NuStar Energy Investor Conference Presentation Deck

NuStar

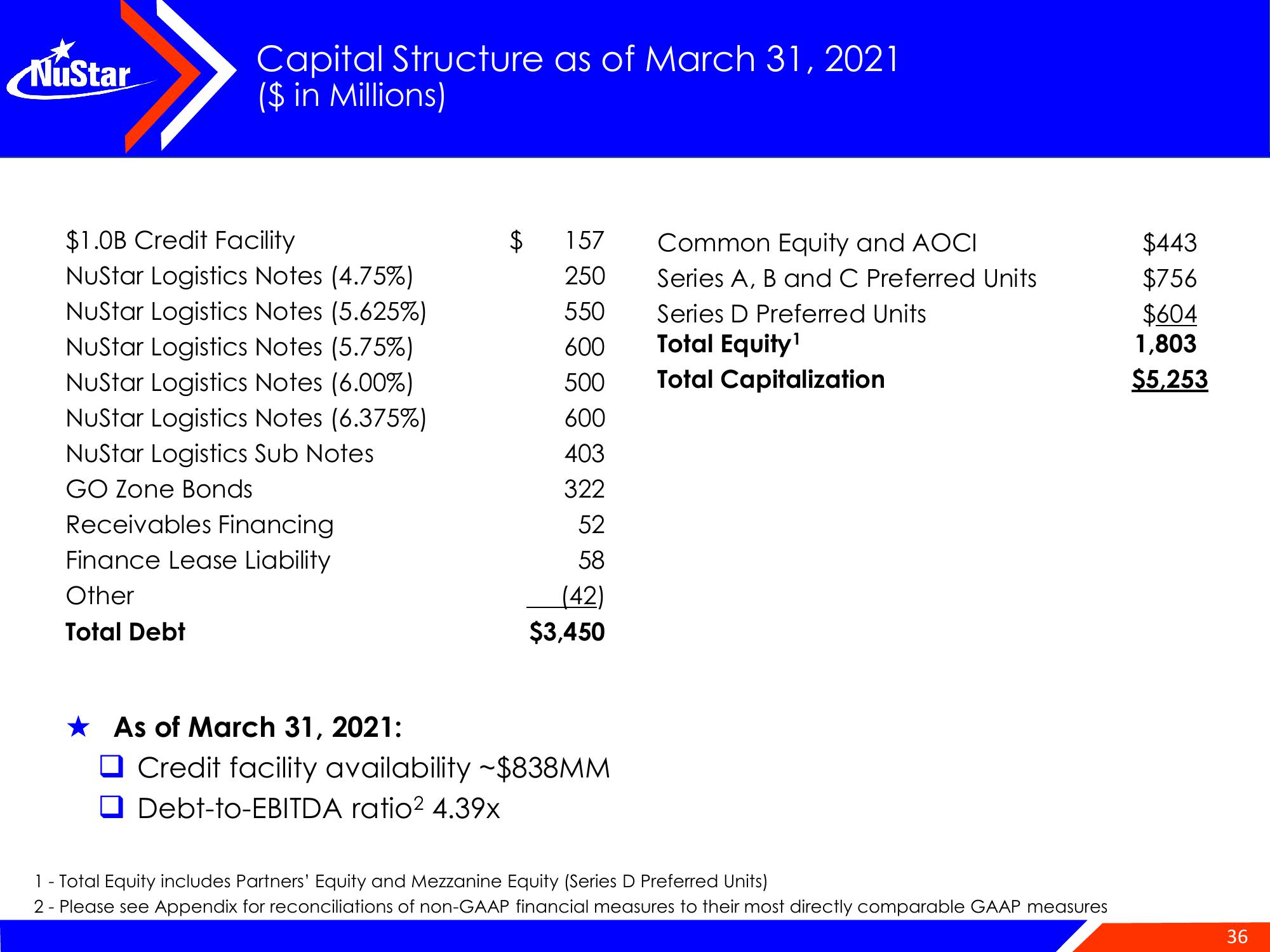

Capital Structure as of March 31, 2021

($ in Millions)

$1.0B Credit Facility

NuStar Logistics Notes (4.75%)

NuStar Logistics Notes (5.625%)

NuStar Logistics Notes (5.75%)

NuStar Logistics Notes (6.00%)

NuStar Logistics Notes (6.375%)

NuStar Logistics Sub Notes

GO Zone Bonds

Receivables Financing

Finance Lease Liability

Other

Total Debt

★ As of March 31, 2021:

$ 157

250

550

600

500

600

403

322

52

58

(42)

$3,450

Credit facility availability ~$838MM

Debt-to-EBITDA ratio2 4.39x

Common Equity and AOCI

Series A, B and C Preferred Units

Series D Preferred Units

Total Equity¹

Total Capitalization

1 - Total Equity includes Partners' Equity and Mezzanine Equity (Series D Preferred Units)

2 - Please see Appendix for reconciliations of non-GAAP financial measures to their most directly comparable GAAP measures

$443

$756

$604

1,803

$5,253

36View entire presentation