Experienced Senior Team Overview

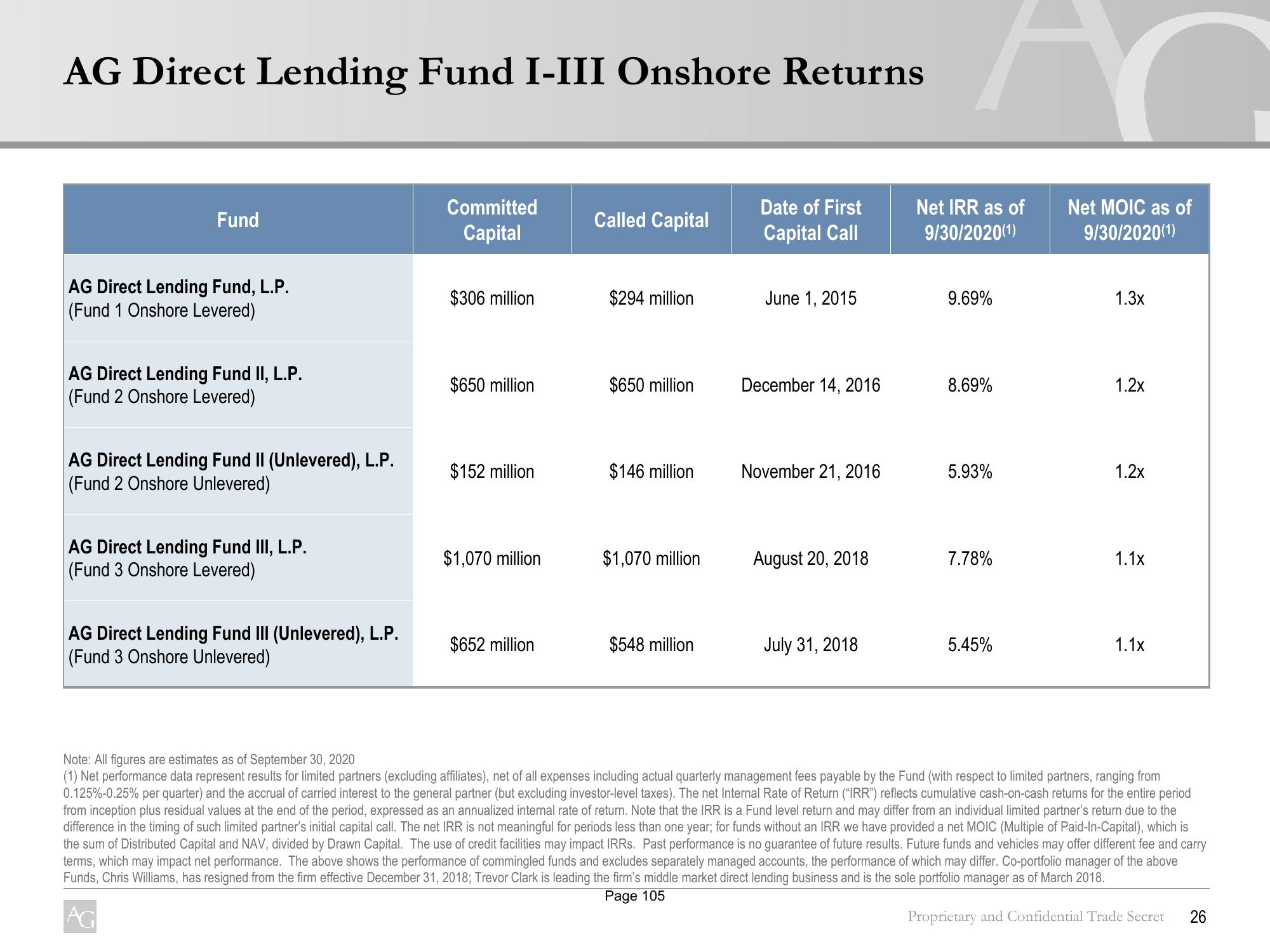

AG Direct Lending Fund I-III Onshore Returns

Fund

AG Direct Lending Fund, L.P.

(Fund 1 Onshore Levered)

AG Direct Lending Fund II, L.P.

(Fund 2 Onshore Levered)

AG Direct Lending Fund II (Unlevered), L.P.

(Fund 2 Onshore Unlevered)

AG Direct Lending Fund III, L.P.

(Fund 3 Onshore Levered)

AG Direct Lending Fund III (Unlevered), L.P.

(Fund 3 Onshore Unlevered)

Committed

Capital

$306 million

$650 million

$152 million

$1,070 million

$652 million

Called Capital

$294 million

$650 million

$146 million

$1,070 million

$548 million

Date of First

Capital Call

June 1, 2015

December 14, 2016

November 21, 2016

August 20, 2018

July 31, 2018

M

Net MOIC as of

9/30/2020(1)

Net IRR as of

9/30/2020(1)

9.69%

8.69%

5.93%

7.78%

5.45%

1.3x

1.2x

1.2x

1.1x

1.1x

Note: All figures are estimates as of September 30, 2020

(1) Net performance data represent results for limited partners (excluding affiliates), net of all expenses including actual quarterly management fees payable by the Fund (with respect to limited partners, ranging from

0.125% 0.25% per quarter) and the accrual carried interest to the general partner (but excluding investor-level taxes). The net Internal Rate of Return ("IRR") reflects cumulative cash-on-cash returns for the entire period

from inception plus residual values at the end of the period, expressed as an annualized internal rate of return. Note that the IRR is a Fund level return and may differ from an individual limited partner's return due to the

difference in the timing of such limited partner's initial capital call. The net IRR is not meaningful for periods less than one year; for funds without an IRR we have provided a net MOIC (Multiple of Paid-In-Capital), which is

the sum of Distributed Capital and NAV, divided by Drawn Capital. The use of credit facilities may impact IRRs. Past performance is no guarantee of future results. Future funds and vehicles may offer different fee and carry

terms, which may impact net performance. The above shows the performance of commingled funds and excludes separately managed accounts, the performance of which may differ. Co-portfolio manager of the above

Funds, Chris Williams, has resigned from the firm effective December 31, 2018; Trevor Clark is leading the firm's middle market direct lending business and is the sole portfolio manager as of March 2018.

Page 105

AG

Proprietary and Confidential Trade Secret

26View entire presentation