OpenText Mergers and Acquisitions Presentation Deck

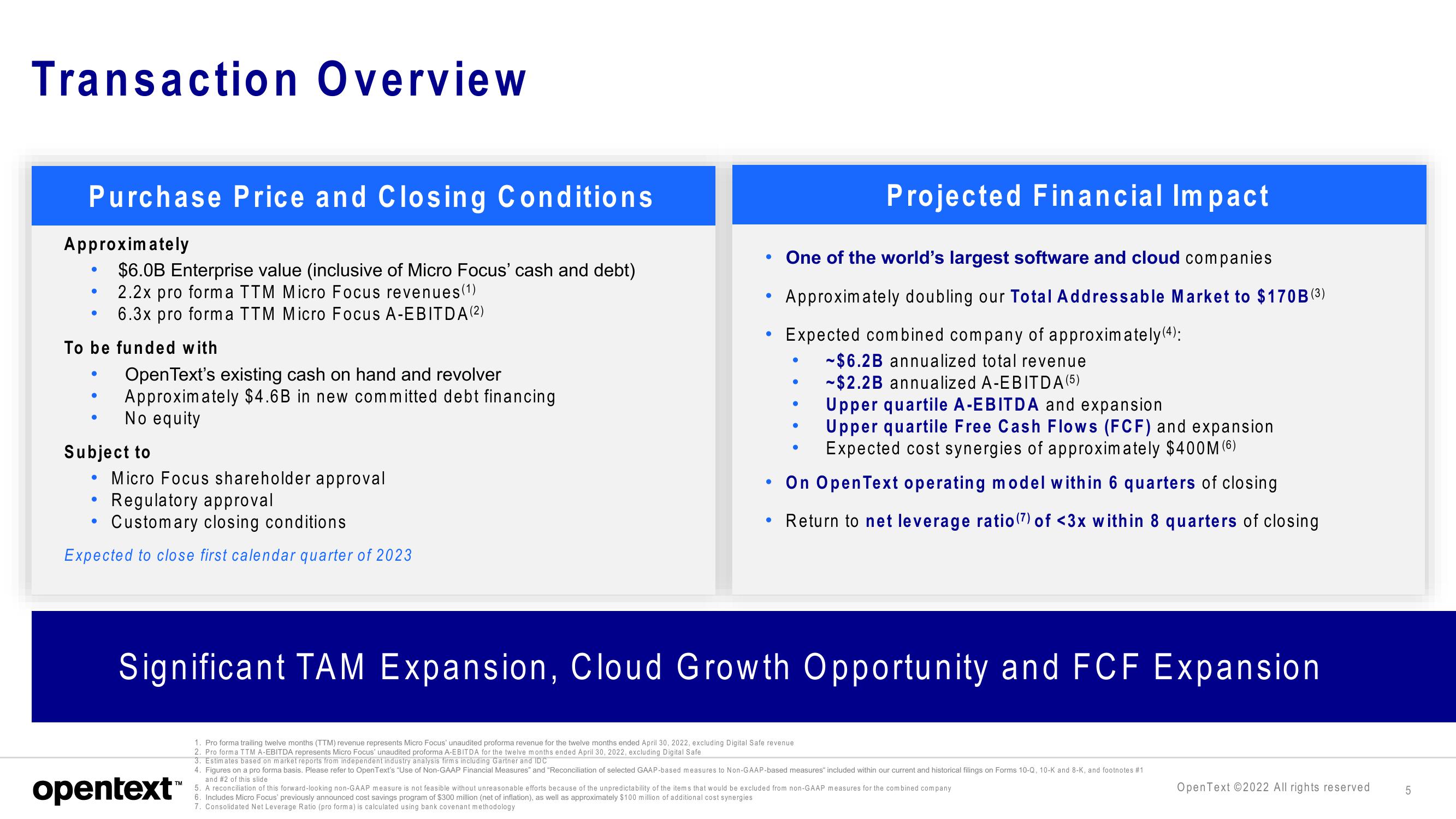

Transaction Overview

Purchase Price and Closing Conditions

Approximately

To be funded with

●

●

●

$6.0B Enterprise value (inclusive of Micro Focus' cash and debt)

2.2x pro forma TTM Micro Focus revenues (1)

6.3x pro forma TTM Micro Focus A-EBITDA (2)

Subject to

●

OpenText's existing cash on hand and revolver

Approximately $4.6B in new committed debt financing

No equity

●

Regulatory approval

Customary closing conditions

Expected to close first calendar quarter of 2023

Micro Focus shareholder approval

●

opentext™

●

●

●

One of the world's largest software and cloud companies

Approximately doubling our Total Addressable Market to $170B (³)

Expected combined company of approximately (4):

$6.2B annualized total revenue

-$2.2B annualized A-EBITDA (5)

●

Projected Financial Impact

Upper quartile A-EBITDA and expansion

Upper quartile Free Cash Flows (FCF) and expansion

Expected cost synergies of approximately $400M (6)

On OpenText operating model within 6 quarters of closing

Return to net leverage ratio (7) of <3x within 8 quarters of closing

●

Significant TAM Expansion, Cloud Growth Opportunity and FCF Expansion

1. Pro forma trailing twelve months (TTM) revenue represents Micro Focus' unaudited proforma revenue for the twelve months ended April 30, 2022, excluding Digital Safe revenue

2. Pro forma TTM A-EBITDA represents Micro Focus' unaudited proforma A-EBITDA for the twelve months ended April 30, 2022, excluding Digital Safe

3. Estimates based on market reports from independent industry analysis firms including Gartner and IDC

4. Figures on a pro forma basis. Please refer to OpenText's "Use of Non-GAAP Financial Measures" and "Reconciliation of selected GAAP-based measures to Non-GAAP-based measures included within our current and historical filings on Forms 10-Q, 10-K and 8-K, and footnotes #1

and #2 of this slide

5. A reconciliation of this forward-looking non-GAAP measure is not feasible without unreasonable efforts because of the unpredictability of the items that would be excluded from non-GAAP measures for the combined company

6. Includes Micro Focus' previously announced cost savings program of $300 million (net of inflation), as well as approximately $100 million of additional cost synergies

7. Consolidated Net Leverage Ratio (pro forma) is calculated using bank covenant methodology

OpenText ©2022 All rights reserved

5View entire presentation