Nuvei Results Presentation Deck

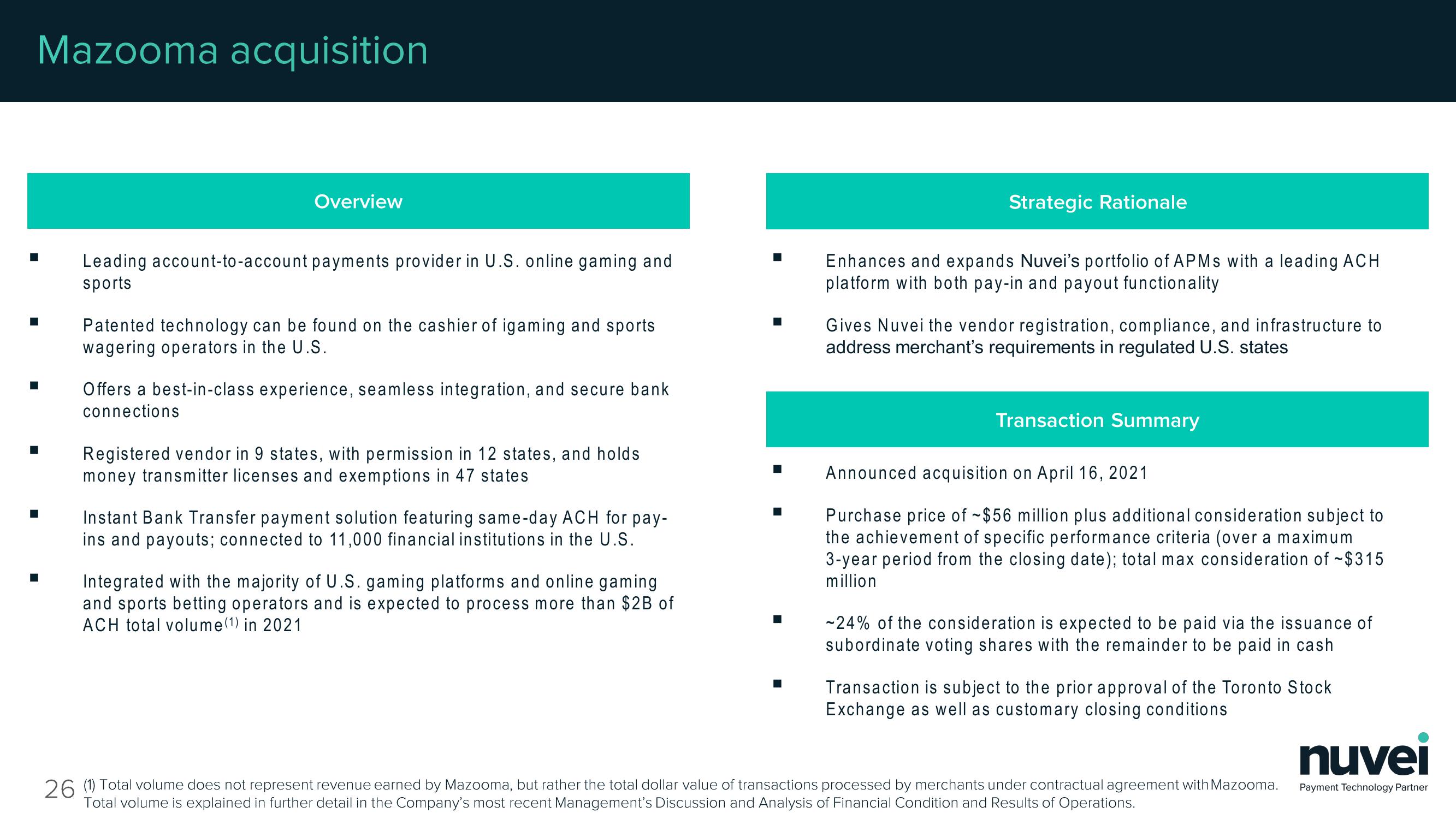

Mazooma acquisition

Overview

Leading account-to-account payments provider in U.S. online gaming and

sports

Patented technology can be found on the cashier of igaming and sports

wagering operators in the U.S.

Offers a best-in-class experience, seamless integration, and secure bank

connections

Registered vendor in 9 states, with permission in 12 states, and holds

money transmitter licenses and exemptions in 47 states

Instant Bank Transfer payment solution featuring same-day ACH for pay-

ins and payouts; connected to 11,000 financial institutions in the U.S.

Integrated with the majority of U.S. gaming platforms and online gaming

and sports betting operators and is expected to process more than $2B of

ACH total volume (¹) in 2021

Strategic Rationale

Enhances and expands Nuvei's portfolio of APMs with a leading ACH

platform with both pay-in and payout functionality

Gives Nuvei the vendor registration, compliance, and infrastructure to

address merchant's requirements in regulated U.S. states

Transaction Summary

Announced acquisition on April 16, 2021

Purchase price of $56 million plus additional consideration subject to

the achievement of specific performance criteria (over a maximum

3-year period from the closing date); total max consideration of ~$315

million

-24% of the consideration is expected to be paid via the issuance of

subordinate voting shares with the remainder to be paid in cash

Transaction is subject to the prior approval of the Toronto Stock

Exchange as well as customary closing conditions

26 (1) Total volume does not represent revenue earned by Mazooma, but rather the total dollar value of transactions processed by merchants under contractual agreement with Mazooma.

Total volume is explained in further detail in the Company's most recent Management's Discussion and Analysis of Financial Condition and Results of Operations.

nuvei

Payment Technology PartnerView entire presentation