Bank of America Investment Banking Pitch Book

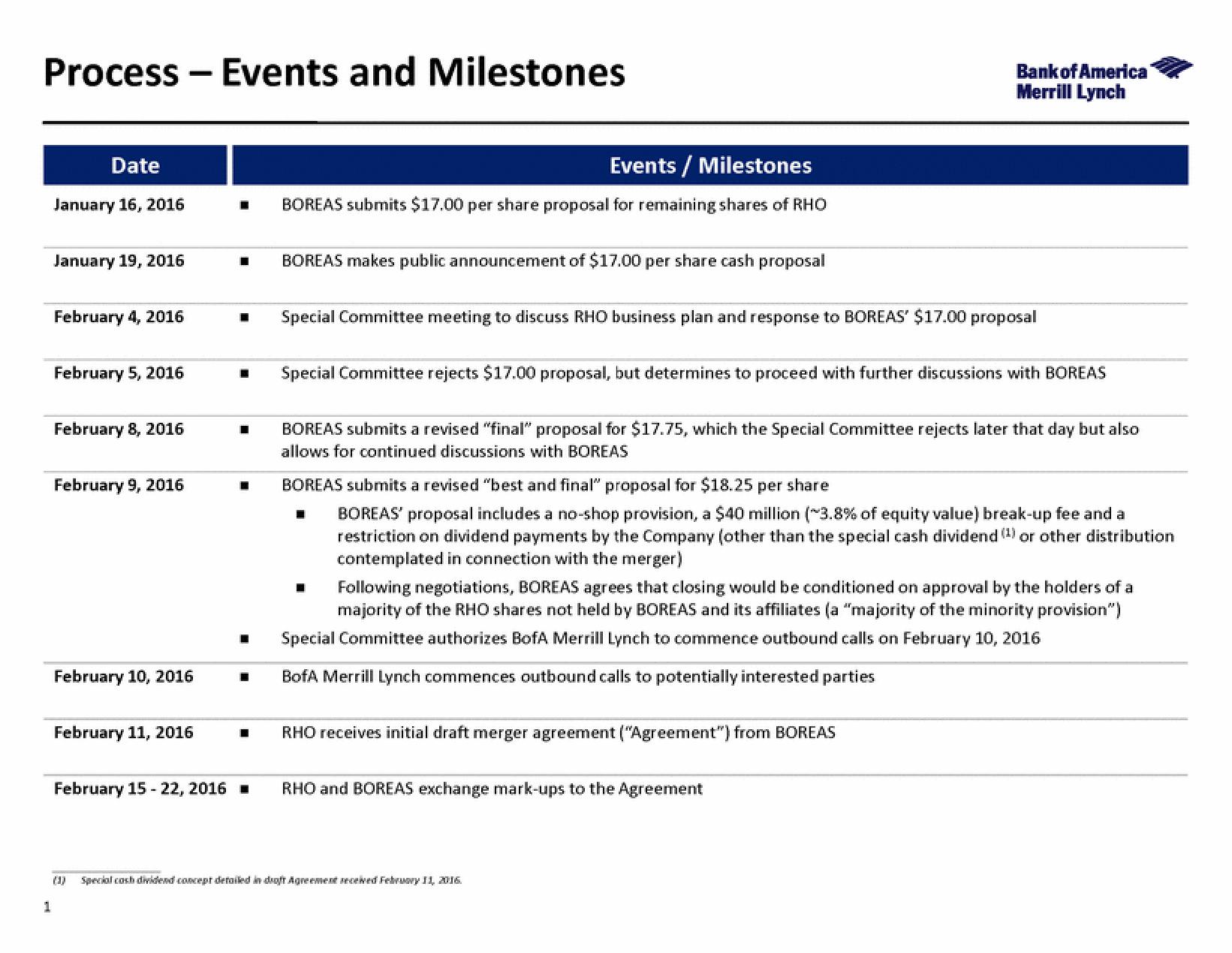

Process - Events and Milestones

1

Date

January 16, 2016

January 19, 2016

February 4, 2016

February 5, 2016

February 8, 2016

February 9, 2016

February 10, 2016

February 11, 2016

February 15 - 22, 2016

(3)

1

Events / Milestones

BOREAS submits $17.00 per share proposal for remaining shares of RHO

■ Special Committee meeting to discuss RHO business plan and response to BOREAS' $17.00 proposal

■

BOREAS makes public announcement of $17.00 per share cash proposal

■ Special Committee rejects $17.00 proposal, but determines to proceed with further discussions with BOREAS

1

Bank of America

Merrill Lynch

BOREAS submits a revised "final" proposal for $17.75, which the Special Committee rejects later that day but also

allows for continued discussions with BOREAS

BOREAS submits a revised "best and final" proposal for $18.25 per share

BOREAS' proposal includes a no-shop provision, a $40 million (~3.8% of equity value) break-up fee and a

restriction on dividend payments by the Company (other than the special cash dividend (¹) or other distribution

contemplated in connection with the merger)

Following negotiations, BOREAS agrees that closing would be conditioned on approval by the holders of a

majority of the RHO shares not held by BOREAS and its affiliates (a "majority of the minority provision")

Special Committee authorizes BofA Merrill Lynch to commence outbound calls on February 10, 2016

BofA Merrill Lynch commences outbound calls to potentially interested parties

RHO receives initial draft merger agreement ("Agreement") from BOREAS

RHO and BOREAS exchange mark-ups to the Agreement

Special cash dividend concept detailed in draft Agreement received February 11, 2016.View entire presentation