Sonder Results Presentation Deck

Appendix

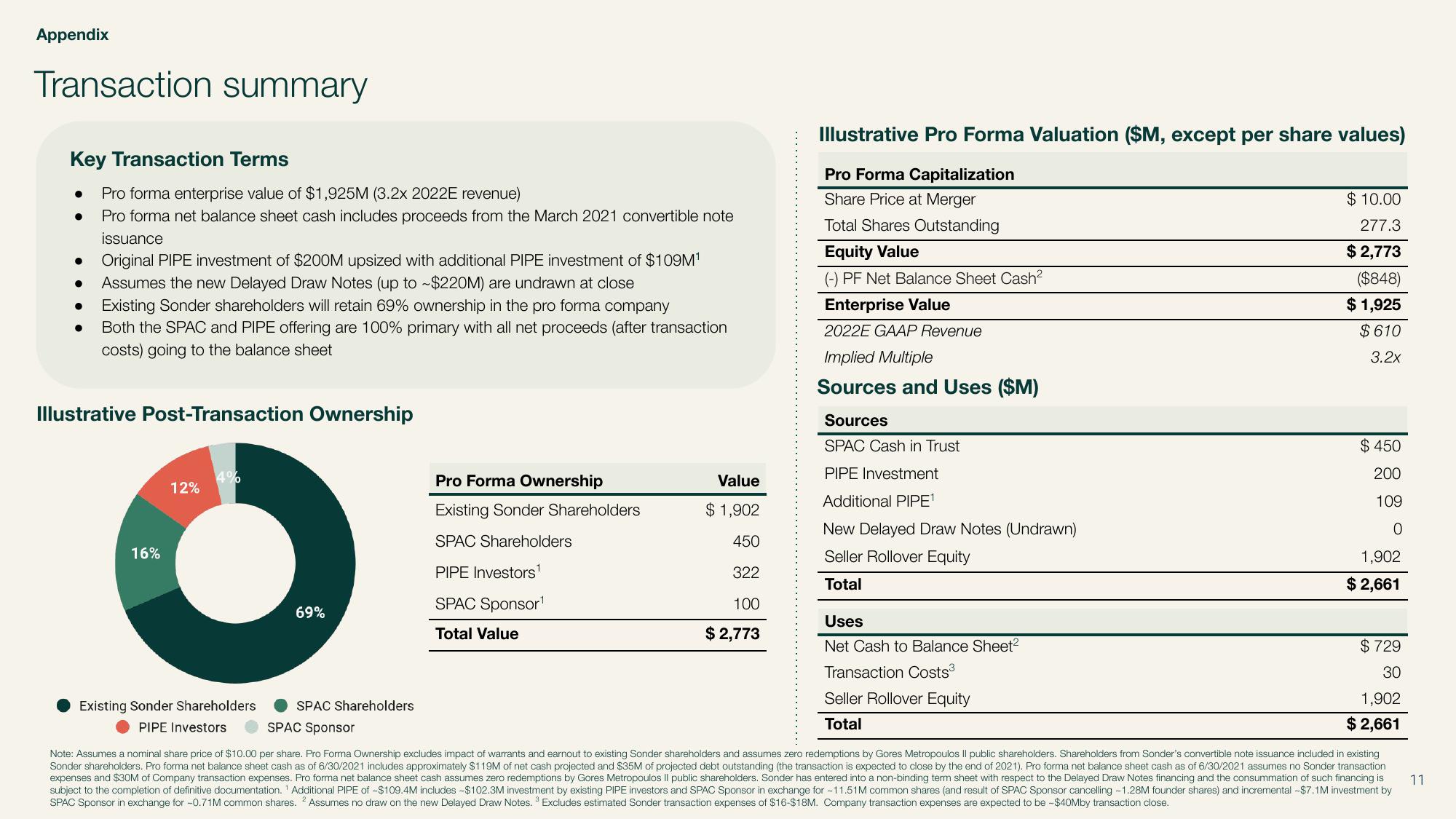

Transaction summary

Key Transaction Terms

● Pro forma enterprise value of $1,925M (3.2x 2022E revenue)

● Pro forma net balance sheet cash includes proceeds from the March 2021 convertible note

issuance

Original PIPE investment of $200M upsized with additional PIPE investment of $109M¹

Assumes the new Delayed Draw Notes (up to $220M) are undrawn at close

Existing Sonder shareholders will retain 69% ownership in the pro forma company

Both the SPAC and PIPE offering are 100% primary with all net proceeds (after transaction

costs) going to the balance sheet

●

Illustrative Post-Transaction Ownership

16%

12%

4%

69%

Pro Forma Ownership

Existing Sonder Shareholders

SPAC Shareholders

PIPE Investors¹

SPAC Sponsor¹

Total Value

Value

$ 1,902

450

322

100

$ 2,773

Illustrative Pro Forma Valuation ($M, except per share values)

Pro Forma Capitalization

Share Price at Merger

Total Shares Outstanding

Equity Value

(-) PF Net Balance Sheet Cash²

Enterprise Value

2022E GAAP Revenue

Implied Multiple

Sources and Uses ($M)

Sources

SPAC Cash in Trust

PIPE Investment

Additional PIPE¹

New Delayed Draw Notes (Undrawn)

Seller Rollover Equity

Total

Uses

Net Cash to Balance Sheet²

Transaction Costs³

$10.00

277.3

$ 2,773

($848)

$ 1,925

$610

3.2x

Seller Rollover Equity

Total

$450

200

109

0

1,902

$ 2,661

$729

30

1,902

$ 2,661

SPAC Shareholders

SPAC Sponsor

Existing Sonder Shareholders

PIPE Investors

Note: Assumes a nominal share price of $10.00 per share. Pro Forma Ownership excludes impact of warrants and earnout to existing Sonder shareholders and assumes zero redemptions by Gores Metropoulos Il public shareholders. Shareholders from Sonder's convertible note issuance included in existing

Sonder shareholders. Pro forma net balance sheet cash as of 6/30/2021 includes approximately $119M of net cash projected and $35M of projected debt outstanding (the transaction is expected to close by the end of 2021). Pro forma net balance sheet cash as of 6/30/2021 assumes no Sonder transaction

expenses and $30M of Company transaction expenses. Pro forma net balance sheet cash assumes zero redemptions by Gores Metropoulos II public shareholders. Sonder has entered into a non-binding term sheet with respect to the Delayed Draw Notes financing and the consummation of such financing is

subject to the completion of definitive documentation. Additional PIPE of -$109.4M includes -$102.3M investment by existing PIPE investors and SPAC Sponsor in exchange for -11.51M common shares (and result of SPAC Sponsor cancelling -1.28M founder shares) and incremental -$7.1M investment by

SPAC Sponsor in exchange for -0.71M common shares. 2 Assumes no draw on the new Delayed Draw Notes. ³ Excludes estimated Sonder transaction expenses of $16-$18M. Company transaction expenses are expected to be -$40Mby transaction close.

11View entire presentation