HBT Financial Results Presentation Deck

Non-GAAP Reconciliations (cont'd)

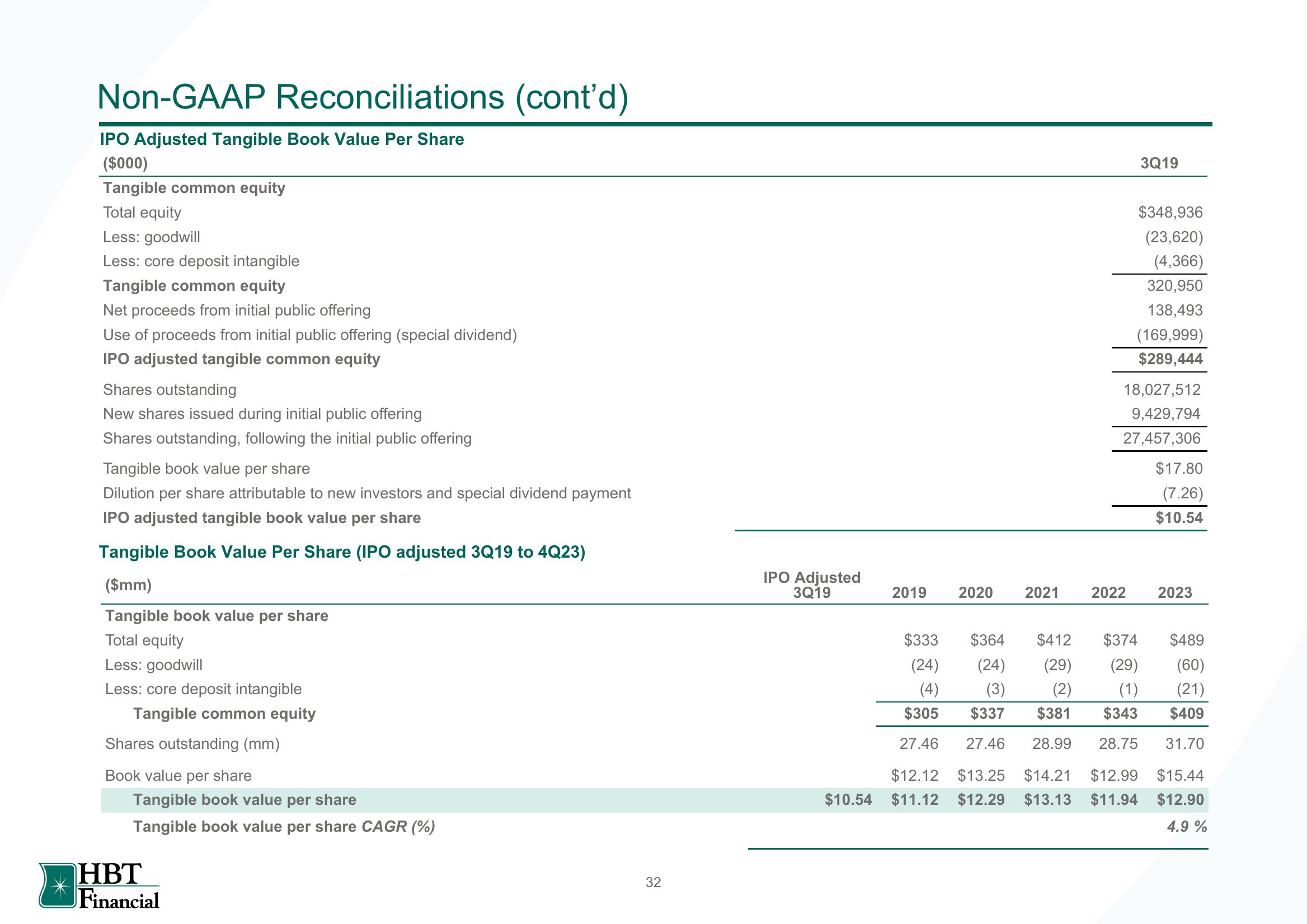

IPO Adjusted Tangible Book Value Per Share

($000)

Tangible common equity

Total equity

Less: goodwill

Less: core deposit intangible

Tangible common equity

Net proceeds from initial public offering

Use of proceeds from initial public offering (special dividend)

IPO adjusted tangible common equity

Shares outstanding

New shares issued during initial public offering

Shares outstanding, following the initial public offering

Tangible book value per share

Dilution per share attributable to new investors and special dividend payment

IPO adjusted tangible book value per share

Tangible Book Value Per Share (IPO adjusted 3Q19 to 4Q23)

($mm)

Tangible book value per share

Total equity

Less: goodwill

Less: core deposit intangible

Tangible common equity

Shares outstanding (mm)

Book value per share

Tangible book value per share

Tangible book value per share CAGR (%)

HBT

Financial

32

IPO Adjusted

3Q19

2019

3Q19

2020 2021 2022

$348,936

(23,620)

(4,366)

320,950

138,493

(169,999)

$289,444

18,027,512

9,429,794

27,457,306

$17.80

(7.26)

$10.54

2023

$333 $364 $412 $374

(24)

(4)

(24)

(3)

$337

(29) (29)

(2) (1)

$381 $343

$305

27.46

27.46 28.99 28.75

$12.12 $13.25 $14.21 $12.99 $15.44

$10.54 $11.12 $12.29 $13.13 $11.94 $12.90

4.9 %

$489

(60)

(21)

$409

31.70View entire presentation