Tudor, Pickering, Holt & Co Investment Banking

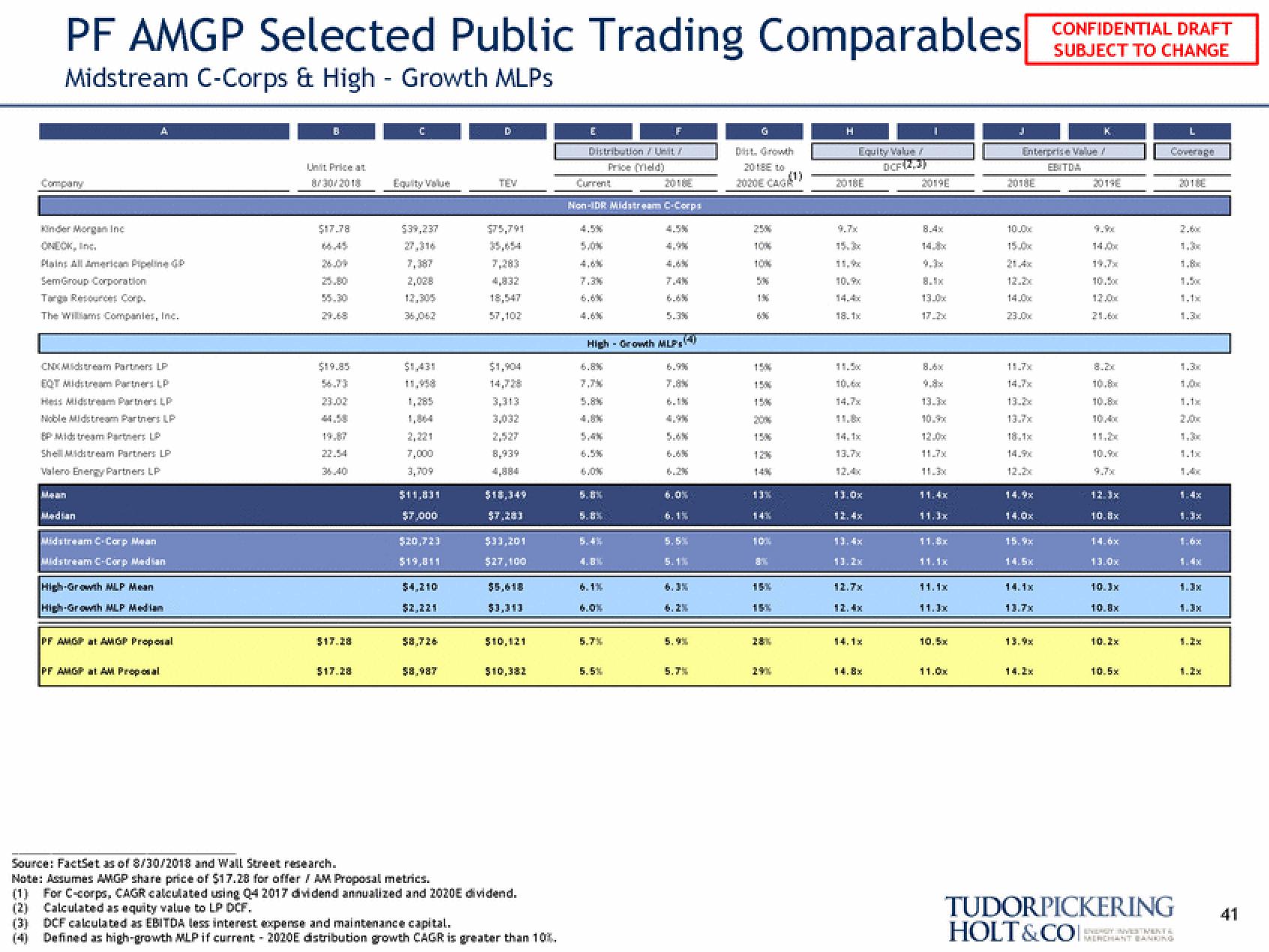

PF AMGP Selected Public Trading Comparables

Midstream C-Corps & High - Growth MLPs

Company

Kinder Morgan Inc

ONEOK, Inc.

Plains All American Pipeline GP

SemGroup Corporation

Tanga Resources Corp.

The Williams Companies, Inc.

A

CNX Midstream Partners LP

EQT Midstream Partners LP

He Midstream Partners LP

Noble Midstream Partners LP

BP Midstream Partners LP

Shell Midstream Partners LP

Valero Energy Partners LP

Median

Midstream C-Corp Mean

Midstream C-Corp Median

High-Growth MLP Mean

High-Growth MLP Median

PF AMGP at AMGP Proposal

PF AMGP at AM Proposal

Unit Price at

8/30/2018

$17.78

26.09

22.54

36.40

$17.28

$17.28

Equity Value

$39,237

2,028

36,062

$1,431

2,221

7,000

3,709

$11,831

$7,000

$20,723

$4,210

$2,221

$8,726

$8,987

D

TEV

7,283

$1,904

3,313

3,032

2,527

8,939

4,884

$18,349

$7.283

$33,201

$27,100

$5,618

$3,313

$10,121

$10,382

Source: FactSet as of 8/30/2018 and Wall Street research.

Note: Assumes AMGP share price of $17.28 for offer / AM Proposal metrics.

(1) For C-corps, CAGR calculated using Q4 2017 dividend annualized and 2020E dividend.

(2) Calculated as equity value to LP DCF.

(3)

DCF calculated as EBITDA less interest expense and maintenance capital.

Defined as high-growth MLP if current - 2020E distribution growth CAGR is greater than 10%.

Distribution/Unit /

Price [field)

Current

Non-IDR Midstream C-Corps

7.3%

High-Growth MLPs (4)

5.8%

5.8%

5.8%

6.1%

5.7%

5.5%

6.0%

6.1%

5.5%

5.1%

5.7%

2018 to

2020E CAGR

25%

10%

10%

5%

196

15%

15%

20%

15%

12%

13%

10%

28%

29%

H

Equity Value /

DCF(2,3)

2018E

10.9x

18.1x

13.7x

12.4x

13.0x

13.2x

12.7x

12.4x

14.1x

2019E

8.4x

13.0x

13.3x

11.7x

11.3x

11.4x

11.3x

11.1x

11.1x

11.3x

td.Ex

11.0x

Enterprise Value

EBITDA

2018E

10.0x

15.0x

12.20

14.0x

23.0x

11.7x

12.2x

14.9x

14.0x

15.9x

1.5x

14.1x

13.7x

13.9x

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

14.2x

K

2019E

14.0x

10.0

12.0x

21.6x

10.8x

10,4x

10.9x

12.3x

10.8x

14.6x

13.0x

10.3x

10.8x

10.2x

fu Ex

TUDORPICKERING

HOLT&CO CHANT BANKING

2018E

1.1x

1.3

1.3x

1,0x

20x

1.3x

1.3x

1.2x

41View entire presentation