ads-tec Energy SPAC Presentation Deck

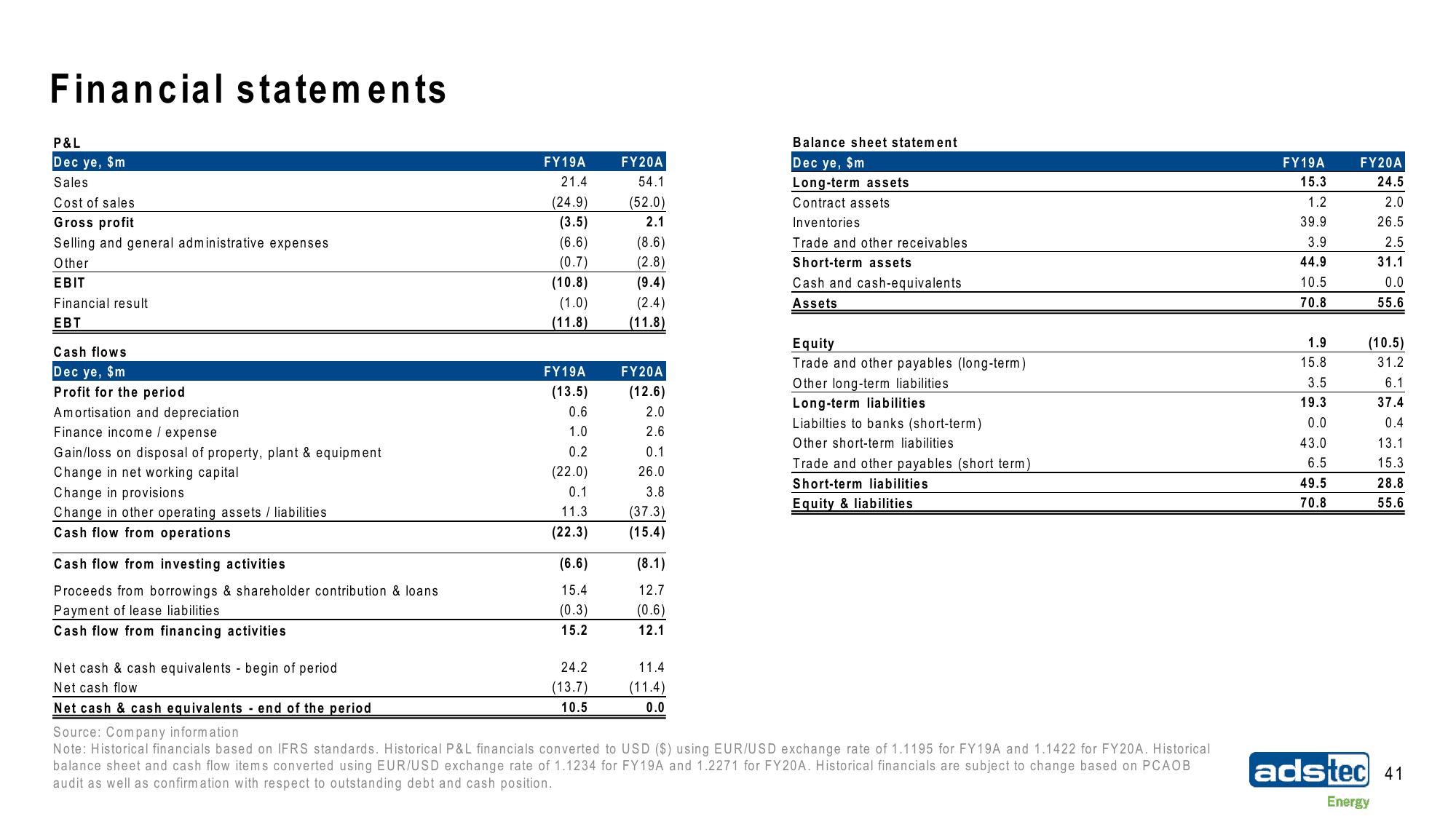

Financial statements

P&L

Dec ye, $m

Sales

Cost of sales

Gross profit

Selling and general administrative expenses

Other

EBIT

Financial result

EBT

Cash flows

Dec ye, $m

Profit for the period

Amortisation and depreciation

Finance income / expense

Gain/loss on disposal of property, plant & equipment

Change in net working capital

Change in provisions

Change in other operating assets / liabilities

Cash flow from operations

Cash flow from investing activities

Proceeds from borrowings & shareholder contribution & loans

Payment of lease liabilities.

Cash flow from financing activities

Net cash & cash equivalents begin of period

Net cash flow

Net cash & cash equivalents end of the period

FY19A

21.4

(24.9)

(3.5)

(6.6)

(0.7)

(10.8)

(1.0)

(11.8)

FY19A

(13.5)

0.6

1.0

0.2

(22.0)

0.1

11.3

(22.3)

(6.6)

15.4

(0.3)

15.2

24.2

(13.7)

10.5

FY20A

54.1

(52.0)

2.1

(8.6)

(2.8)

(9.4)

(2.4)

(11.8)

FY20A

(12.6)

2.0

2.6

0.1

26.0

3.8

(37.3)

(15.4)

(8.1)

12.7

(0.6)

12.1

11.4

(11.4)

0.0

Balance sheet statement

Dec ye, $m

Long-term assets

Contract assets

Inventories

Trade and other receivables

Short-term assets

Cash and cash-equivalents

Assets

Equity

Trade and other payables (long-term)

Other long-term liabilities

Long-term liabilities.

Liabilties to banks (short-term)

Other short-term liabilities

Trade and other payables (short term)

Short-term liabilities

Equity & liabilities

Source: Company information

Note: Historical financials based on IFRS standards. Historical P&L financials converted to USD ($) using EUR/USD exchange rate of 1.1195 for FY19A and 1.1422 for FY20A. Historical

balance sheet and cash flow items converted using EUR/USD exchange rate of 1.1234 for FY19A and 1.2271 for FY20A. Historical financials are subject to change based on PCAOB

audit as well as confirmation with respect to outstanding debt and cash position.

FY19A

15.3

1.2

29

39.9

3.9

44.9

10.5

70.8

1.9

15.8

er 00

3.5

19.3

0.0

43.0

6.5

49.5

70.8

FY20A

24.5

2.0

26.5

2.5

31.1

0.0

55.6

(10.5)

31.2

6.1

37.4

0.4

13.1

15.3

28.8

55.6

adstec 41

EnergyView entire presentation