WeWork Investor Presentation Deck

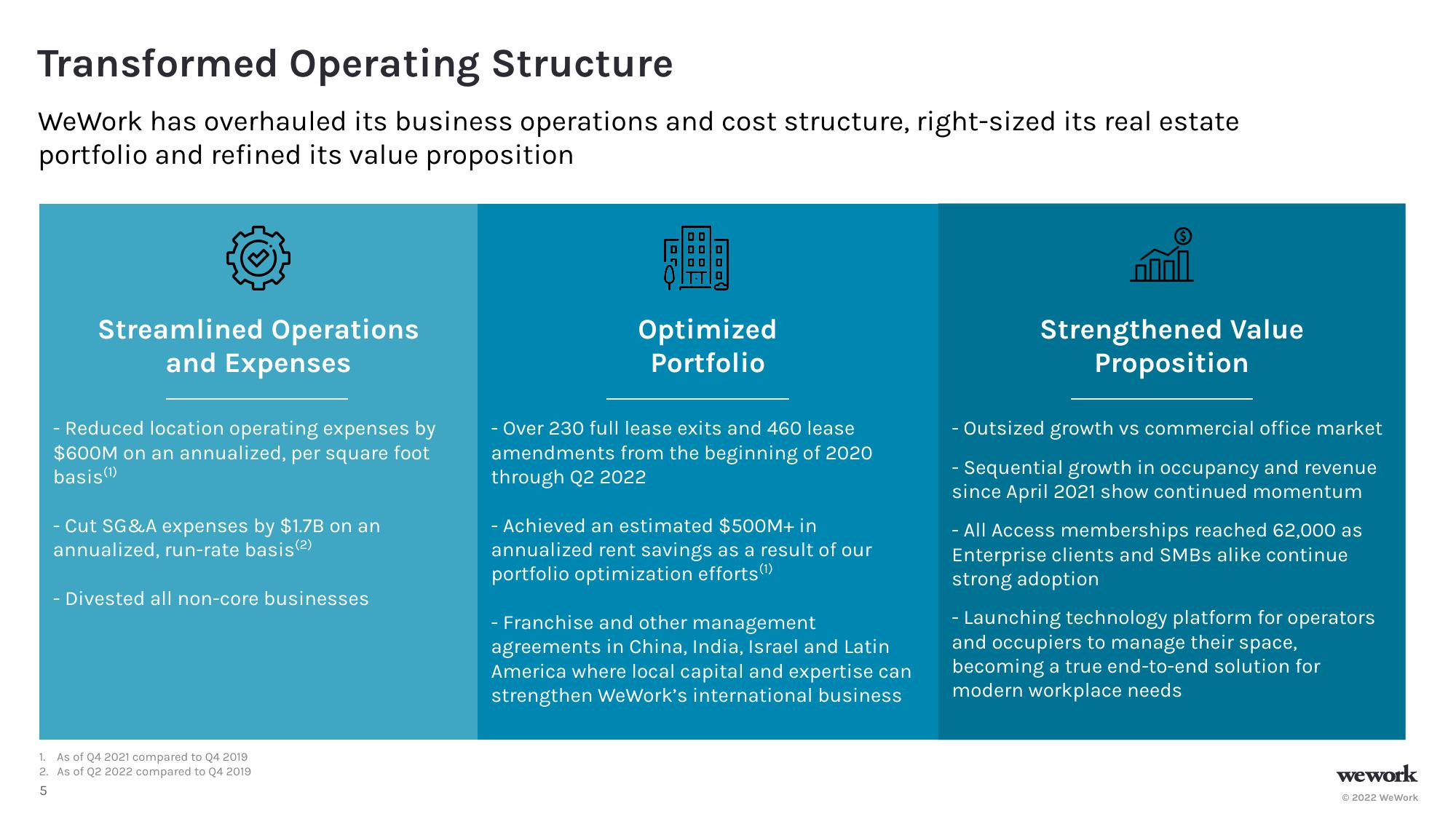

Transformed Operating Structure

WeWork has overhauled its business operations and cost structure, right-sized its real estate

portfolio and refined its value proposition

Streamlined Operations

and Expenses

- Reduced location operating expenses by

$600M on an annualized, per square foot

basis (1)

- Cut SG&A expenses by $1.7B on an

annualized, run-rate basis (²)

- Divested all non-core businesses

1. As of Q4 2021 compared to Q4 2019

2. As of Q2 2022 compared to Q4 2019

5

DO

Optimized

Portfolio

- Over 230 full lease exits and 460 lease

amendments from the beginning of 2020

through Q2 2022

- Achieved an estimated $500M+ in

annualized rent savings as a result of our

portfolio optimization efforts (1)

- Franchise and other management

agreements in China, India, Israel and Latin

America where local capital and expertise can

strengthen WeWork's international business

Strengthened Value

Proposition

- Outsized growth vs commercial office market

- Sequential growth in occupancy and revenue

since April 2021 show continued momentum

- All Access memberships reached 62,000 as

Enterprise clients and SMBs alike continue

strong adoption

- Launching technology platform for operators

and occupiers to manage their space,

becoming a true end-to-end solution for

modern workplace needs

wework

Ⓒ2022 WeWorkView entire presentation