Sotheby's Investor Presentation Deck

APPENDIX

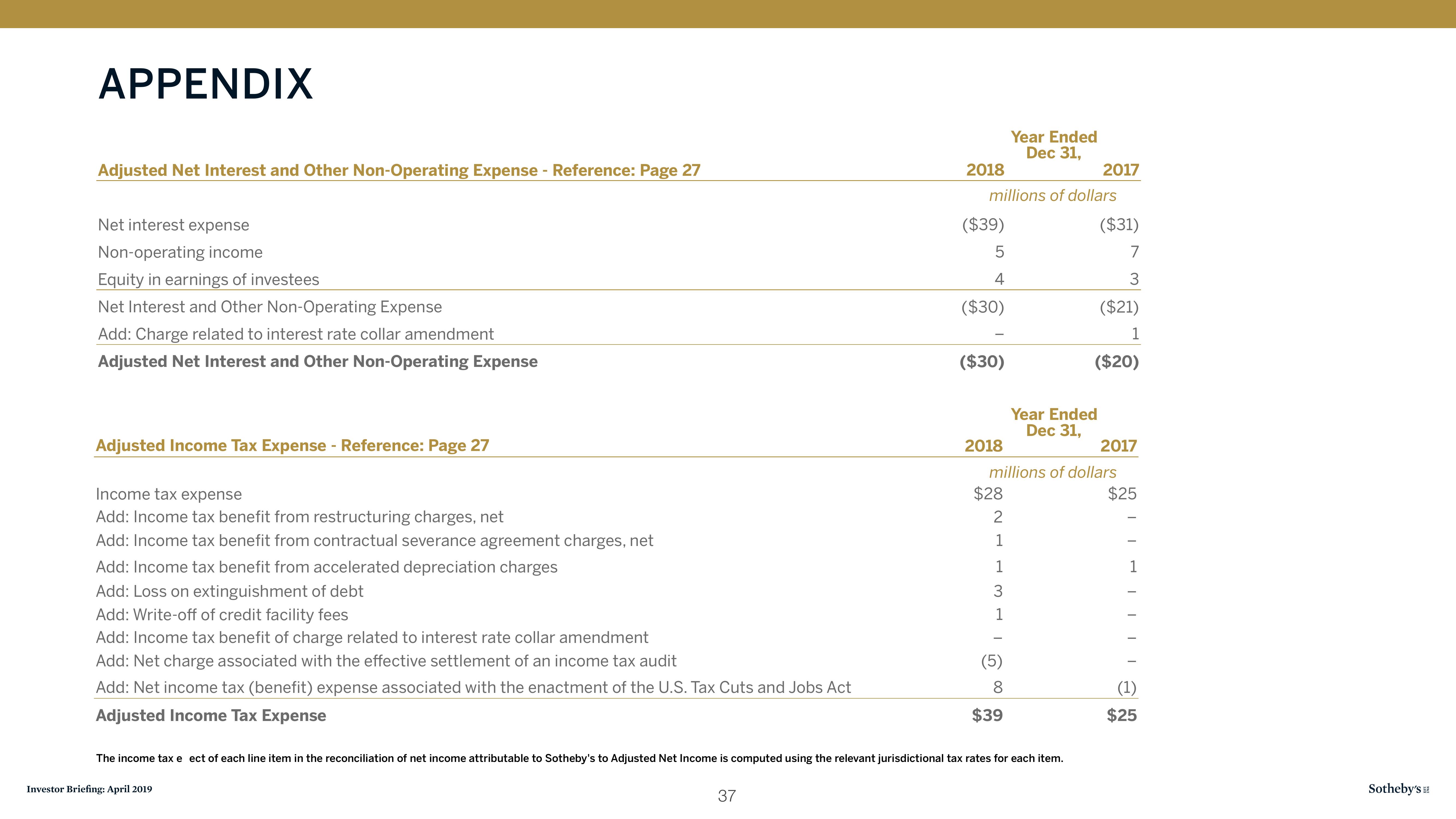

Adjusted Net Interest and Other Non-Operating Expense - Reference: Page 27

Net interest expense

Non-operating income

Equity in earnings of investees

Net Interest and Other Non-Operating Expense

Add: Charge related to interest rate collar amendment

Adjusted Net Interest and Other Non-Operating Expense

Adjusted Income Tax Expense - Reference: Page 27

Income tax expense

Add: Income tax benefit from restructuring charges, net

Add: Income tax benefit from contractual severance agreement charges, net

Add: Income tax benefit from accelerated depreciation charges

Add: Loss on extinguishment of debt

Add: Write-off of credit facility fees

Add: Income tax benefit of charge related to interest rate collar amendment

Add: Net charge associated with the effective settlement of an income tax audit

Add: Net income tax (benefit) expense associated with the enactment of the U.S. Tax Cuts and Jobs Act

Adjusted Income Tax Expense

Investor Briefing: April 2019

2018

37

($39)

5

4

($30)

millions of dollars

($30)

2018

$28

2

1

1

3

1

Year Ended

Dec 31,

(5)

8

$39

The income tax e ect of each line item in the reconciliation of net income attributable to Sotheby's to Adjusted Net Income is computed using the relevant jurisdictional tax rates for each item.

2017

Year Ended

Dec 31,

millions of dollars

($31)

7

3

($21)

1

($20)

2017

$25

1

(1)

$25

Sotheby'sView entire presentation