Apollo Global Management Investor Day Presentation Deck

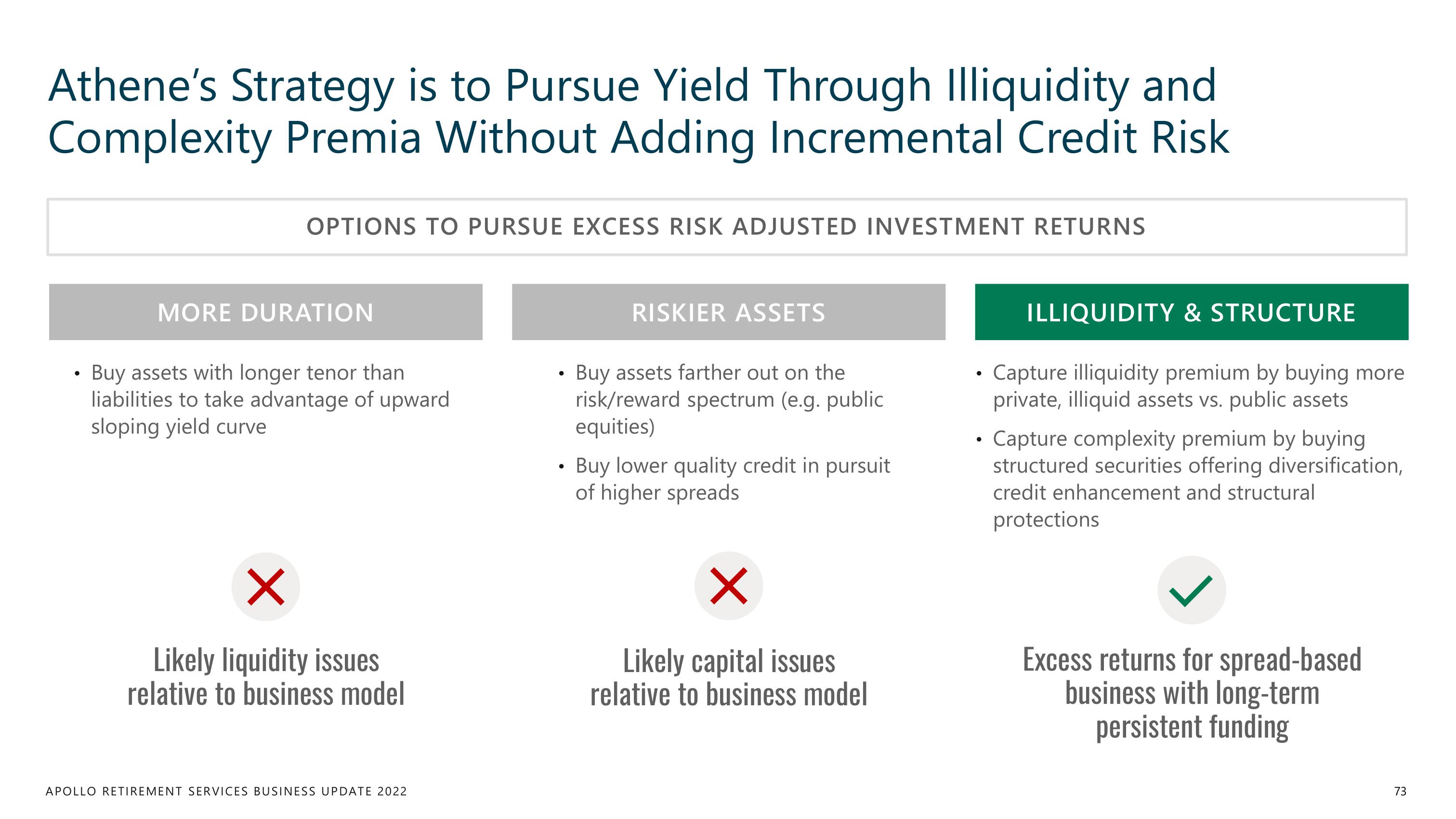

Athene's Strategy is to Pursue Yield Through Illiquidity and

Complexity Premia Without Adding Incremental Credit Risk

OPTIONS TO PURSUE EXCESS RISK ADJUSTED INVESTMENT RETURNS

MORE DURATION

• Buy assets with longer tenor than

liabilities to take advantage of upward

sloping yield curve

×

Likely liquidity issues

relative to business model

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

●

RISKIER ASSETS

Buy assets farther out on the

risk/reward spectrum (e.g. public

equities)

Buy lower quality credit in pursuit

of higher spreads

×

Likely capital issues

relative to business model

●

●

ILLIQUIDITY & STRUCTURE

Capture illiquidity premium by buying more

private, illiquid assets vs. public assets

Capture complexity premium by buying

structured securities offering diversification,

credit enhancement and structural

protections

Excess returns for spread-based

business with long-term

persistent funding

73View entire presentation