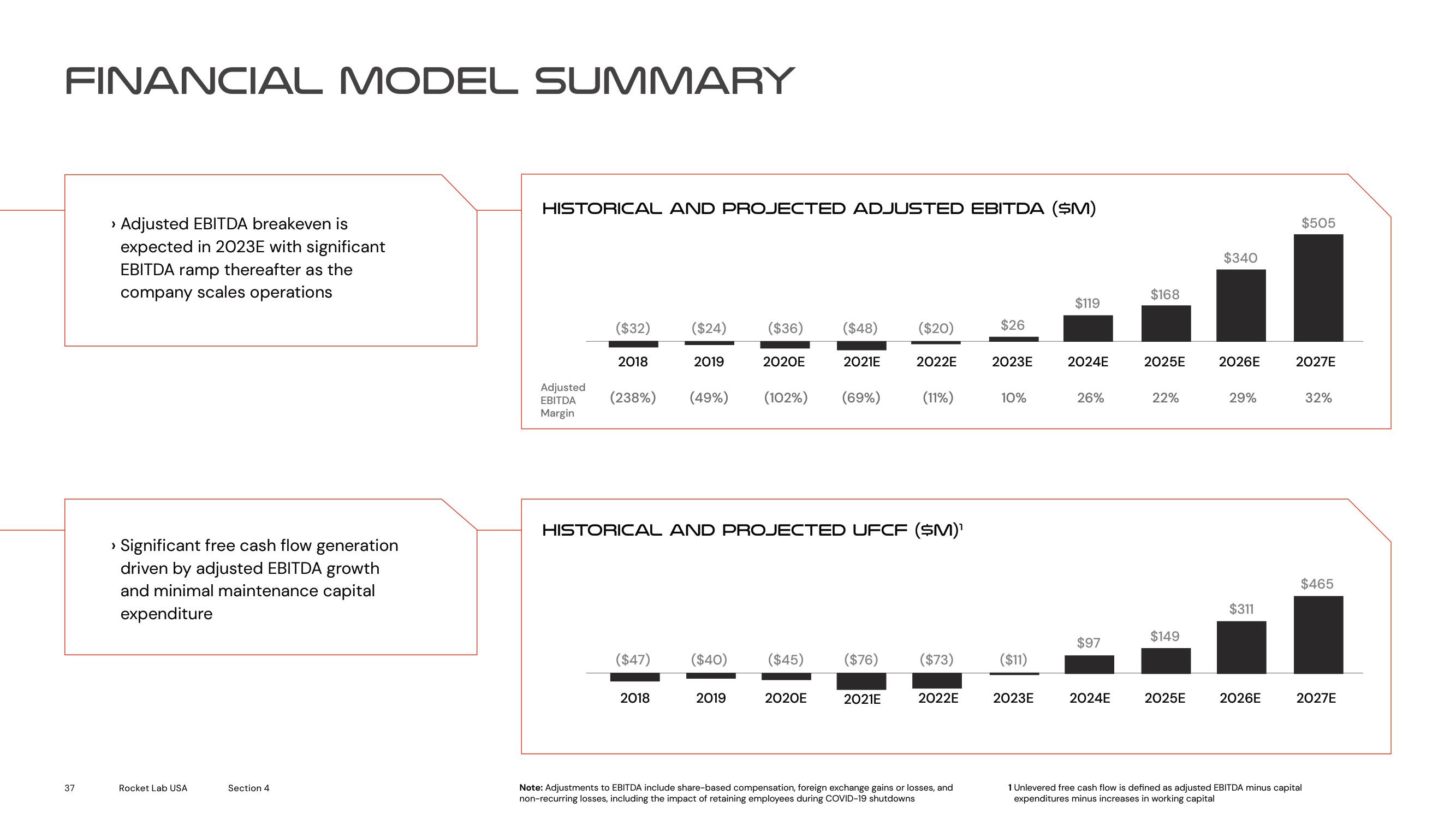

› Adjusted EBITDA breakeven is

expected in 2023E with significant

EBITDA ramp thereafter as the

company scales operations

› Significant free cash flow generation

driven by adjusted EBITDA growth

and minimal maintenance capital

expenditure

Rocket Lab USA

Section 4

HISTORICAL AND PROJECTED ADJUSTED EBITDA ($M)

Adjusted

EBITDA

Margin

($32)

2018

($24)

(238%) (49%)

($47)

2019

2018

($36) ($48) ($20)

2020E

2019

2021E

(102%) (69%)

HISTORICAL AND PROJECTED UFCF ($M)¹

2020E

2022E

($40) ($45) ($76) ($73)

(11%)

2021E

2022E

Note: Adjustments to EBITDA include share-based compensation, foreign exchange gains or losses, and

non-recurring losses, including the impact of retaining employees during COVID-19 shutdowns

$26

2023E

10%

($11)

2023E

$119

2024E

26%

$97

2024E

$168

2025E

22%

$149

2025E

$340

2026E

29%

$311

2026E

$505

2027E

32%

$465

2027E

1 Unlevered free cash flow is defined as adjusted EBITDA minus capital

expenditures minus increases in working capitalView entire presentation