Credit Suisse Results Presentation Deck

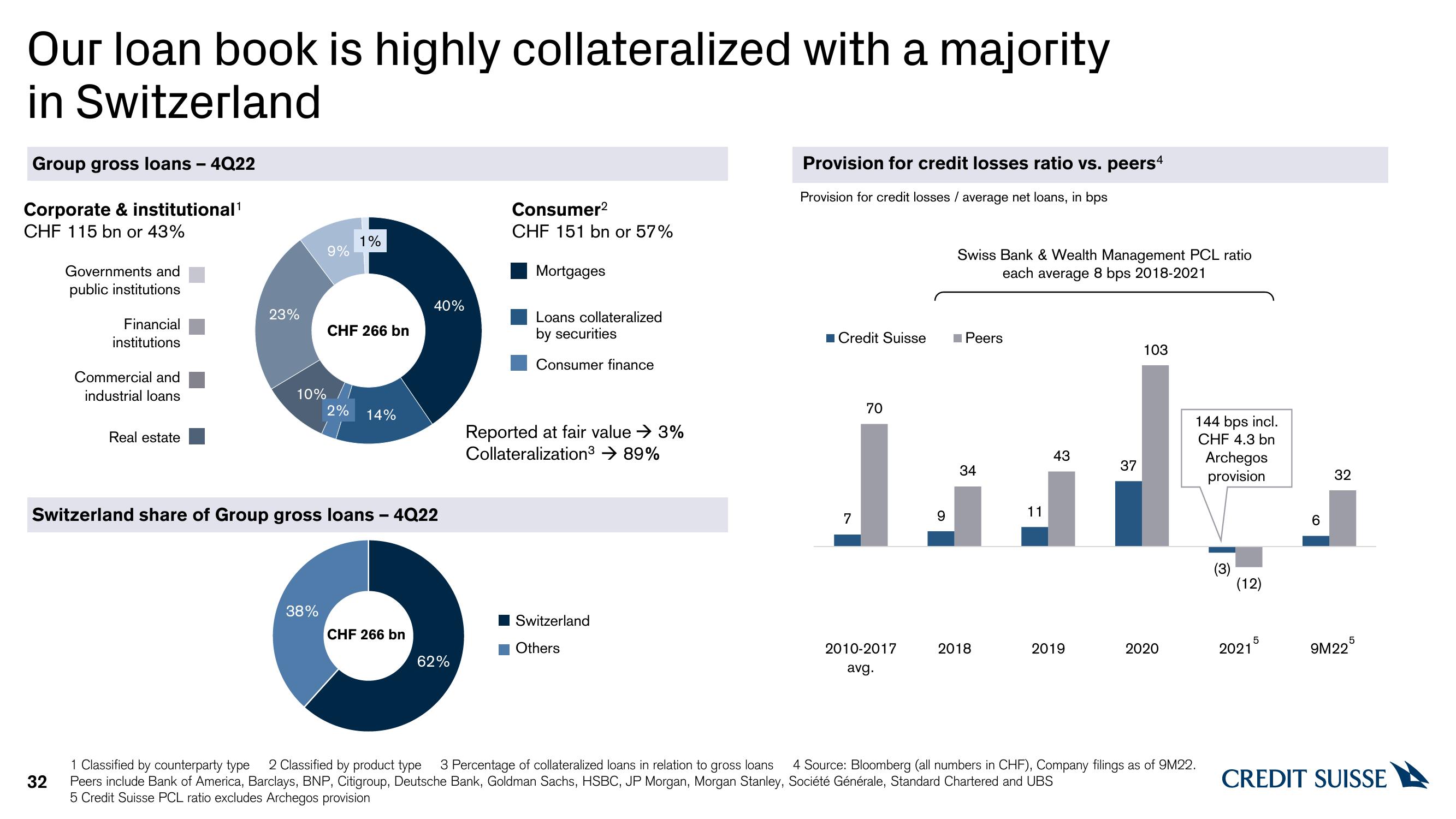

Our loan book is highly collateralized with a majority

in Switzerland

Group gross loans - 4Q22

Corporate & institutional¹

CHF 115 bn or 43%

Governments and

public institutions

32

Financial

institutions

Commercial and

industrial loans

Real estate

23%

10%

9%

38%

1%

CHF 266 bn

2%

14%

Switzerland share of Group gross loans - 4Q22

40%

CHF 266 bn

62%

Consumer²

CHF 151 bn or 57%

Mortgages

Loans collateralized

by securities

Consumer finance

Reported at fair value → 3%

Collateralization³ → 89%

Switzerland

Others

Provision for credit losses ratio vs. peers4

Provision for credit losses / average net loans, in bps

■Credit Suisse

7

70

2010-2017

avg.

9

Swiss Bank & Wealth Management PCL ratio

each average

8 bps 2018-2021

Peers

34

2018

11

43

2019

37

103

2020

144 bps incl.

CHF 4.3 bn

1 Classified by counterparty type 2 Classified by product type 3 Percentage of collateralized loans in relation to gross loans 4 Source: Bloomberg (all numbers in CHF), Company filings as of 9M22.

Peers include Bank of America, Barclays, BNP, Citigroup, Deutsche Bank, Goldman Sachs, HSBC, JP Morgan, Morgan Stanley, Société Générale, Standard Chartered and UBS

5 Credit Suisse PCL ratio excludes Archegos provision

Archegos

provision

(3)

(12)

20215

6

32

9M225

CREDIT SUISSEView entire presentation