Atalaya Risk Management Overview

Atalaya Overview

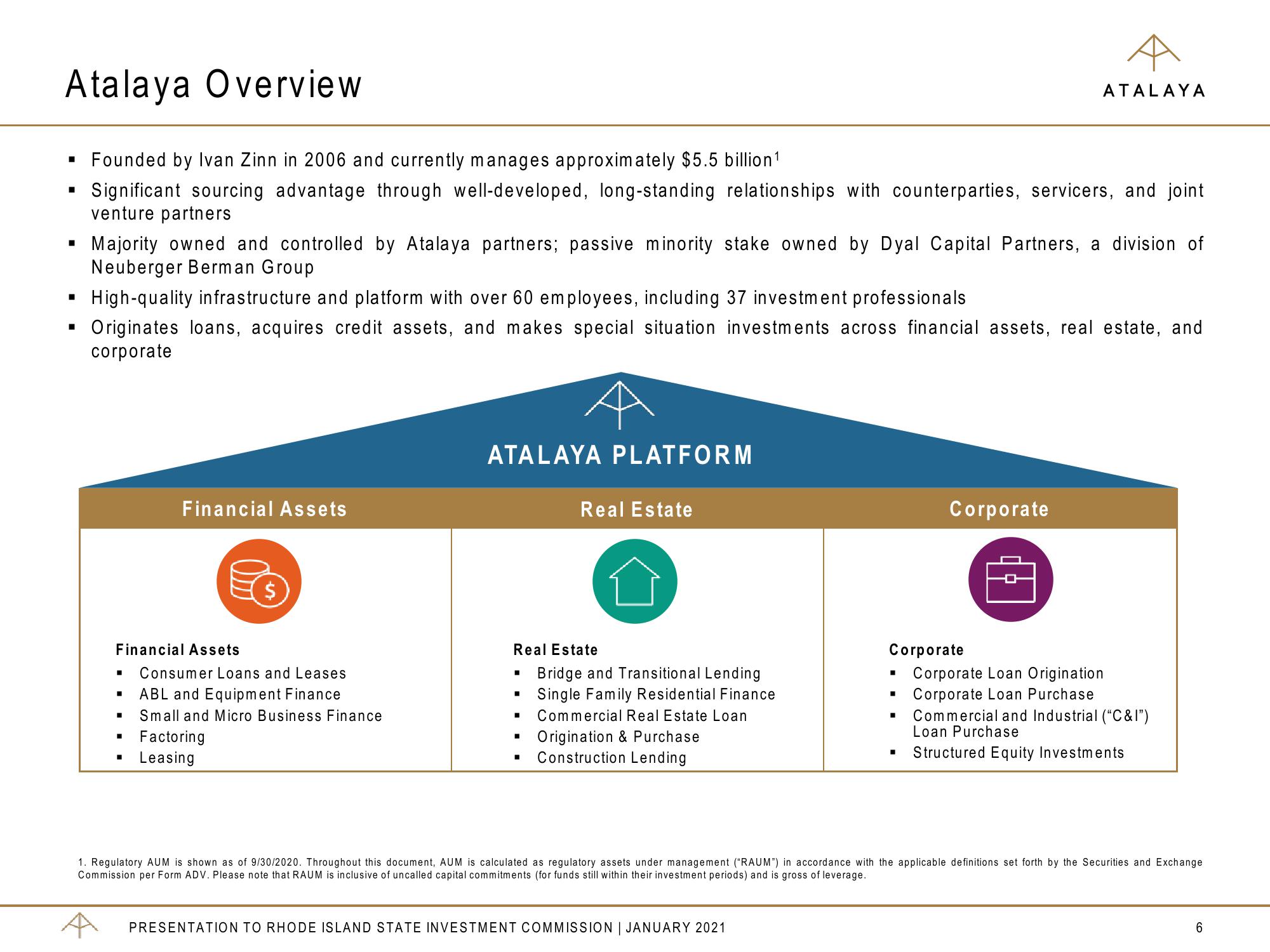

▪ Founded by Ivan Zinn in 2006 and currently manages approximately $5.5 billion ¹

Significant sourcing advantage through well-developed, long-standing relationships with counterparties, servicers, and joint

venture partners

I

Majority owned and controlled by Atalaya partners; passive minority stake owned by Dyal Capital Partners, a division of

Neuberger Berman Group

High-quality infrastructure and platform with over 60 employees, including 37 investment professionals

Originates loans, acquires credit assets, and makes special situation investments across financial assets, real estate, and

corporate

Financial Assets

Financial Assets

■

Consumer Loans and Leases.

ABL and Equipment Finance

■ Small and Micro Business Finance

■

$

■ Factoring

Leasing

ATALAYA PLATFORM

Real Estate

Bridge and Transitional Lending

Single Family Residential Finance

■ Commercial Real Estate Loan

Origination & Purchase

Construction Lending

■

Real Estate

■

■

PRESENTATION TO RHODE ISLAND STATE INVESTMENT COMMISSION | JANUARY 2021

Corporate

I

ATALAYA

■

Corporate

■

Corporate Loan Origination

Corporate Loan Purchase

Commercial and Industrial ("C&I")

Loan Purchase

Structured Equity Investments

1. Regulatory AUM is shown as of 9/30/2020. Throughout this document, AUM is calculated as regulatory assets under management ("RAUM") in accordance with the applicable definitions set forth by the Securities and Exchange.

Commission per Form ADV. Please note that RAUM is inclusive of uncalled capital commitments (for funds still within their investment periods) and is gross of leverage.

6View entire presentation