Evercore Investment Banking Pitch Book

Preliminary Situation Assessment

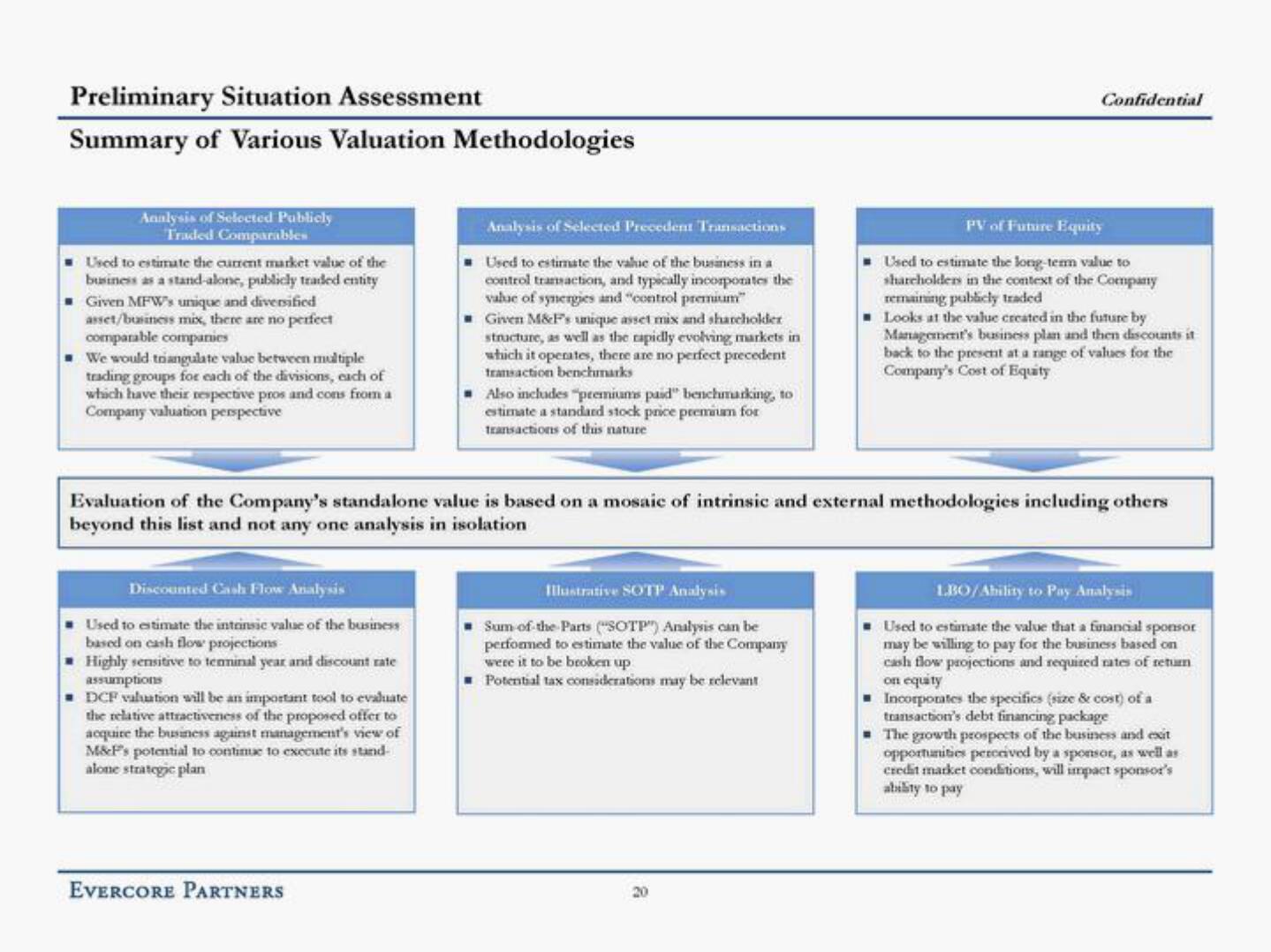

Summary of Various Valuation Methodologies

Analysis of Selected Publicly

Traded Comparables

Used to estimate the current market value of the

business as a stand-alone, publicly traded entity

Given MFW's unique and diversified

asset/business mix, there are no perfect

comparable companies

We would triangulate value between multiple

trading groups for each of the divisions, each of

which have their respective pros and cons from a

Company valuation perspective

Discounted Cash Flow Analysis

Used to estimate the intrinsic value of the business

based on cash flow projections

Highly sensitive to terminal year and discount rate

assumptions

DCF valuation will be an important tool to evaluate

the relative attractiveness of the proposed offer to

acquire the business against management's view of

M&F's potential to continue to execute its stand-

alone strategic plan

Analysis of Selected Precedent Transactions

Used to estimate the value of the business in a

control transaction, and typically incorporates the

value of synergies and "control premium"

Given M&F's unique asset mix and shareholder

structure, as well as the rapidly evolving markets in

which it operates, there are no perfect precedent

transaction benchmarks

EVERCORE PARTNERS

Also includes "premiums paid" benchmarking, to

estimate a standard stock price premium for

transactions of this nature

Evaluation of the Company's standalone value is based on a mosaic of intrinsic and external methodologies including others

beyond this list and not any one analysis in isolation

Illustrative SOTP Analysis

Sum of the Parts ("SOTP") Analysis can be

performed to estimate the value of the Company

were it to be broken up

Potential tax considerations may be relevant

Confidential

20

PV of Future Equity

Used to estimate the long-term value to

shareholders in the context of the Company

remaining publicly traded

Looks at the value created in the future by

Management's business plan and then discounts it

back to the present at a range of values for the

Company's Cost of Equity

LBO/Ability to Pay Analysis

Used to estimate the value that a financial sponsor

may be willing to pay for the business based on

cash flow projections and required rates of return

on equity

Incorporates the specifics (size & cost) of a

transaction's debt financing package

The growth prospects of the business and exit

opportunities perceived by a sponsor, as well as

credit market conditions, will impact sponsor's

ability to payView entire presentation