ads-tec Energy SPAC Presentation Deck

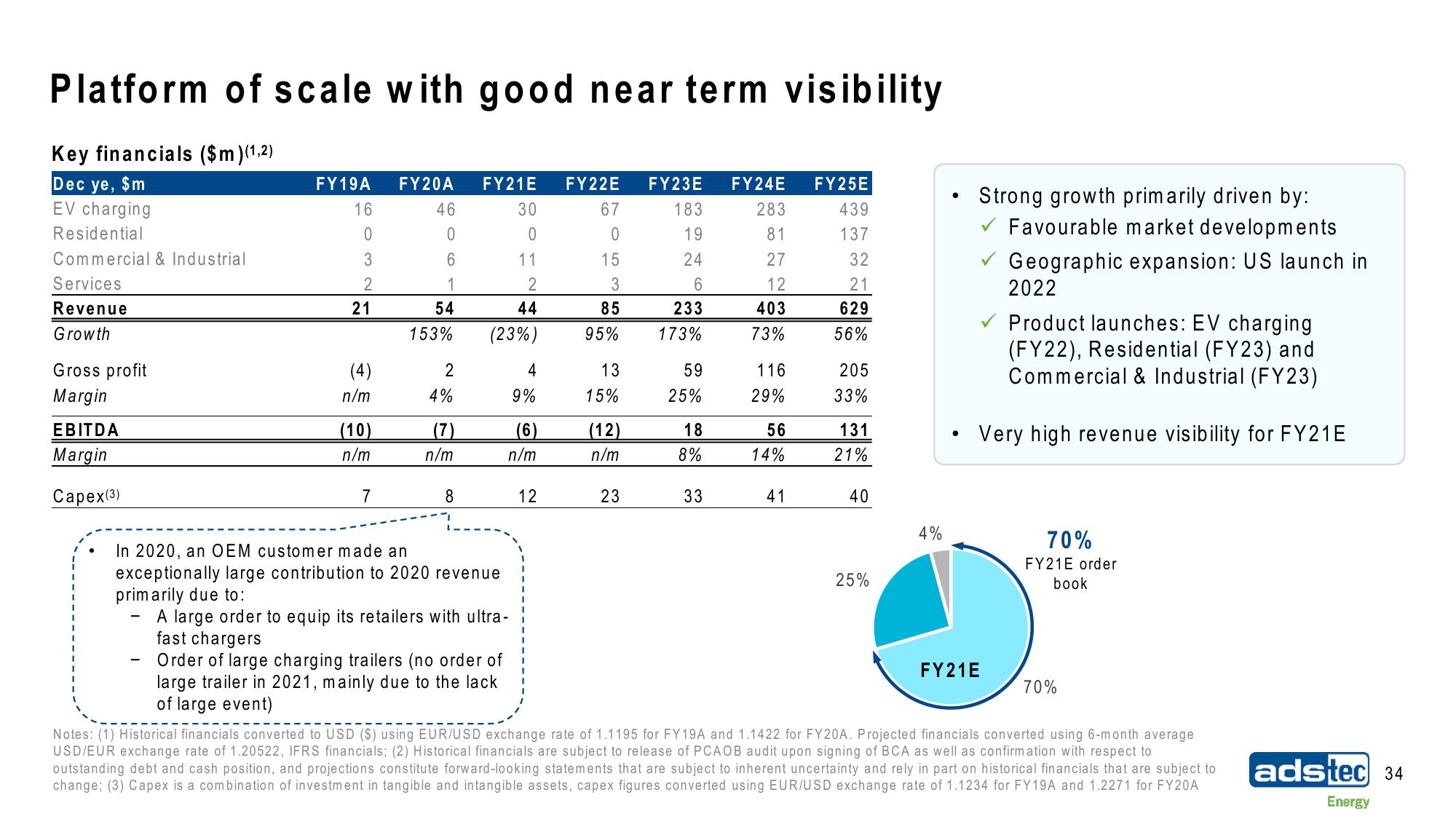

Platform of scale with good near term visibility

Key financials ($m)(1,2)

Dec ye, $m

EV charging

Residential

Commercial & Industrial

Services

Revenue

Growth

Gross profit

Margin

EBITDA

Margin

Capex(3)

FY19A

16

0

3

2

-

21

(4)

n/m

(10)

n/m

7

FY20A

46

0

6

1

54

153%

2

4%

(7)

n/m

8

FY21E FY22E FY23E FY24E FY25E

439

183

283

19

81

137

24

27

32

12

21

6

233

173%

403

629

73%

56%

11

2

44

(23%)

In 2020, an OEM customer made an

exceptionally large contribution to 2020 revenue

primarily due to:

A large order to equip its retailers with ultra-

fast chargers

30

0

Order of large charging trailers (no order of

large trailer in 2021, mainly due to the lack

of large event)

4

9%

(6)

n/m

12

67

0

15

3

85

95%

13

15%

(12)

n/m

23

59

25%

18

8%

33

116

29%

56

14%

41

205

33%

131

21%

40

25%

4%

●

Strong growth primarily driven by:

Favourable market developments

Geographic expansion: US launch in

2022

Product launches: EV charging

(FY22), Residential (FY23) and

Commercial & Industrial (FY23)

Very high revenue visibility for FY21E

FY21E

70%

FY21E order

book

70%

Notes: (1) Historical financials converted to USD ($) using EUR/USD exchange rate of 1.1195 for FY19A and 1.1422 for FY20A. Projected financials converted using 6-month average

USD/EUR exchange rate of 1.20522, IFRS financials; (2) Historical financials are subject to release of PCAOB audit upon signing of BCA as well as confirmation with respect to

outstanding debt and cash position, and projections constitute forward-looking statements that are subject to inherent uncertainty and rely in part on historical financials that are subject to

change; (3) Capex is a combination of investment in tangible and intangible assets, capex figures converted using EUR/USD exchange rate of 1.1234 for FY19A and 1.2271 for FY20A

adstec 34

EnergyView entire presentation