Dave Results Presentation Deck

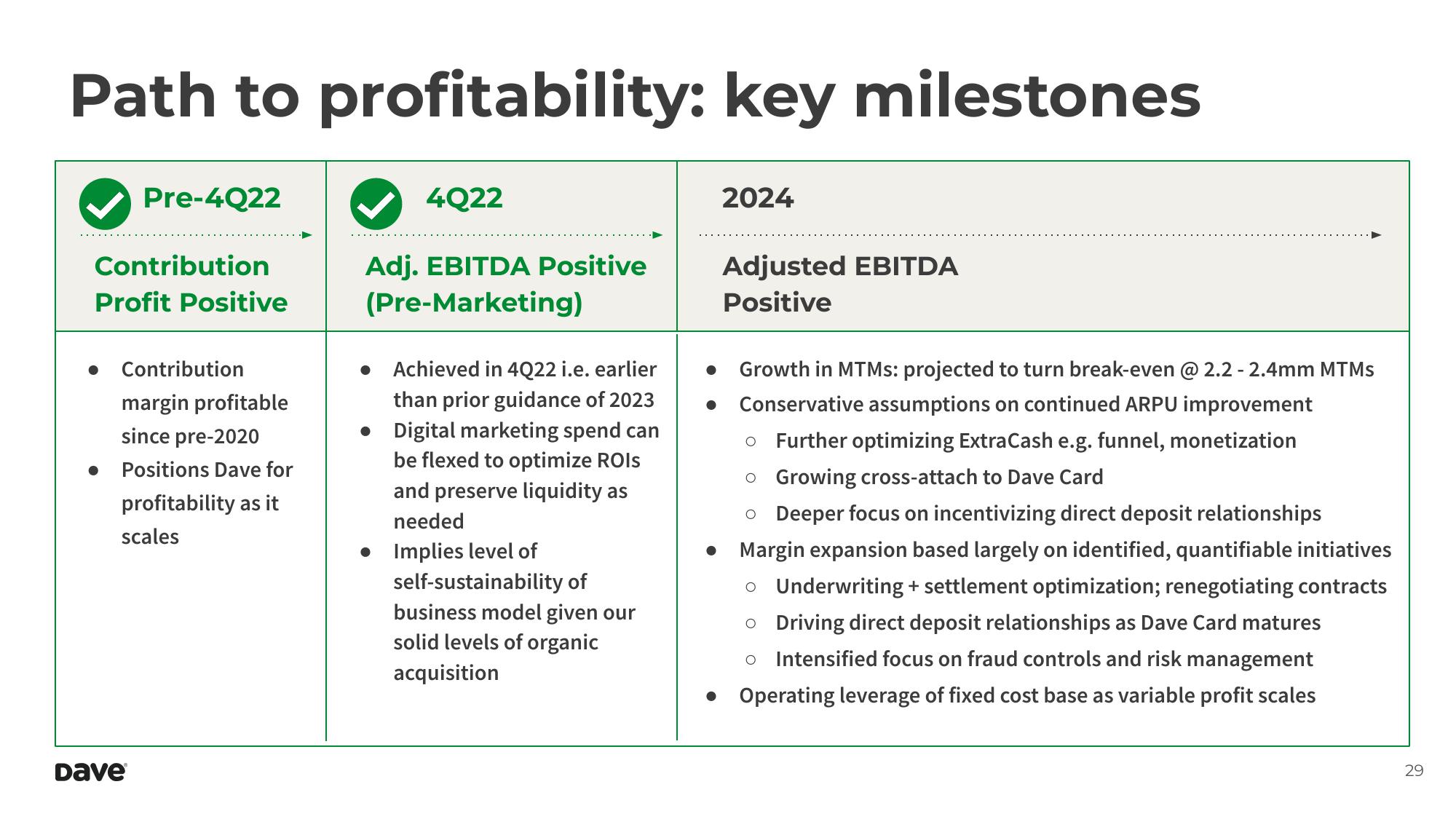

Path to profitability: key milestones

Pre-4Q22

Contribution

Profit Positive

Contribution

margin profitable

since pre-2020

Positions Dave for

profitability as it

scales

Dave

4Q22

Adj. EBITDA Positive

(Pre-Marketing)

Achieved in 4Q22 i.e. earlier

than prior guidance of 2023

Digital marketing spend can

be flexed to optimize ROIS

and preserve liquidity as

needed

Implies level of

self-sustainability of

business model given our

solid levels of organic

acquisition

2024

Adjusted EBITDA

Positive

Growth in MTMs: projected to turn break-even @ 2.2 - 2.4mm MTMs

Conservative assumptions on continued ARPU improvement

o Further optimizing ExtraCash e.g. funnel, monetization

o Growing cross-attach to Dave Card

o Deeper focus on incentivizing direct deposit relationships

Margin expansion based largely on identified, quantifiable initiatives

o Underwriting + settlement optimization; renegotiating contracts

o Driving direct deposit relationships as Dave Card matures

O Intensified focus on fraud controls and risk management

Operating leverage of fixed cost base as variable profit scales

29View entire presentation