Greenlight Company Presentation

Large One-Time Share Repurchase

FY 2013E Net income ($ billions)

Pro forma shares outstanding (millions)

Pro forma EPS

Post-deal P/E multiple

Pro forma Apple share price

15% sold at $600 plus 85% of shares at $528

Current stock price

Value unlocked

Greenlight Capital, Inc.

$42.5

805

$53

10.0x

$528

$539

$450

$89

22

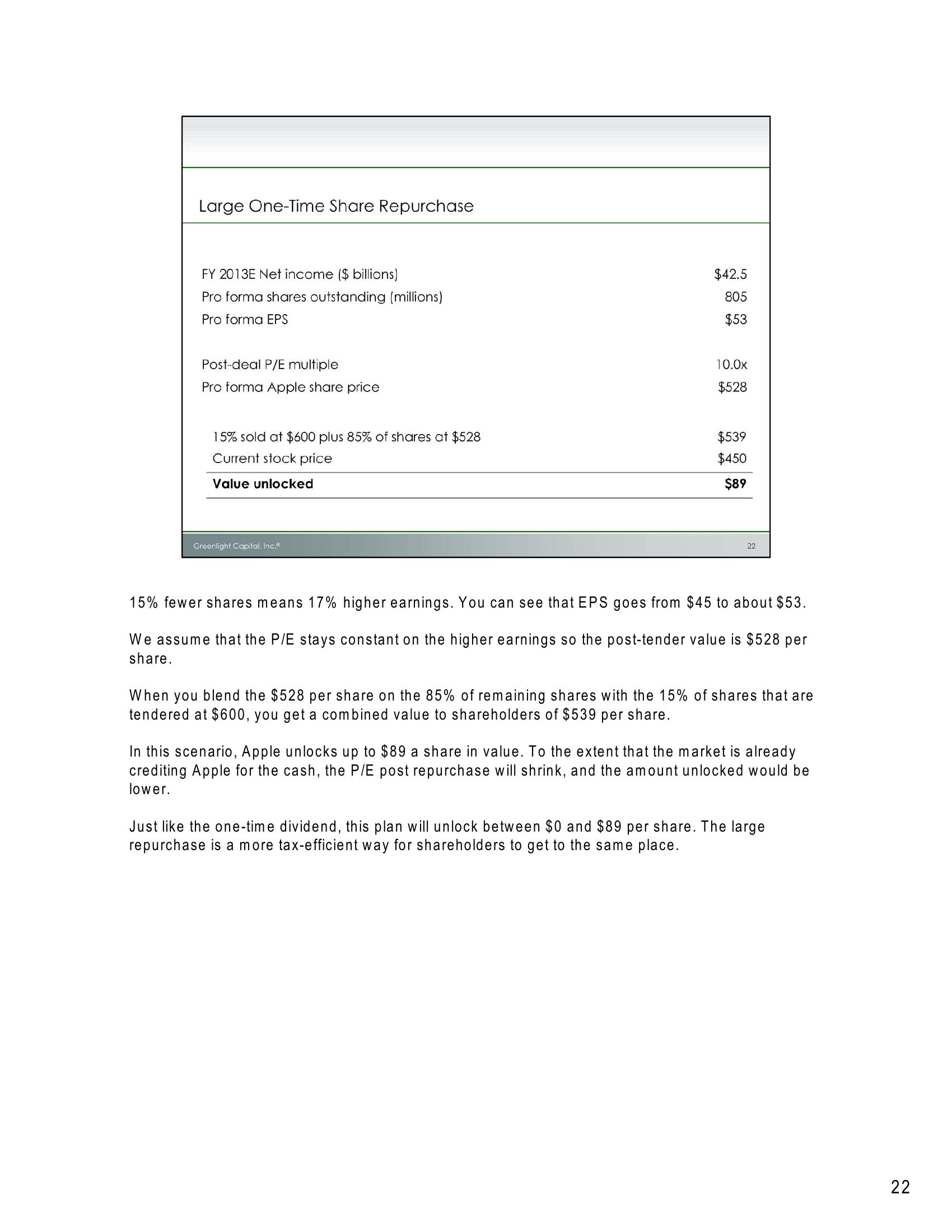

15% fewer shares means 17% higher earnings. You can see that EPS goes from $45 to about $53.

We assume that the P/E stays constant on the higher earnings so the post-tender value is $528 per

share.

When you blend the $528 per share on the 85% of remaining shares with the 15% of shares that are

tendered at $600, you get a combined value to shareholders of $539 per share.

In this scenario, Apple unlocks up to $89 a share in value. To the extent that the market is already

crediting Apple for the cash, the P/E post repurchase will shrink, and the amount unlocked would be

lower.

Just like the one-time dividend, this plan will unlock between $0 and $89 per share. The large

repurchase is a more tax-efficient way for shareholders to get to the same place.

22View entire presentation