Masterworks Investor Presentation Deck

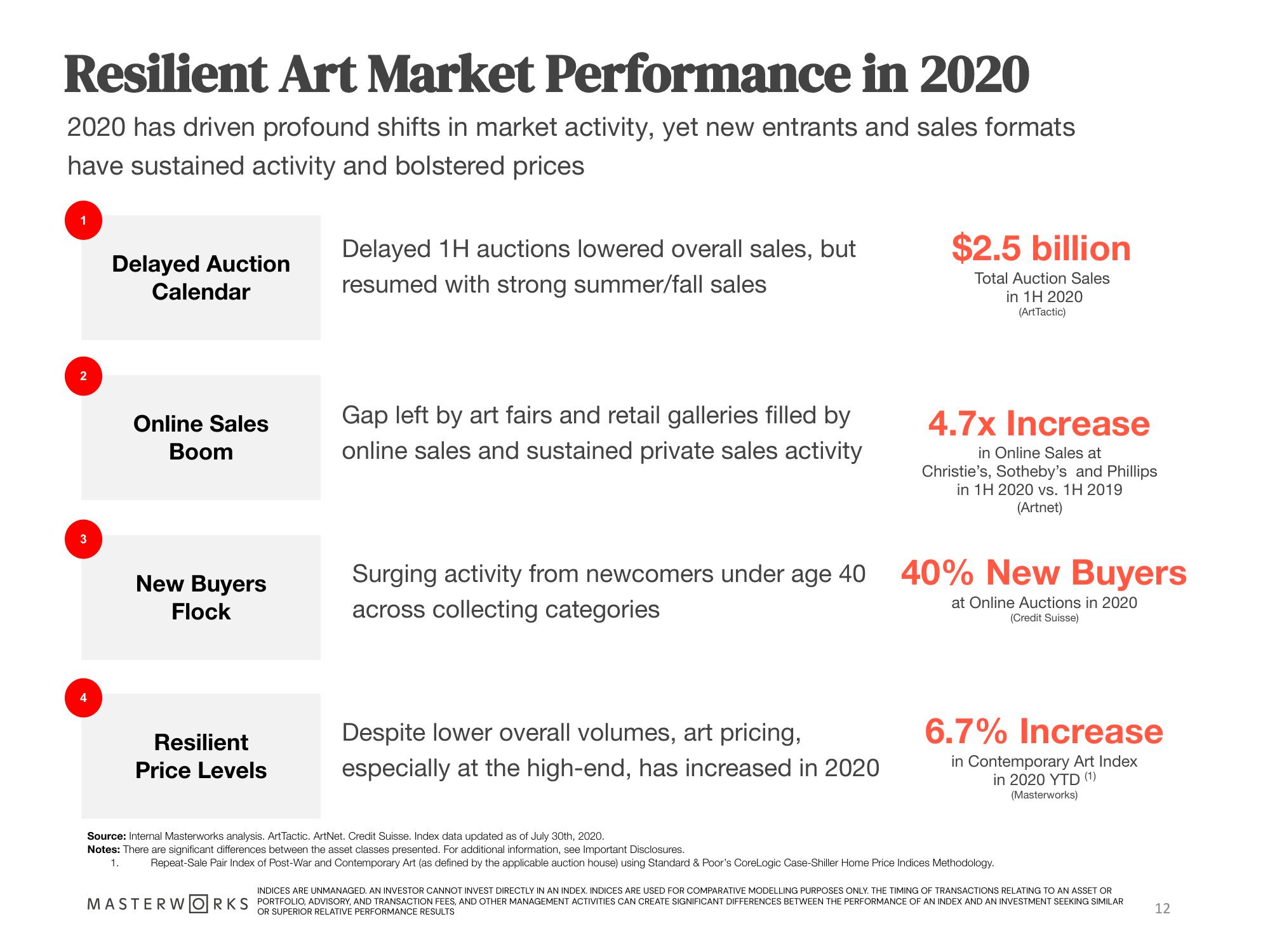

Resilient Art Market Performance in 2020

2020 has driven profound shifts in market activity, yet new entrants and sales formats

have sustained activity and bolstered prices

1

2

3

4

Delayed Auction

Calendar

Online Sales

Boom

New Buyers

Flock

Resilient

Price Levels

Delayed 1H auctions lowered overall sales, but

resumed with strong summer/fall sales

Gap left by art fairs and retail galleries filled by

online sales and sustained private sales activity

Surging activity from newcomers under age 40

across collecting categories

Despite lower overall volumes, art pricing,

especially at the high-end, has increased in 2020

$2.5 billion

Total Auction Sales

in 1H 2020

(Art Tactic)

4.7x Increase

in Online Sales at

Christie's, Sotheby's and Phillips

in 1H 2020 vs. 1H 2019

(Artnet)

40% New Buyers

at Online Auctions in 2020

(Credit Suisse)

6.7% Increase

in Contemporary Art Index

in 2020 YTD (1)

(Masterworks)

Source: Internal Masterworks analysis. Art Tactic. ArtNet. Credit Suisse. Index data updated as of July 30th, 2020.

Notes: There are significant differences between the asset classes presented. For additional information, see Important Disclosures.

1. Repeat-Sale Pair Index of Post-War and Contemporary Art (as defined by the applicable auction house) using Standard & Poor's CoreLogic Case-Shiller Home Price Indices Methodology.

INDICES ARE UNMANAGED. AN INVESTOR CANNOT INVEST DIRECTLY IN AN INDEX. INDICES ARE USED FOR COMPARATIVE MODELLING PURPOSES ONLY. THE TIMING OF TRANSACTIONS RELATING TO AN ASSET OR

MASTERWORKS PORTFOLIO, ADVISORY, AND TRANSACTION FEES, AND OTHER MANAGEMENT ACTIVITIES CAN CREATE SIGNIFICANT DIFFERENCES BETWEEN THE PERFORMANCE OF AN INDEX AND AN INVESTMENT SEEKING SIMILAR

OR SUPERIOR RELATIVE PERFORMANCE RESULTS

12View entire presentation