Ares US Real Estate Opportunity Fund III

AREOF III Fundraising Update

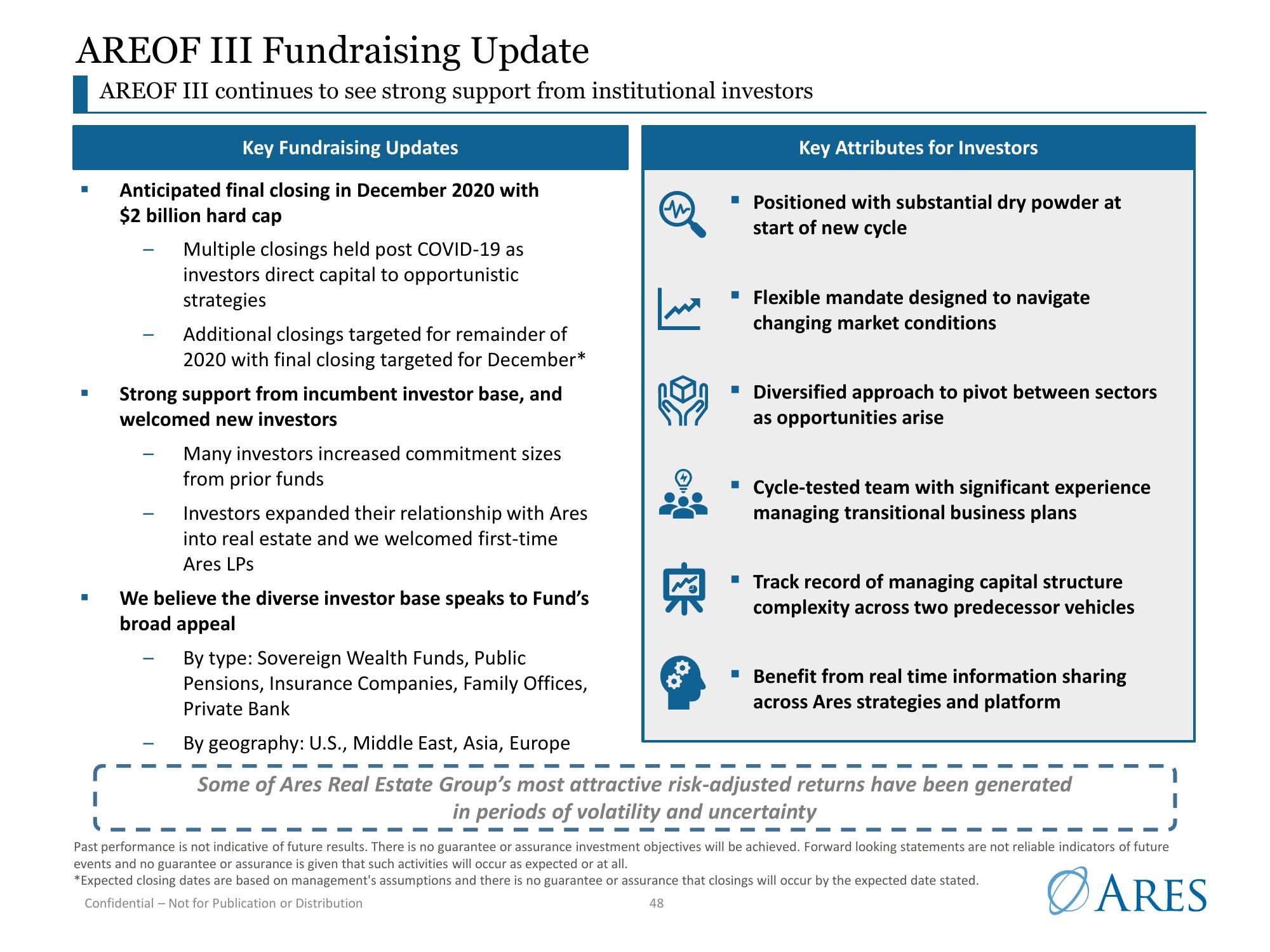

AREOF III continues to see strong support from institutional investors

■

Key Fundraising Updates

Anticipated final closing in December 2020 with

$2 billion hard cap

Multiple closings held post COVID-19 as

investors direct capital to opportunistic

strategies

Additional closings targeted for remainder of

2020 with final closing targeted for December*

Strong support from incumbent investor base, and

welcomed new investors

Many investors increased commitment sizes

from prior funds

Investors expanded their relationship with Ares

into real estate and we welcomed first-time

Ares LPs

We believe the diverse investor base speaks to Fund's

broad appeal

欧

Key Attributes for Investors

▪ Positioned with substantial dry powder at

start of new cycle

▪ Flexible mandate designed to navigate

changing market conditions

▪ Diversified approach to pivot between sectors

as opportunities arise

■ Cycle-tested team with significant experience

managing transitional business plans

▪ Track record of managing capital structure

complexity across two predecessor vehicles

By type: Sovereign Wealth Funds, Public

Pensions, Insurance Companies, Family Offices,

Private Bank

By geography: U.S., Middle East, Asia, Europe

Some of Ares Real Estate Group's most attractive risk-adjusted returns have been generated

in periods of volatility and uncertainty

▪ Benefit from real time information sharing

across Ares strategies and platform

Past performance is not indicative of future results. There is no guarantee or assurance investment objectives will be achieved. Forward looking statements are not reliable indicators of future

events and no guarantee or assurance is given that such activities will occur as expected or at all.

*Expected closing dates are based on management's assumptions and there is no guarantee or assurance that closings will occur by the expected date stated.

Confidential - Not for Publication or Distribution

ARES

48View entire presentation