KKR Real Estate Finance Trust Results Presentation Deck

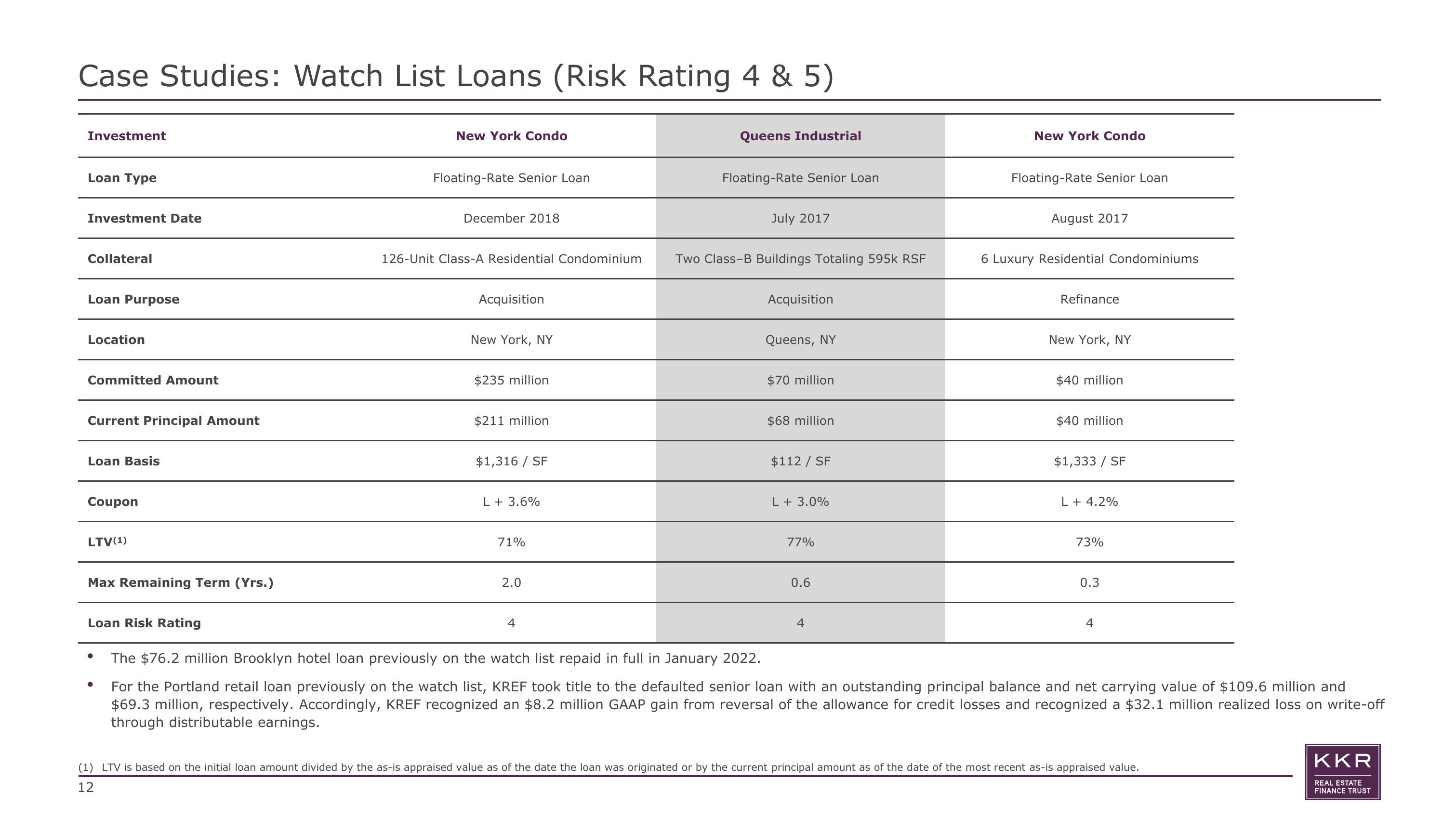

Case Studies: Watch List Loans (Risk Rating 4 & 5)

Investment

Loan Type

Investment Date

Collateral

Loan Purpose

Location

Committed Amount

Current Pri al Amount

Loan Basis

Coupon

LTV(¹)

Max Remaining Term (Yrs.)

Loan Risk Rating

New York Condo

Floating-Rate Senior Loan

December 2018

126-Unit Class-A Residential Condominium

Acquisition

New York, NY

$235 million

$211 million

$1,316 / SF

L + 3.6%

71%

2.0

4

Queens Industrial

Floating-Rate Senior Loan

July 2017

Two Class-B Buildings Totaling 595k RSF

Acquisition

Queens, NY

$70 million

$68 million

$112 / SF

L + 3.0%

77%

0.6

4

New York Condo

Floating-Rate Senior Loan

August 2017

6 Luxury Residential Condominiums

Refinance

New York, NY

$40 million

$40 million

$1,333 / SF

L + 4.2%

73%

0.3

The $76.2 million Brooklyn hotel loan previously on the watch list repaid in full in January 2022.

For the Portland retail loan previously on the watch list, KREF took title to the defaulted senior loan with an outstanding principal balance and net carrying value of $109.6 million and

$69.3 million, respectively. Accordingly, KREF recognized an $8.2 million GAAP gain from reversal of the allowance for credit losses and recognized a $32.1 million realized loss on write-off

through distributable earnings.

(1) LTV is based on the initial loan amount divided by the as-is appraised value as of the date the loan was originated or by the current principal amount as of the date of the most recent as-is appraised value.

12

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation