First Merchants Results Presentation Deck

Business Highlights

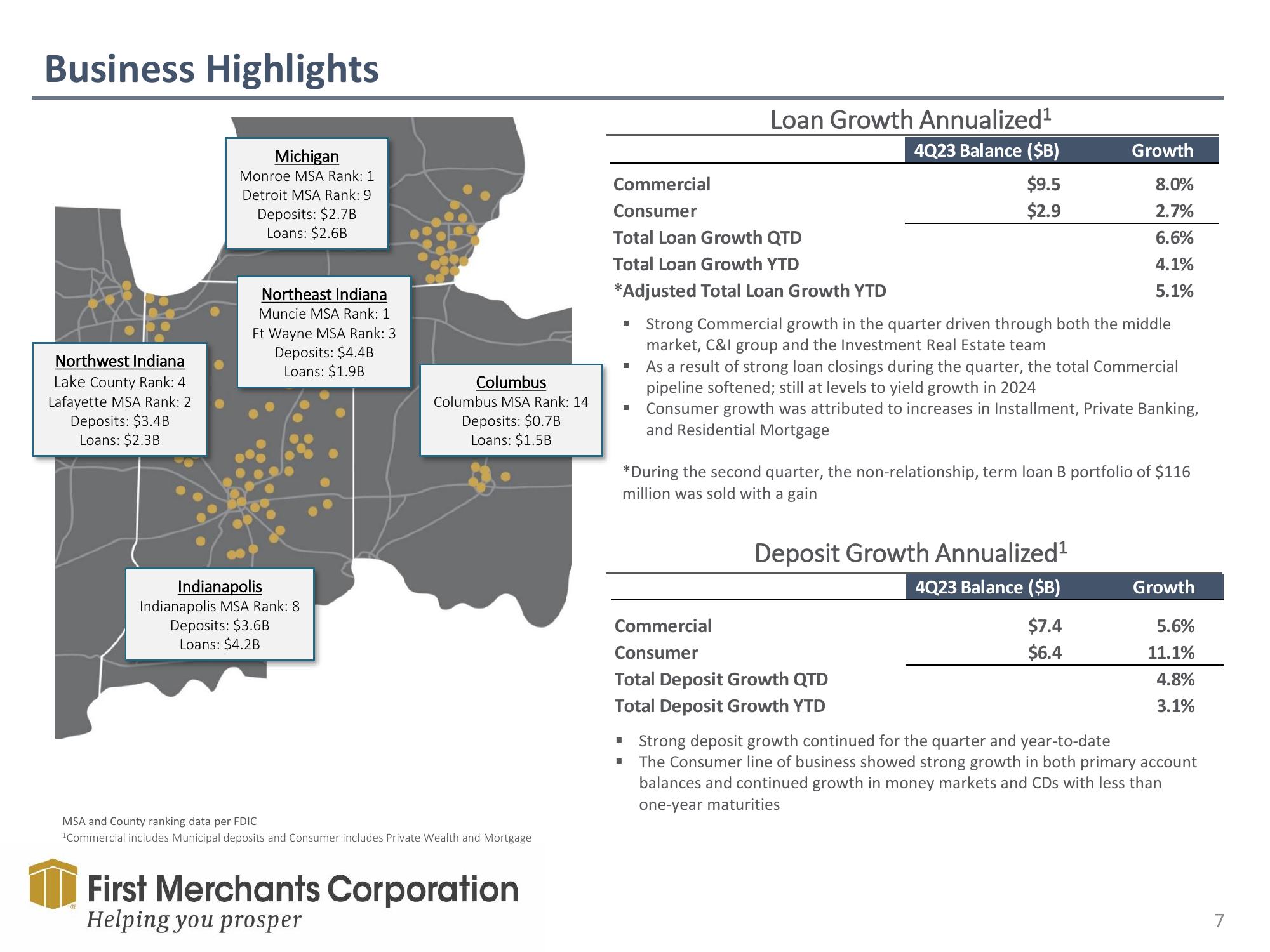

Northwest Indiana

Lake County Rank: 4

Lafayette MSA Rank: 2

Deposits: $3.4B

Loans: $2.3B

Michigan

Monroe MSA Rank: 1.

Detroit MSA Rank: 9

Deposits: $2.7B

Loans: $2.6B

Northeast Indiana

Muncie MSA Rank: 1

Ft Wayne MSA Rank: 3

Deposits: $4.4B

Loans: $1.9B

Indianapolis

Indianapolis MSA Rank: 8

Deposits: $3.6B

Loans: $4.2B

Columbus

Columbus MSA Rank: 14

Deposits: $0.7B

Loans: $1.5B

MSA and County ranking data per FDIC

¹Commercial includes Municipal deposits and Consumer includes Private Wealth and Mortgage

First Merchants Corporation

Helping you prosper

Commercial

Consumer

Total Loan Growth QTD

Total Loan Growth YTD

*Adjusted Total Loan Growth YTD

I

■

■

Loan Growth Annualized¹

4Q23 Balance ($B)

Commercial

Consumer

■

*During the second quarter, the non-relationship, term loan B portfolio of $116

million was sold with a gain

■

$9.5

$2.9

Strong Commercial growth in the quarter driven through both the middle

market, C&I group and the Investment Real Estate team

As a result of strong loan closings during the quarter, the total Commercial

pipeline softened; still at levels to yield growth in 2024

Consumer growth was attributed to increases in Installment, Private Banking,

and Residential Mortgage

Total Deposit Growth QTD

Total Deposit Growth YTD

Deposit Growth Annualized¹

4Q23 Balance ($B)

Growth

8.0%

2.7%

6.6%

4.1%

5.1%

$7.4

$6.4

Growth

5.6%

11.1%

4.8%

3.1%

Strong deposit growth continued for the quarter and year-to-date

The Consumer line of business showed strong growth in both primary account

balances and continued growth in money markets and CDs with less than

one-year maturities

7View entire presentation