Forbes SPAC Presentation Deck

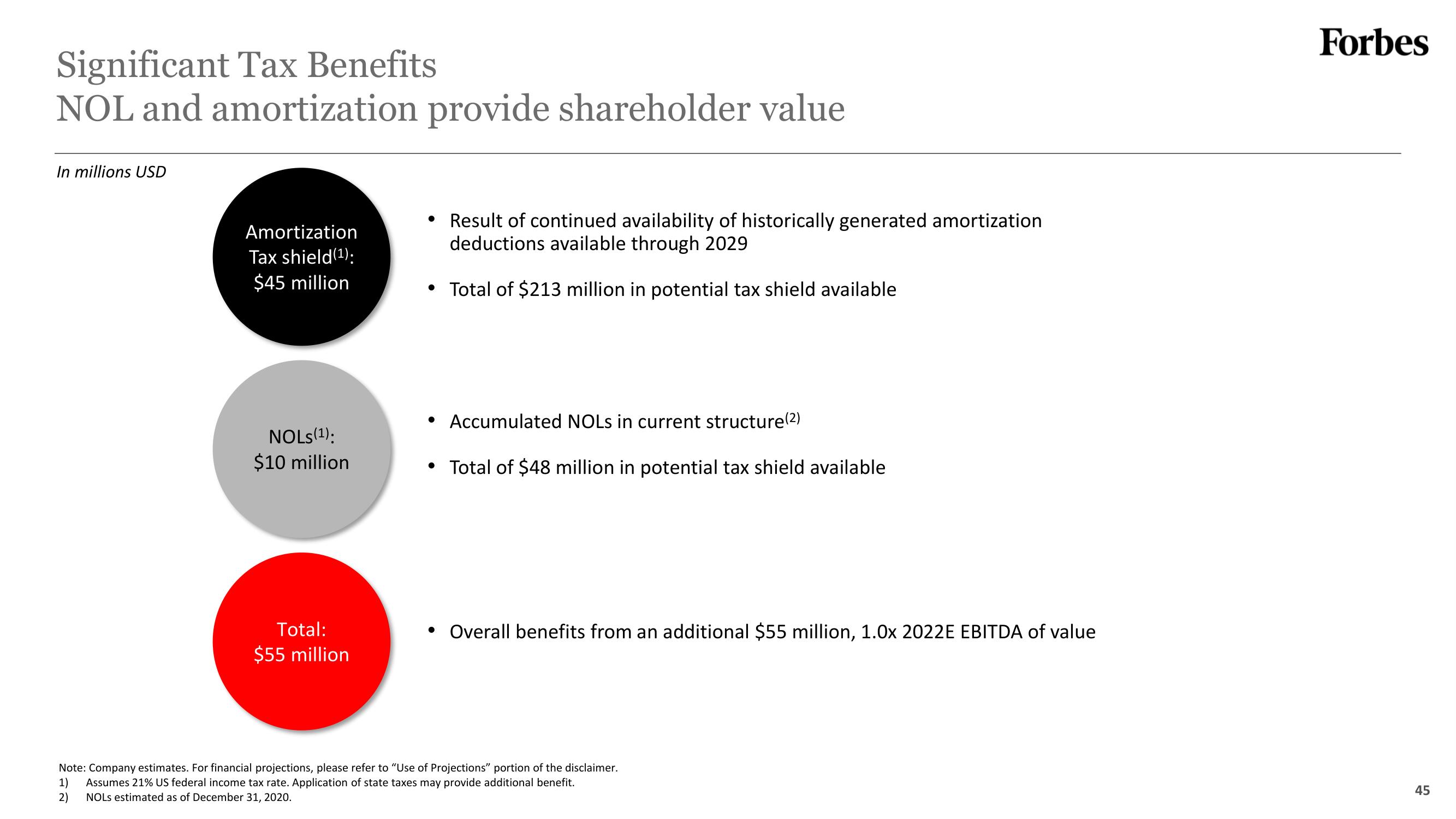

Significant Tax Benefits

NOL and amortization provide shareholder value

In millions USD

Amortization

Tax shield (¹):

$45 million

1)

2)

NOLS (¹):

$10 million

Total:

$55 million

Result of continued availability of historically generated amortization

deductions available through 2029

• Total of $213 million in potential tax shield available

• Accumulated NOLs in current structure(2)

• Total of $48 million in potential tax shield available

• Overall benefits from an additional $55 million, 1.0x 2022E EBITDA of value

Note: Company estimates. For financial projections, please refer to "Use of Projections" portion of the disclaimer.

Assumes 21% US federal income tax rate. Application of state taxes may provide additional benefit.

NOLS estimated as of December 31, 2020.

Forbes

45View entire presentation