Greenlight Company Presentation

Start Small

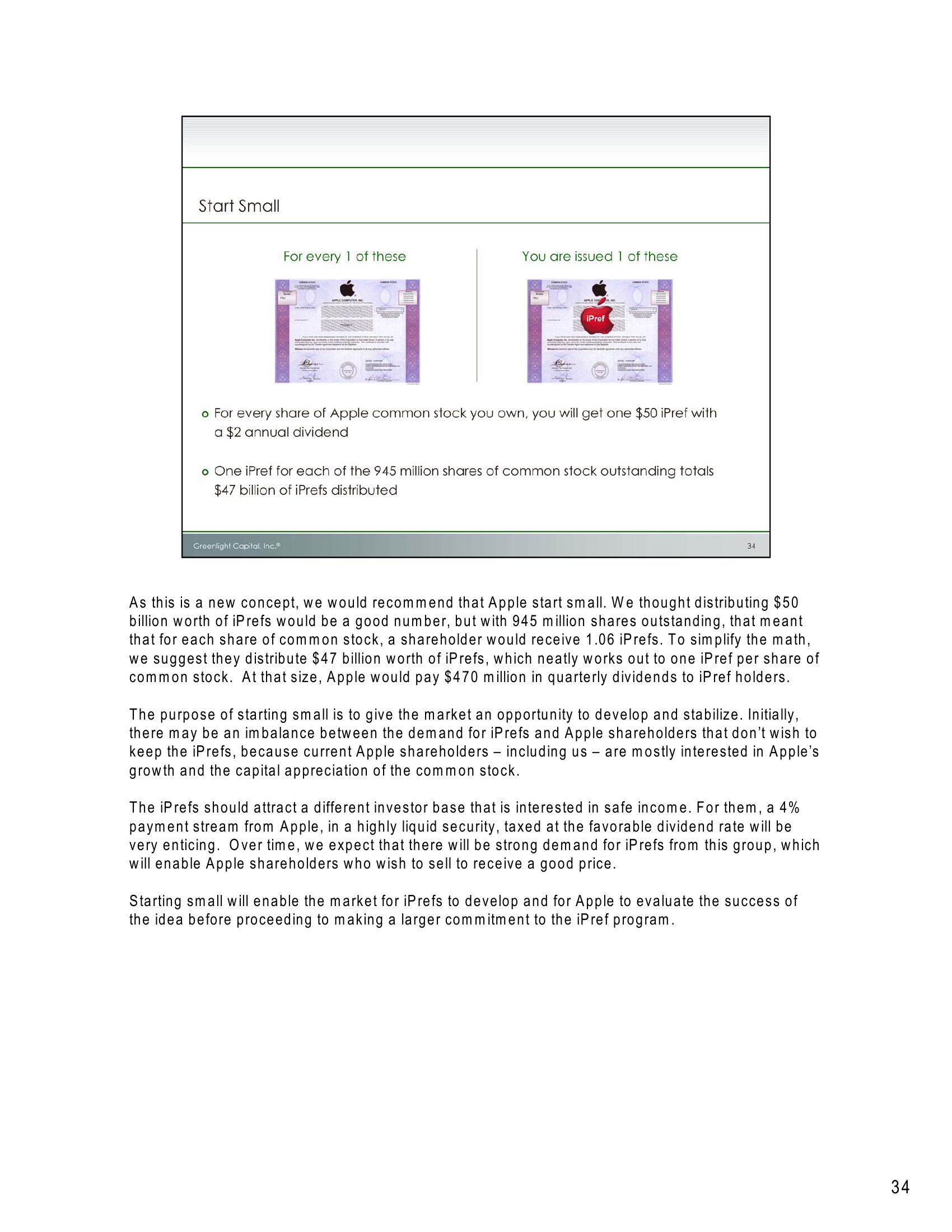

For every 1 of these

You are issued 1 of these

Greenlight Capital, Inc.

iPref

o For every share of Apple common stock you own, you will get one $50 iPref with

a $2 annual dividend

o One iPref for each of the 945 million shares of common stock outstanding totals

$47 billion of iPrefs distributed

34

As this is a new concept, we would recommend that Apple start small. We thought distributing $50

billion worth of iPrefs would be a good number, but with 945 million shares outstanding, that meant

that for each share of common stock, a shareholder would receive 1.06 iPrefs. To simplify the math,

we suggest they distribute $47 billion worth of iPrefs, which neatly works out to one iPref per share of

common stock. At that size, Apple would pay $470 million in quarterly dividends to iPref holders.

The purpose of starting small is to give the market an opportunity to develop and stabilize. Initially,

there may be an imbalance between the demand for iPrefs and Apple shareholders that don't wish to

keep the iPrefs, because current Apple shareholders - including us - are mostly interested in Apple's

growth and the capital appreciation of the common stock.

The iPrefs should attract a different investor base that is interested in safe income. For them, a 4%

payment stream from Apple, in a highly liquid security, taxed at the favorable dividend rate will be

very enticing. Over time, we expect that there will be strong demand for iPrefs from this group, which

will enable Apple shareholders who wish to sell to receive a good price.

Starting small will enable the market for iPrefs to develop and for Apple to evaluate the success of

the idea before proceeding to making a larger commitment to the iPref program.

34View entire presentation