Selina SPAC

Transaction Summary

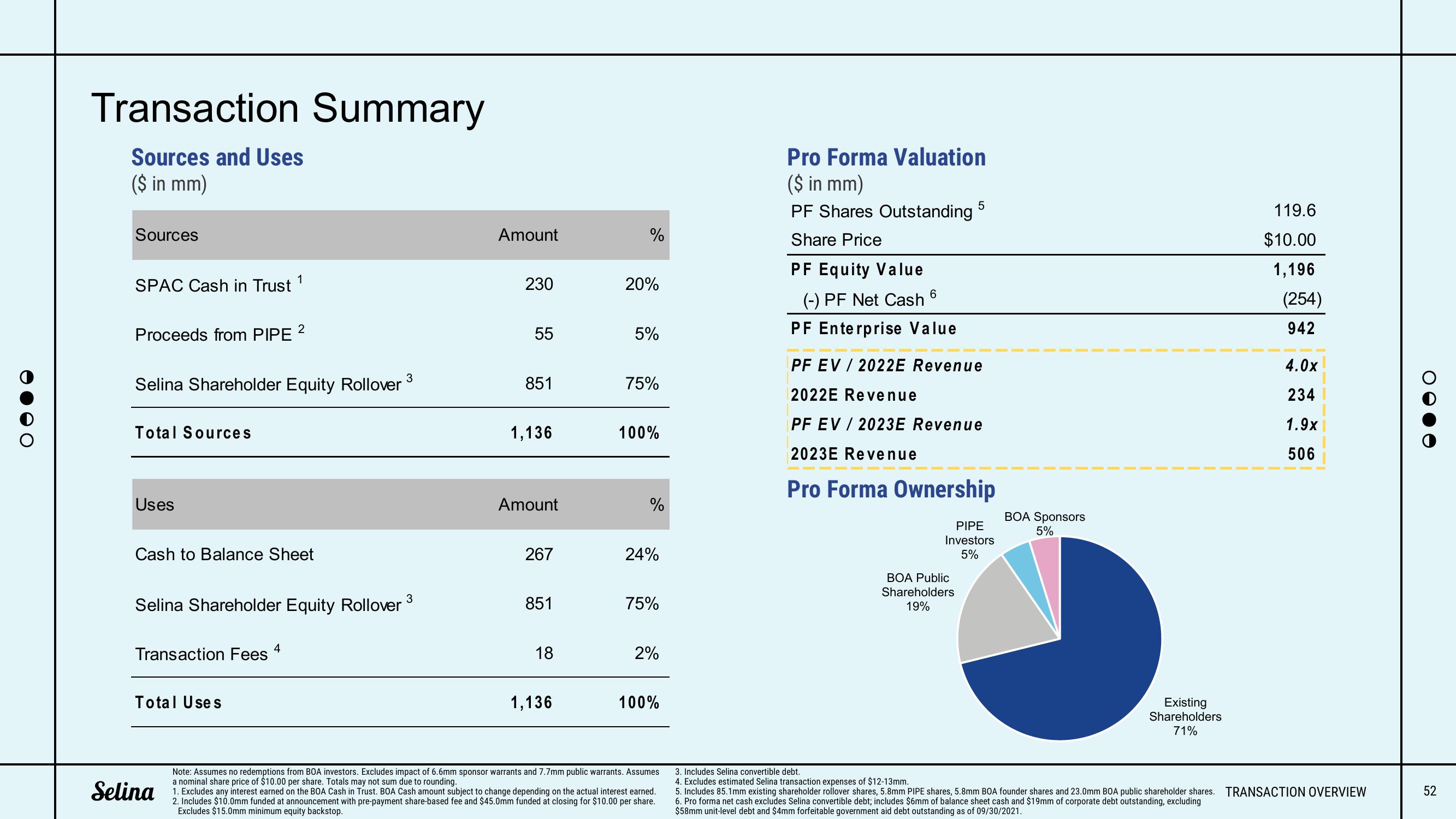

Sources and Uses

($ in mm)

Sources

SPAC Cash in Trust ¹

Proceeds from PIPE ²

Selina Shareholder Equity Rollover ³

Total Sources

Uses

Cash to Balance Sheet

Selina Shareholder Equity Rollover ³

4

Transaction Fees

Total Uses

Selina

Amount

230

55

851

1,136

Amount

267

851

18

1,136

%

20%

5%

75%

100%

%

24%

75%

2%

100%

Note: Assumes no redemptions from BOA investors. Excludes impact of 6.6mm sponsor warrants and 7.7mm public warrants. Assumes

a nominal share price of $10.00 per share. Totals may not sum due to rounding.

1. Excludes any interest earned on the BOA Cash in Trust. BOA Cash amount subject to change depending on the actual interest earned.

2. Includes $10.0mm funded at announcement with pre-payment share-based fee and $45.0mm funded at closing for $10.00 per share.

Excludes $15.0mm minimum equity backstop.

Pro Forma Valuation

($ in mm)

PF Shares Outstanding 5

Share Price

PF Equity Value

(-) PF Net Cash 6

PF Enterprise Value

PF EV / 2022E Revenue

2022E Revenue

PF EV / 2023E Revenue

2023E Revenue

Pro Forma Ownership

====

PIPE

Investors

5%

BOA Public

Shareholders

19%

BOA Sponsors

5%

Existing

Shareholders

71%

119.6

$10.00

1,196

(254)

942

4.0x

234

1.9x

506

3. Includes Selina convertible debt.

4. Excludes estimated Selina transaction expenses of $12-13mm.

5. Includes 85.1mm existing shareholder rollover shares, 5.8mm PIPE shares, 5.8mm BOA founder shares and 23.0mm BOA public shareholder shares. TRANSACTION OVERVIEW

6. Pro forma net cash excludes Selina convertible debt; includes $6mm of balance sheet cash and $19mm of corporate debt outstanding, excluding

$58mm unit-level debt and $4mm forfeitable government aid debt outstanding as of 09/30/2021.

52View entire presentation