Evercore Investment Banking Pitch Book

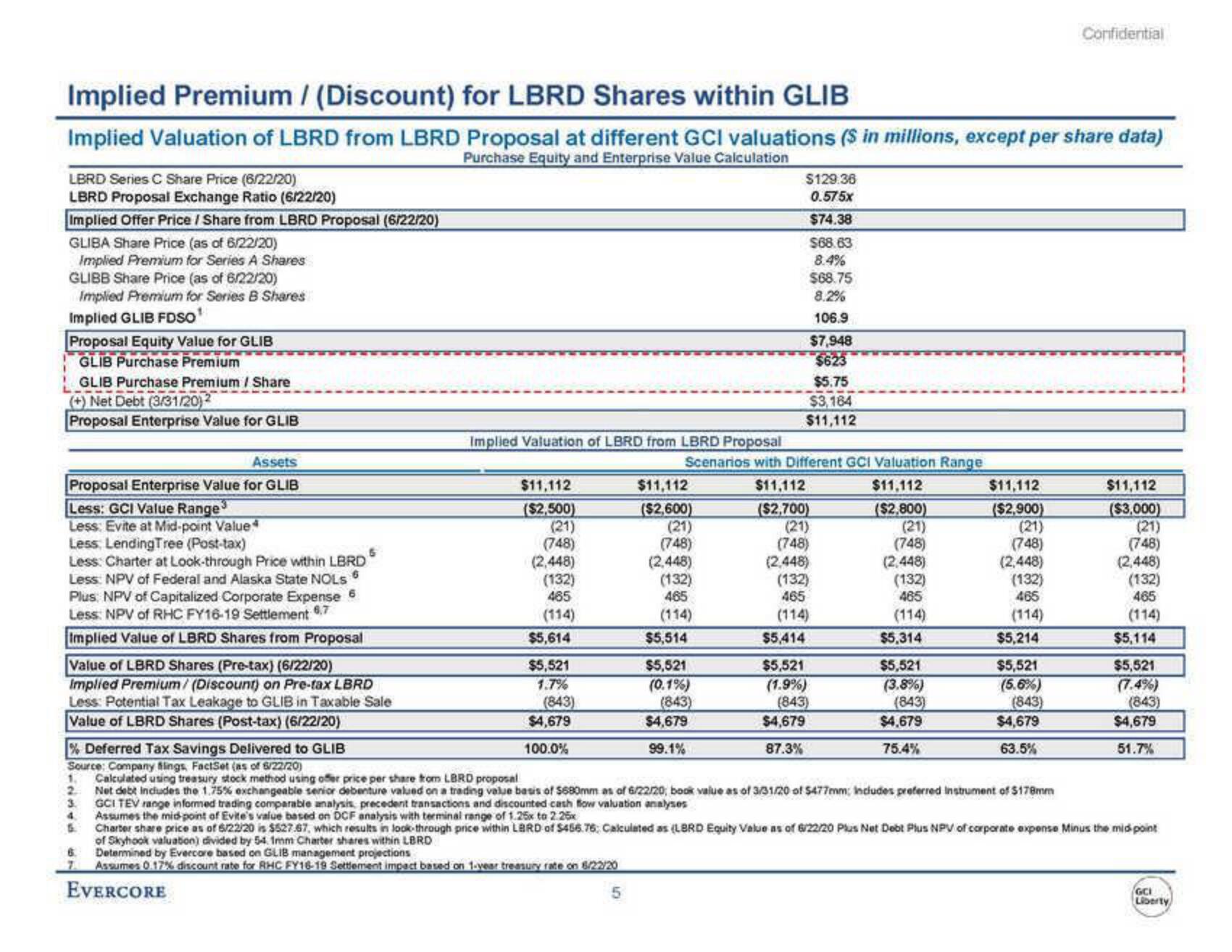

Implied Premium / (Discount) for LBRD Shares within GLIB

Implied Valuation of LBRD from LBRD Proposal at different GCI valuations ($ in millions, except per share data)

Purchase Equity and Enterprise Value Calculation

LBRD Series C Share Price (6/22/20)

LBRD Proposal Exchange Ratio (6/22/20)

Implied Offer Price / Share from LBRD Proposal (6/22/20)

GLIBA Share Price (as of 6/22/20)

Implied Premium for Series A Shares

GLIBB Share Price (as of 6/22/20)

Implied Premium for Series B Shares

Implied GLIB FDSO¹

Proposal Equity Value for GLIB

GLIB Purchase Premium

GLIB Purchase Premium/ Share

(+) Net Debt (3/31/20)2

Proposal Enterprise Value for GLIB

Assets

Proposal Enterprise Value for GLIB

Less: GCI Value Range3

Less: Evite at Mid-point Value*

Less Lending Tree (Post-tax)

6

Less: Charter at Look-through Price within LBRD

Less: NPV of Federal and Alaska State NOLS

Plus, NPV of Capitalized Corporate Expense 6

Less: NPV of RHC FY16-19 Settlement 6.7

Implied Value of LBRD Shares from Proposal

5

Value of LBRD Shares (Pre-tax) (6/22/20)

Implied Premium/ (Discount) on Pre-tax LBRD

Less: Potential Tax Leakage to GLIB in Taxable Sale

Value of LBRD Shares (Post-tax) (6/22/20)

Implied Valuation of LBRD from LBRD Proposal

$11,112

($2,500)

(21)

(748)

(2,448)

(132)

465

(114)

$5,614

$5,521

1.7%

(843)

$4,679

100.0%

$11,112

($2,600)

(21)

(748)

5

(2,448)

(132)

465

(114)

Scenarios with Different GCI Valuation Range

$11,112

$11,112

($2,700)

($2,800)

(21)

(21)

(748)

(748)

(2,448)

(2,448)

(132)

(132)

465

465

(114)

(114)

$5,414

$5,514

$5,521

(0.1%)

(843)

$4,679

99.1%

$129.36

0.575×

$74.38

$68.63

8.4%

$68.75

8.2%

106.9

$7,948

$623

$5.75

$3,164

$11,112

$4,679

87.3%

$5,521

(1.9%)

(843)

$5,314

$5,521

(3.8%)

(843)

$4,679

75.4%

$11,112

($2,900)

(21)

(748)

(2,448)

(132)

465

(114)

$5,214

$5,521

(5.6%)

(843)

$4,679

63.5%

% Deferred Tax Savings Delivered to GLIB

Source: Company flings, FactSet (as of 6/22/20)

Calculated using treasury stock method using offer price per share from LBRD proposal

Net debt includes the 1.75% exchangeable senior debenture valued on a trading value basis of $680mm as of 6/22/20; book value as of 3/31/20 of $477mm: Includes preferred Instrument of $178mm

GCI TEV range informed trading comparable analysis, precedent transactions and discounted cash flow valuation analyses

Confidential

$11,112

($3,000)

(21)

(748)

(2,448)

(132)

465

(114)

$5,114

$5,521

(7.4%)

(843)

$4,679

51.7%

1.

2

3.

4 Assumes the mid-point of Evite's value based on DCF analysis with terminal range of 1.25x to 2.25x

6

Charter share price as of 6/22/20 is $527.67, which results in look-through price within LBRD of $456.76: Calculated as (LBRD Equity Value as of 6/22/20 Plus Net Debt Plus NPV of corporate expense Minus the mid-point

of Skyhook valuation) divided by 54. 1mm Charter shares within LBRD

6.

Determined by Evercore based on GLIB management projections

7. Assumes 0.17% discount rate for RHC FY16-19 Settlement impact based on 1-year treasury rate on 6/22/20

EVERCORE

GCI

LibertyView entire presentation