Confluent Investor Presentation Deck

Dollar-based Net Retention Rate (NRR)

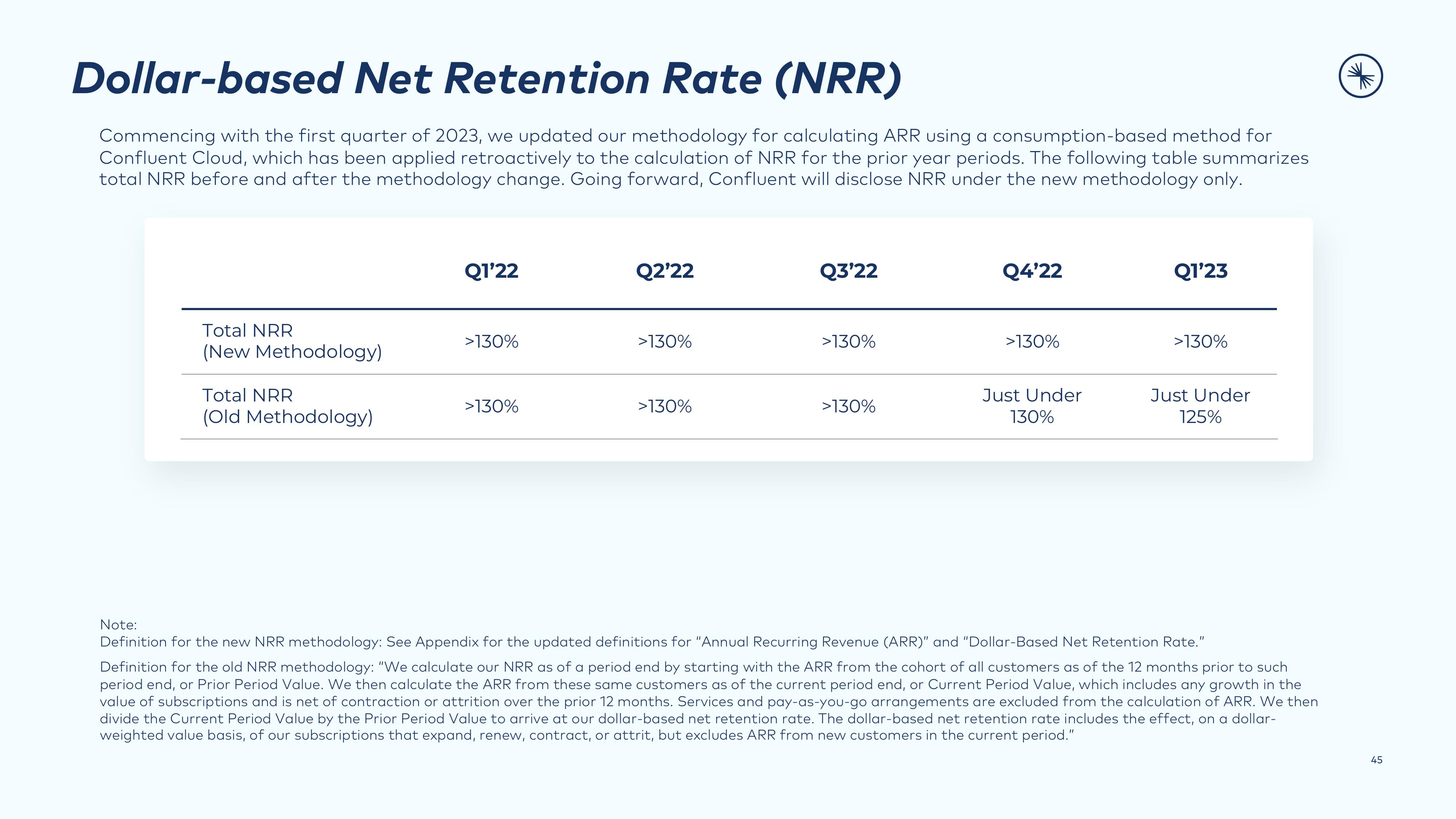

Commencing with the first quarter of 2023, we updated our methodology for calculating ARR using a consumption-based method for

Confluent Cloud, which has been applied retroactively to the calculation of NRR for the prior year periods. The following table summarizes

total NRR before and after the methodology change. Going forward, Confluent will disclose NRR under the new methodology only.

Total NRR

(New Methodology)

Total NRR

(Old Methodology)

Q1'22

>130%

>130%

Q2'22

>130%

>130%

Q3'22

>130%

>130%

Q4'22

>130%

Just Under

130%

Q1'23

>130%

Just Under

125%

Note:

Definition for the new NRR methodology: See Appendix for the updated definitions for "Annual Recurring Revenue (ARR)" and "Dollar-Based Net Retention Rate."

Definition for the old NRR methodology: "We calculate our NRR as of a period end by starting with the ARR from the cohort of all customers as of the 12 months prior to such

period end, or Prior Period Value. We then calculate the ARR from these same customers as of the current period end, or Current Period Value, which includes any growth in the

value of subscriptions and is net of contraction or attrition over the prior 12 months. Services and pay-as-you-go arrangements are excluded from the calculation of ARR. We then

divide the Current Period Value by the Prior Period Value to arrive at our dollar-based net retention rate. The dollar-based net retention rate includes the effect, on a dollar-

weighted value basis, of our subscriptions that expand, renew, contract, or attrit, but excludes ARR from new customers in the current period."

AN

45View entire presentation