Embracer Group Results Presentation Deck

FINANCIAL PERFORMANCE | Q1

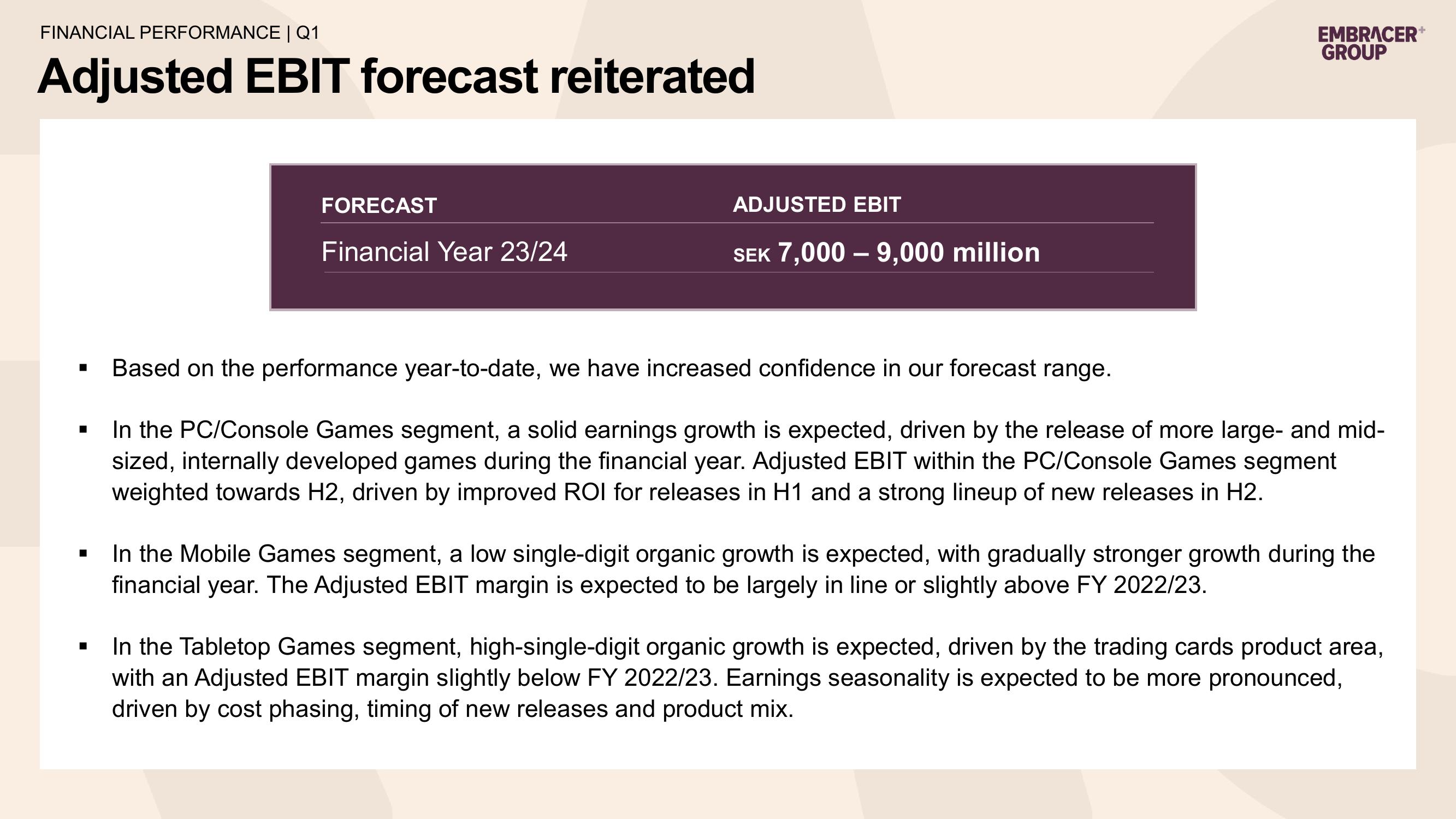

Adjusted EBIT forecast reiterated

■

■

FORECAST

Financial Year 23/24

ADJUSTED EBIT

SEK 7,000 - 9,000 million

EMBRACER+

GROUP

Based on the performance year-to-date, we have increased confidence in our forecast range.

In the PC/Console Games segment, a solid earnings growth is expected, driven by the release of more large- and mid-

sized, internally developed games during the financial year. Adjusted EBIT within the PC/Console Games segment

weighted towards H2, driven by improved ROI for releases in H1 and a strong lineup of new releases in H2.

In the Mobile Games segment, a low single-digit organic growth is expected, with gradually stronger growth during the

financial year. The Adjusted EBIT margin is expected to be largely in line or slightly above FY 2022/23.

In the Tabletop Games segment, high-single-digit organic growth is expected, driven by the trading cards product area,

with an Adjusted EBIT margin slightly below FY 2022/23. Earnings seasonality is expected to be more pronounced,

driven by cost phasing, timing of new releases and product mix.View entire presentation