Carlyle Investor Conference Presentation Deck

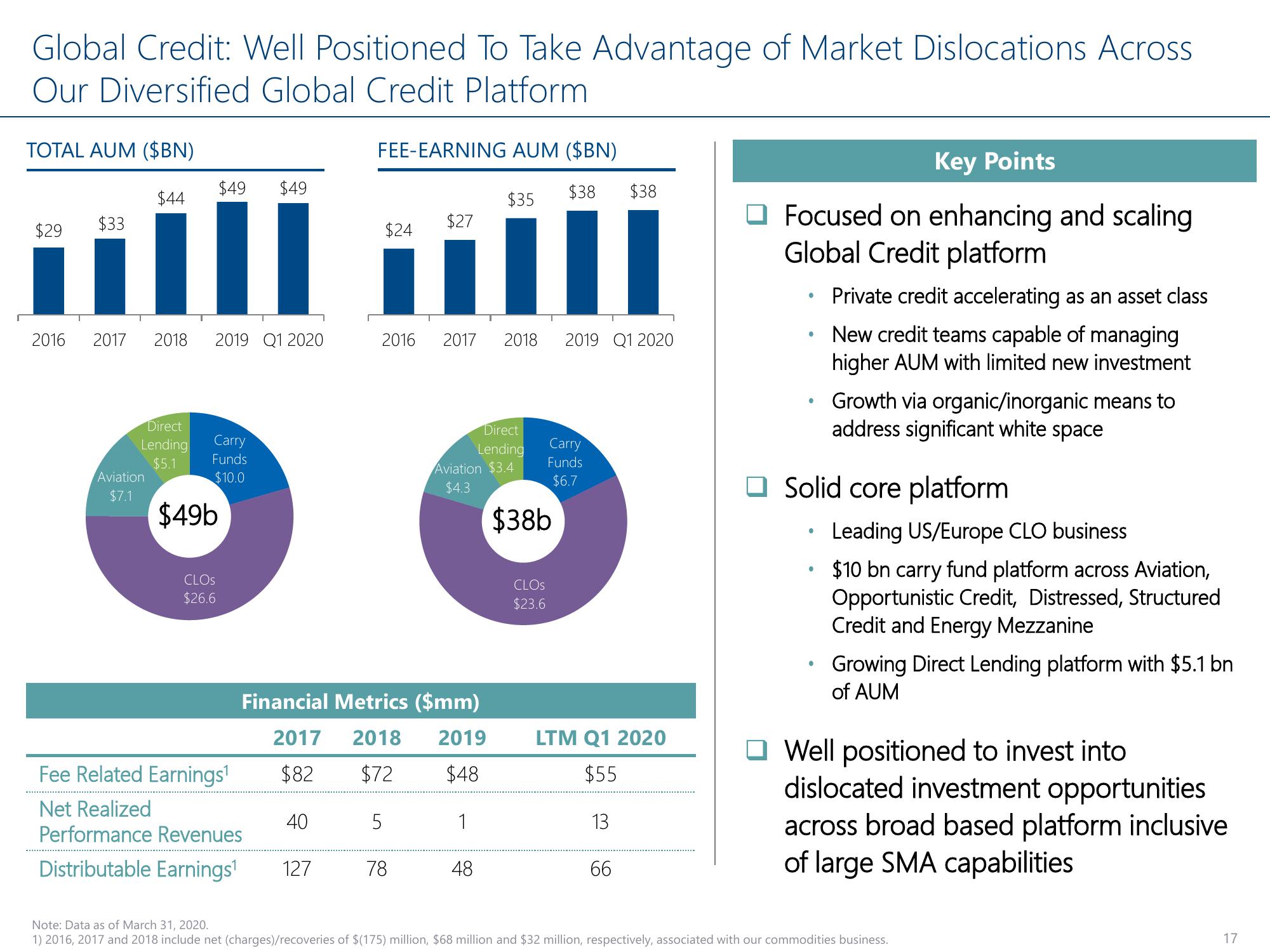

Global Credit: Well Positioned To Take Advantage of Market Dislocations Across

Our Diversified Global Credit Platform

TOTAL AUM ($BN)

$44

$29 $33

2016

2017 2018 2019 Q1 2020

Direct

Lending

$5.1

Aviation

$7.1

$49 $49

Carry

Funds

$10.0

$49b

CLOS

$26.6

FEE-EARNING AUM ($BN)

Fee Related Earnings¹

Net Realized

Performance Revenues

Distributable Earnings¹

$24

2016

5

$27

78

Financial Metrics ($mm)

2017 2018 2019

$72

$82

$48

40

127

2017 2018

$35

Aviation $3.4

$4.3

1

Direct

Lending

48

$38b

CLOS

$23.6

$38 $38

2019 Q1 2020

Carry

Funds

$6.7

LTM Q1 2020

$55

13

66

Key Points

Focused on enhancing and scaling

Global Credit platform

●

●

●

Private credit accelerating as an asset class

New credit teams capable of managing

higher AUM with limited new investment

Growth via organic/inorganic means to

address significant white space

Solid core platform

Leading US/Europe CLO business

$10 bn carry fund platform across Aviation,

Opportunistic Credit, Distressed, Structured

Credit and Energy Mezzanine

Growing Direct Lending platform with $5.1 bn

of AUM

Well positioned to invest into

dislocated investment opportunities

across broad based platform inclusive

of large SMA capabilities

Note: Data as of March 31, 2020.

1) 2016, 2017 and 2018 include net (charges)/recoveries of $(175) million, $68 million and $32 million, respectively, associated with our commodities business.

17View entire presentation