Allego Results Presentation Deck

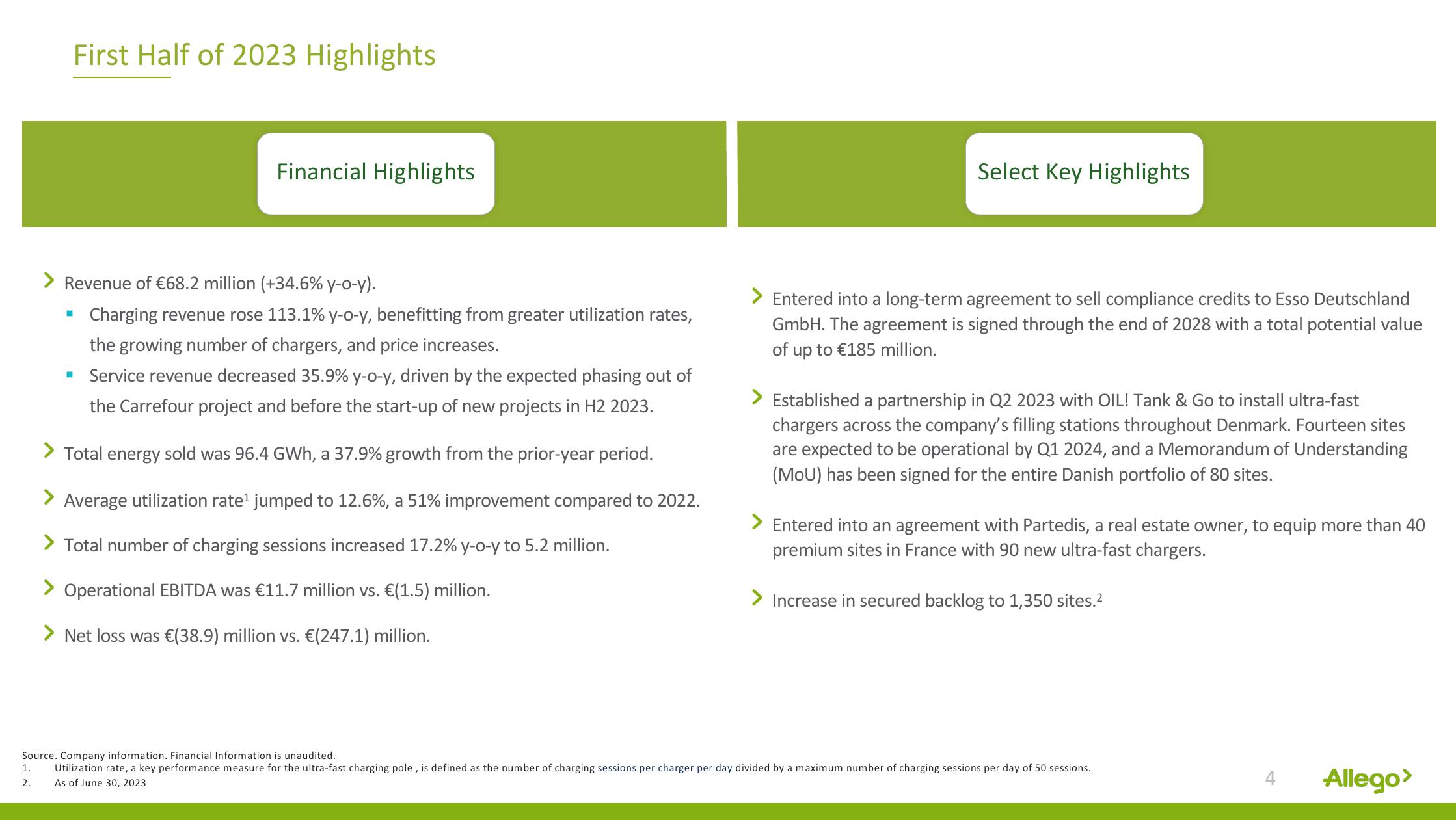

First Half of 2023 Highlights

■

Financial Highlights

> Revenue of €68.2 million (+34.6% y-o-y).

Charging revenue rose 113.1% y-o-y, benefitting from greater utilization rates,

the growing number of chargers, and price increases.

▪ Service revenue decreased 35.9% y-o-y, driven by the expected phasing out of

the Carrefour project and before the start-up of new projects in H2 2023.

Total energy sold was 96.4 GWh, a 37.9% growth from the prior-year period.

> Average utilization rate¹ jumped to 12.6%, a 51% improvement compared to 2022.

> Total number of charging sessions increased 17.2% y-o-y to 5.2 million.

> Operational EBITDA was €11.7 million vs. €(1.5) million.

> Net loss was €(38.9) million vs. €(247.1) million.

Select Key Highlights

> Entered into a long-term agreement to sell compliance credits to Esso Deutschland

GmbH. The agreement is signed through the end of 2028 with a total potential value

of up to €185 million.

> Established a partnership in Q2 2023 with OIL! Tank & Go to install ultra-fast

chargers across the company's filling stations throughout Denmark. Fourteen sites

are expected to be operational by Q1 2024, and a Memorandum of Understanding

(MoU) has been signed for the entire Danish portfolio of 80 sites.

> Entered into an agreement with Partedis, a real estate owner, to equip more than 40

premium sites in France with 90 new ultra-fast chargers.

> Increase in secured backlog to 1,350 sites.²

Source. Company information. Financial Information is unaudited.

1.

Utilization rate, a key performance measure for the ultra-fast charging pole, is defined as the number of charging sessions per charger per day divided by a maximum number of charging sessions per day of 50 sessions.

As of June 30, 2023

2.

4

Allego>View entire presentation