KKR Real Estate Finance Trust Investor Presentation Deck

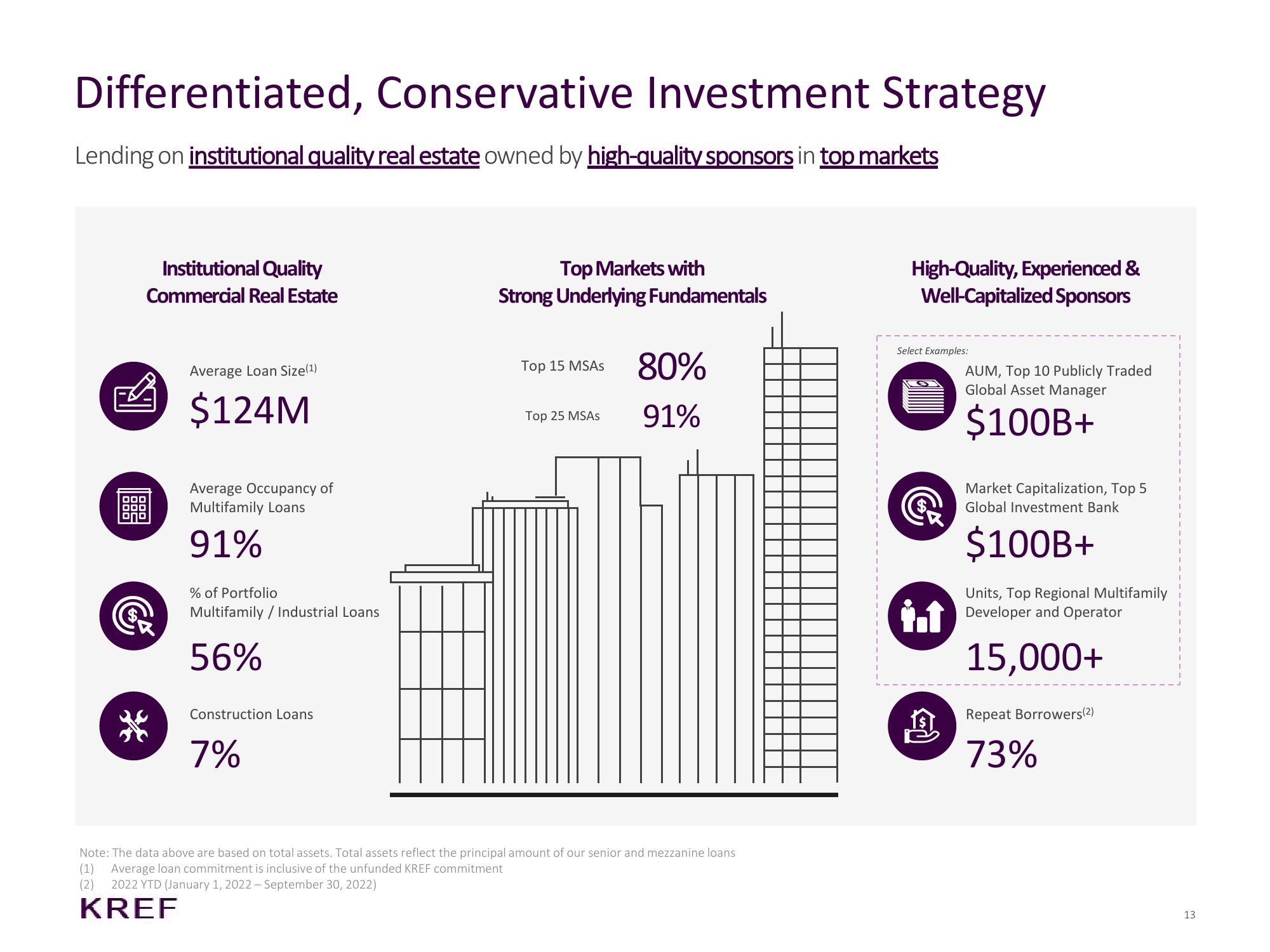

Differentiated, Conservative Investment Strategy

Lending on institutional quality real estate owned by high-quality sponsors in top markets

Institutional Quality

Commercial Real Estate

B

***

Average Loan Size(¹)

$124M

Average Occupancy of

Multifamily Loans

91%

% of Portfolio

Multifamily / Industrial Loans

56%

Construction Loans

7%

Top Markets with

Strong Underlying Fundamentals

Top 15 MSAS

Top 25 MSAS

80%

91%

Note: The data above are based on total assets. Total assets reflect the principal amount of our senior and mezzanine loans

(1) Average loan commitment is inclusive of the unfunded KREF commitment

(2) 2022 YTD (January 1, 2022-September 30, 2022)

KREF

High-Quality, Experienced &

Well-Capitalized Sponsors

Select Examples:

息

AUM, Top 10 Publicly Traded

Global Asset Manager

$100B+

Market Capitalization, Top 5

Global Investment Bank

$100B+

Units, Top Regional Multifamily

Developer and Operator

15,000+

Repeat Borrowers(2)

73%

13View entire presentation