Q2 Quarter 2023

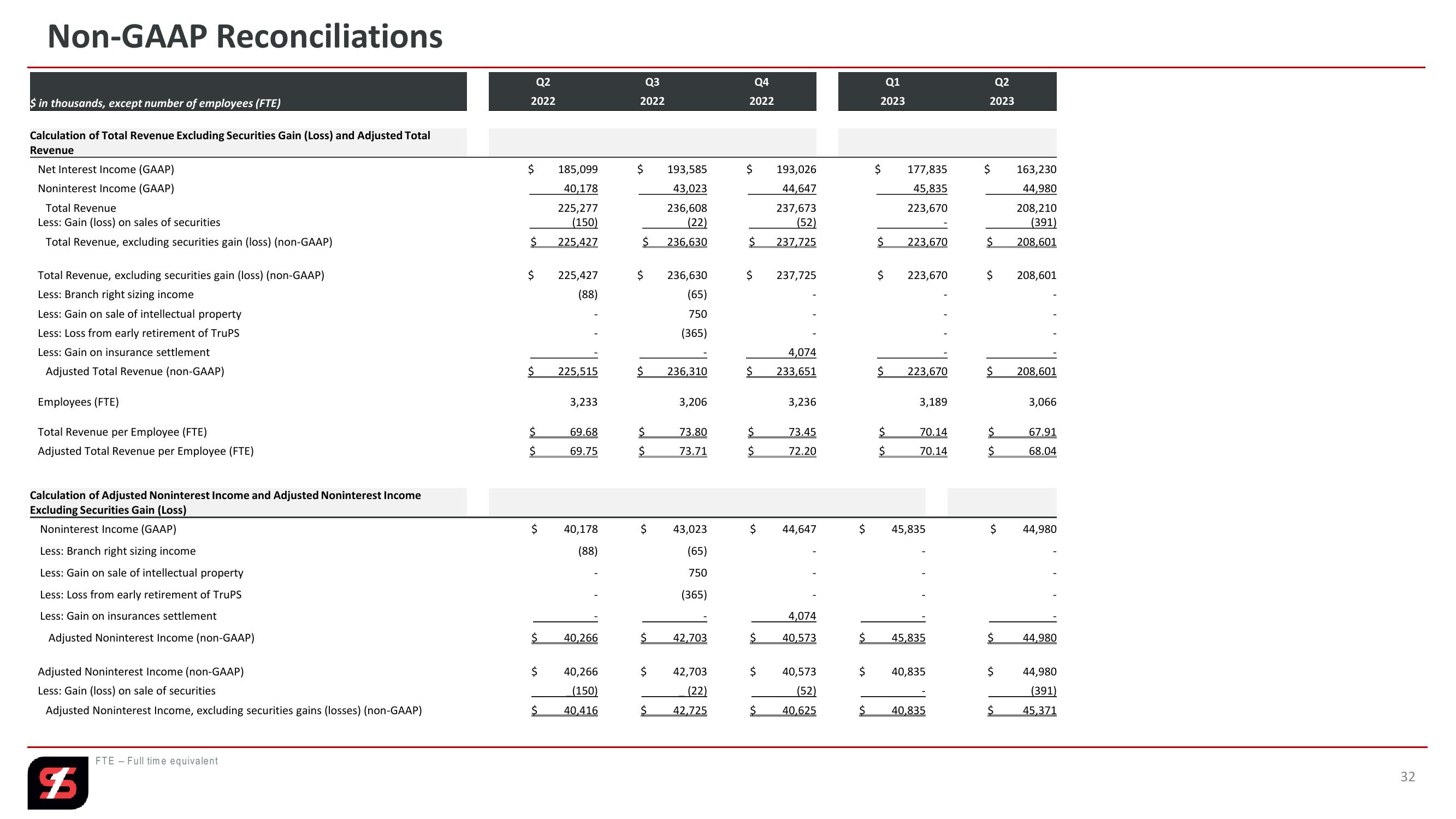

Non-GAAP Reconciliations

$ in thousands, except number of employees (FTE)

Calculation of Total Revenue Excluding Securities Gain (Loss) and Adjusted Total

Revenue

Q2

Q3

2022

2022

Q4

2022

Q1

2023

Q2

2023

Net Interest Income (GAAP)

$

Noninterest Income (GAAP)

Total Revenue

Less: Gain (loss) on sales of securities

185,099

40,178

225,277

$

Total Revenue, excluding securities gain (loss) (non-GAAP)

$

(150)

225,427

193,585

43,023

236,608

(22)

$

$ 236,630

$

193,026

44,647

237,673

(52)

237,725

$

177,835

45,835

223,670

$

163,230

44,980

208,210

(391)

$ 223,670

$ 208,601

Total Revenue, excluding securities gain (loss) (non-GAAP)

$

Less: Branch right sizing income

225,427

(88)

$

236,630

$

237,725

$

223,670

$

208,601

(65)

Less: Gain on sale of intellectual property

750

Less: Loss from early retirement of TruPS

Less: Gain on insurance settlement

Adjusted Total Revenue (non-GAAP)

Employees (FTE)

Total Revenue per Employee (FTE)

(365)

$

225,515

$ 236,310

$

4,074

233,651

$

223,670

$

208,601

3,233

3,206

3,236

3,189

3,066

$

69.68

$

73.80

$

73.45

$

70.14

$

67.91

Adjusted Total Revenue per Employee (FTE)

$

69.75

$

73.71

$

72.20

$

70.14

$

68.04

Calculation of Adjusted Noninterest Income and Adjusted Noninterest Income

Excluding Securities Gain (Loss)

Noninterest Income (GAAP)

$

Less: Branch right sizing income

Less: Gain on sale of intellectual property

Less: Loss from early retirement of TruPS

Less: Gain on insurances settlement

Adjusted Noninterest Income (non-GAAP)

40,178

(88)

$

43,023

$

44,647

$

45,835

$

44,980

(65)

750

(365)

4,074

$

40,266

$

42,703

$

40,573

$

45,835

$

44,980

Adjusted Noninterest Income (non-GAAP)

$

40,266

$

42,703

$

40,573

$

40,835

$

44,980

Less: Gain (loss) on sale of securities

(150)

(22)

(52)

(391)

Adjusted Noninterest Income, excluding securities gains (losses) (non-GAAP)

$

40,416

$

42,725

$

40,625

$

40,835

$

45,371

FTE Full time equivalent

$

32View entire presentation