Antofagasta Investor Update

2022 Performance and guidance

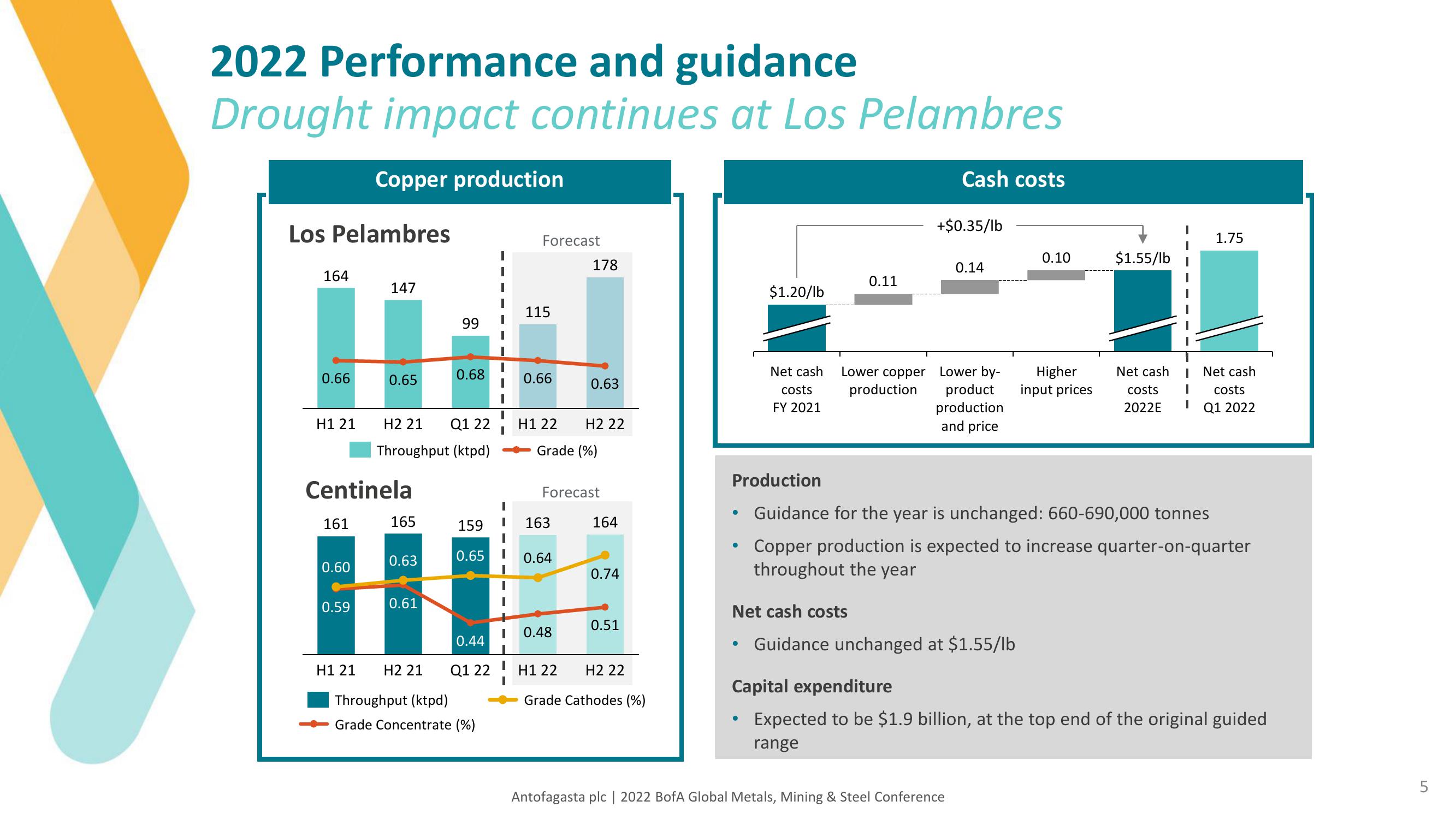

Drought impact continues at Los Pelambres

Los Pelambres

164

0.66

H1 21

161

0.60

Copper production

0.59

Centinela

H1 21

147

0.65

H2 21

Q1 22

Throughput (ktpd)

165

0.63

0.61

99

H2 21

0.68

159

0.65

0.44

Q1 22

Throughput (ktpd)

Grade Concentrate (%)

I

Forecast

115

I

0.66

I 163

H1 22

Grade (%)

178

0.64

I 0.48

0.63

Forecast

H2 22

164

0.74

0.51

H1 22

H2 22

Grade Cathodes (%)

●

●

$1.20/lb

Net cash

costs

FY 2021

●

T

0.11

Cash costs

+$0.35/lb

0.14

Lower copper Lower by-

production product

production

and price

Net cash costs

Guidance unchanged at $1.55/lb

Antofagasta plc | 2022 BofA Global Metals, Mining & Steel Conference

0.10

Higher

input prices

$1.55/lb

Production

Guidance for the year is unchanged: 660-690,000 tonnes

Copper production is expected to increase quarter-on-quarter

throughout the year

I

Net cash

I

costs I

2022E

1.75

Net cash

costs

Q1 2022

Capital expenditure

Expected to be $1.9 billion, at the top end of the original guided

range

LO

5View entire presentation