Nexters SPAC Presentation Deck

Well-positioned to become a consolidator in the gaming

space in the Russian speaking community and beyond

Our approach to M&A

Our unique attributes

19

Wide playing field: we estimate there are more than 1,000

independent studios in Russia/FSU³

Focus area: mobile gaming, which is our core area of expertise

with opportunity to diversify our current portfolio beyond

Our value creation playbook: marketing/user acquisition,

data-driven approach to title selection, creative expertise and

monetization

Commercial consideration: value-accretive and disciplined

approach with focus on value creation in future periods

Financing: combination of own cash and equity

Founder motivation: long term earnouts linked to ambitious

KPIs, while keeping creative independence

Transformational opportunities: opportunistic approach,

leveraging network connections with game developers in

Russia / FSU

000

duke

(1)

(2)

(3)

First game developing Company out of Russia expected to be listed on

Nasdaq, bringing attractive acquisition currency to the prospective targets

Strong connectivity within the Russian speaking gaming community

backed by common culture, values and languag

Track record of Kismet sponsor - industry network connections and

expertise in M&A

High synergy potential coming from partnership with Nexters and Playrix

shareholders

nexters

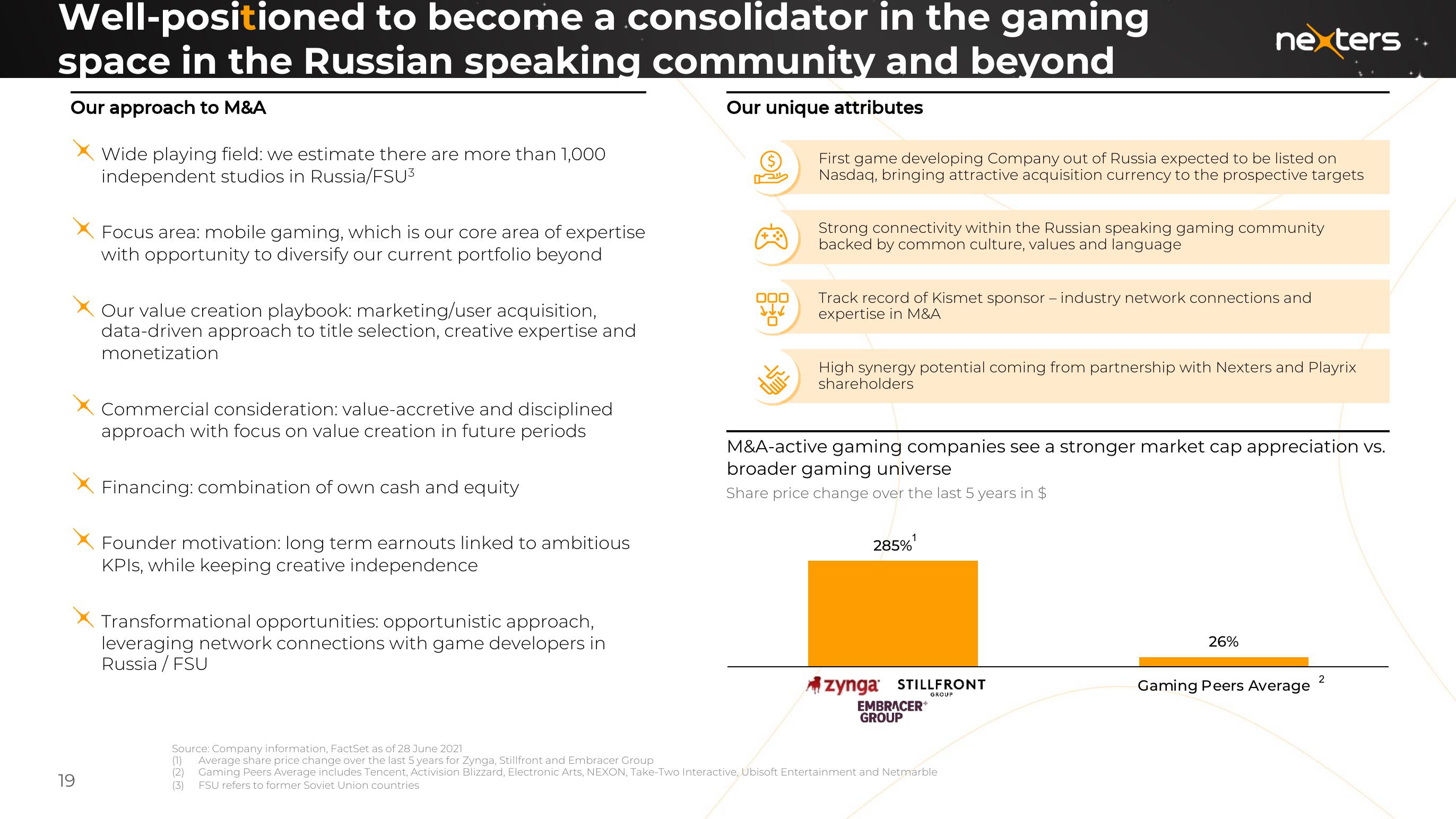

M&A-active gaming companies see a stronger market cap appreciation vs.

broader gaming universe

Share price change over the last 5 years in $

285%¹

Zynga STILLFRONT

GROUP

EMBRACER+

GROUP

Source: Company information, FactSet as of 28 June 2021

Average share price change over the last 5 years for Zynga, Stillfront and Embracer Group

Gaming Peers Average includes Tencent, Activision Blizzard, Electronic Arts, NEXON, Take-Two Interactive, Ubisoft Entertainment and Netmarble

FSU refers to former Soviet Union countries

26%

Gaming Peers Average

2View entire presentation