P3 Health Partners SPAC Presentation Deck

Pro Forma Capitalization and Ownership

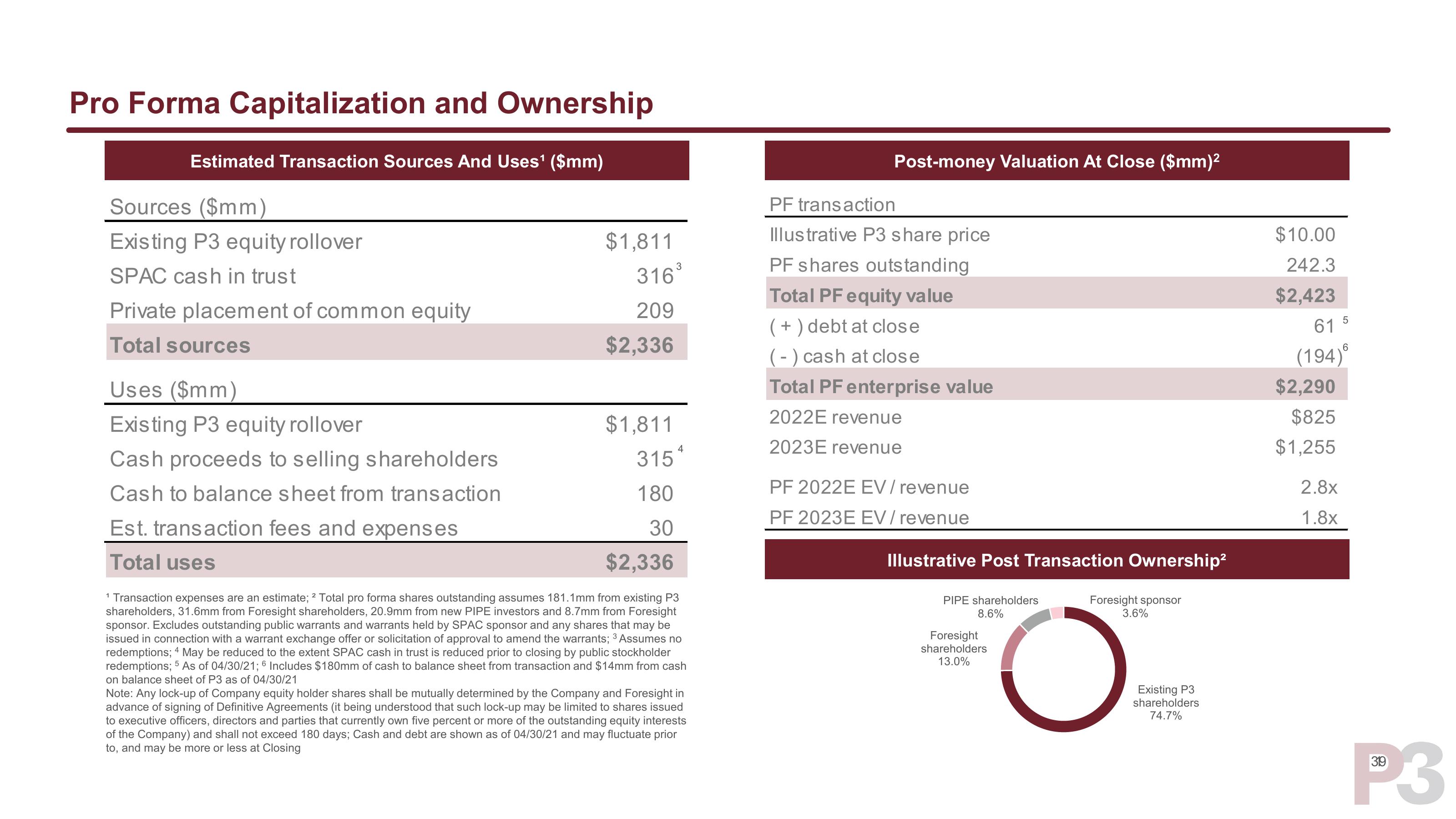

Estimated Transaction Sources And Uses¹ ($mm)

Sources ($mm)

Existing P3 equity rollover

SPAC cash in trust

Private placement of common equity

Total sources

Uses ($mm)

Existing P3 equity rollover

Cash proceeds to selling shareholders

Cash to balance sheet from transaction

Est. transaction fees and expenses

Total uses

$1,811

316³

209

$2,336

$1,811

315

180

30

4

$2,336

1 Transaction expenses are an estimate; 2 Total pro forma shares outstanding assumes 181.1mm from existing P3

shareholders, 31.6mm from Foresight shareholders, 20.9mm from new PIPE investors and 8.7mm from Foresight

sponsor. Excludes outstanding public warrants and warrants held by SPAC sponsor and any shares that may be

issued in connection with a warrant exchange offer or solicitation of approval to amend the warrants; 3 Assumes no

redemptions; 4 May be reduced to the extent SPAC cash in trust is reduced prior to closing by public stockholder

redemptions; 5 As of 04/30/21; 6 Includes $180mm of cash to balance sheet from transaction and $14mm from cash

on balance sheet of P3 as of 04/30/21

Note: Any lock-up of Company equity holder shares shall be mutually determined by the Company and Foresight in

advance of signing of Definitive Agreements (it being understood that such lock-up may be limited to shares issued

to executive officers, directors and parties that currently own five percent or more of the outstanding equity interests

of the Company) and shall not exceed 180 days; Cash and debt are shown as of 04/30/21 and may fluctuate prior

to, and may be more or less at Closing

Post-money Valuation At Close ($mm)²

PF transaction

Illustrative P3 share price

PF shares outstanding

Total PF equity value

(+) debt at close

(-) cash at close

Total PF enterprise value

2022E revenue

2023E revenue

PF 2022E EV / revenue

PF 2023E EV / revenue

Illustrative Post Transaction Ownership²

PIPE shareholders

8.6%

Foresight

shareholders

13.0%

Foresight sponsor

3.6%

O

Existing P3

shareholders

74.7%

$10.00

242.3

$2,423

61 5

(194)

$2,290

$825

$1,255

6

2.8x

1.8x

319

P3View entire presentation