Vista Equity Partners Fund VIII, L.P. Recommendation Report

●

●

Hamilton Lane

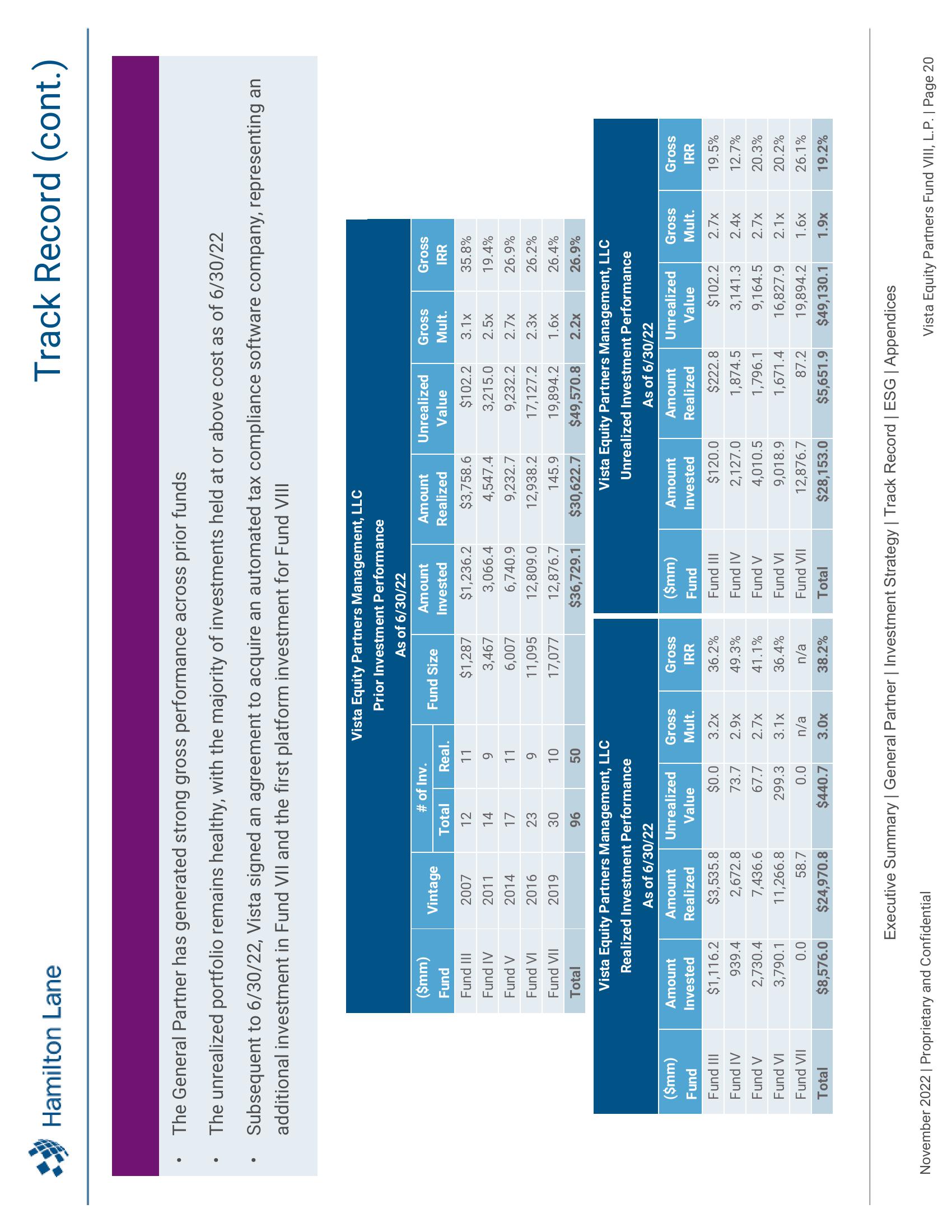

The General Partner has generated strong gross performance across prior funds

The unrealized portfolio remains healthy, with the majority of investments held at or above cost as of 6/30/22

Subsequent to 6/30/22, Vista signed an agreement to acquire an automated tax compliance software company, representing an

additional investment in Fund VII and the first platform investment for Fund VIII

($mm)

Fund

Fund III

Fund IV

Fund V

Fund VI

Fund VII

Total

($mm)

Fund

Fund III

Fund IV

Fund V

Fund VI

Fund VII

Total

Amount

Invested

Vintage

$1,116.2

939.4

2,730.4

3,790.1

0.0

$8,576.0

2007

2011

2014

2016

2019

# of Inv.

Vista Equity Partners Management, LLC

Realized Investment Performance

As of 6/30/22

$3,535.8

2,672.8

7,436.6

11,266.8

58.7

$24,970.8

Total

12

14

17

23

30

96

Vista Equity Partners Management, LLC

Prior Investment Performance

As of 6/30/22

November 2022 | Proprietary and Confidential

Real.

11

9

11

9

10

50

Amount Unrealized Gross

Realized

Value

Mult.

Fund Size

$0.0 3.2x

73.7

2.9x

67.7

2.7x

299.3

3.1x

0.0

n/a

$440.7 3.0x

$1,287

3,467

6,007

11,095

17,077

Gross

IRR

36.2%

49.3%

41.1%

36.4%

n/a

38.2%

Amount

Invested

$1,236.2

3,066.4

6,740.9

12,809.0

12,876.7

$36,729.1

($mm)

Fund

Fund III

Fund IV

Fund V

Fund VI

Fund VII

Total

Amount

Realized

$3,758.6

4,547.4

9,232.7

12,938.2

145.9

$30,622.7

Track Record (cont.)

Amount

Invested

Unrealized Gross

Value

Mult.

$120.0

2,127.0

4,010.5

9,018.9

12,876.7

$28,153.0

$102.2 3.1x

3,215.0 2.5x

9,232.2 2.7x

17,127.2 2.3x

19,894.2 1.6x

$49,570.8 2.2x

Vista Equity Partners Management, LLC

Unrealized Investment Performance

As of 6/30/22

Amount Unrealized Gross

Realized

Value

Mult.

$222.8

1,874.5

1,796.1

1,671.4

87.2

$5,651.9

Gross

IRR

Executive Summary | General Partner | Investment Strategy | Track Record | ESG | Appendices

35.8%

19.4%

26.9%

26.2%

26.4%

26.9%

$102.2

2.7x

3,141.3

2.4x

9,164.5

2.7x

16,827.9

2.1x

19,894.2 1.6x

$49,130.1 1.9x

Gross

IRR

19.5%

12.7%

20.3%

20.2%

26.1%

19.2%

Vista Equity Partners Fund VIII, L.P. | Page 20View entire presentation