J.P.Morgan Results Presentation Deck

Consumer & Community Banking¹

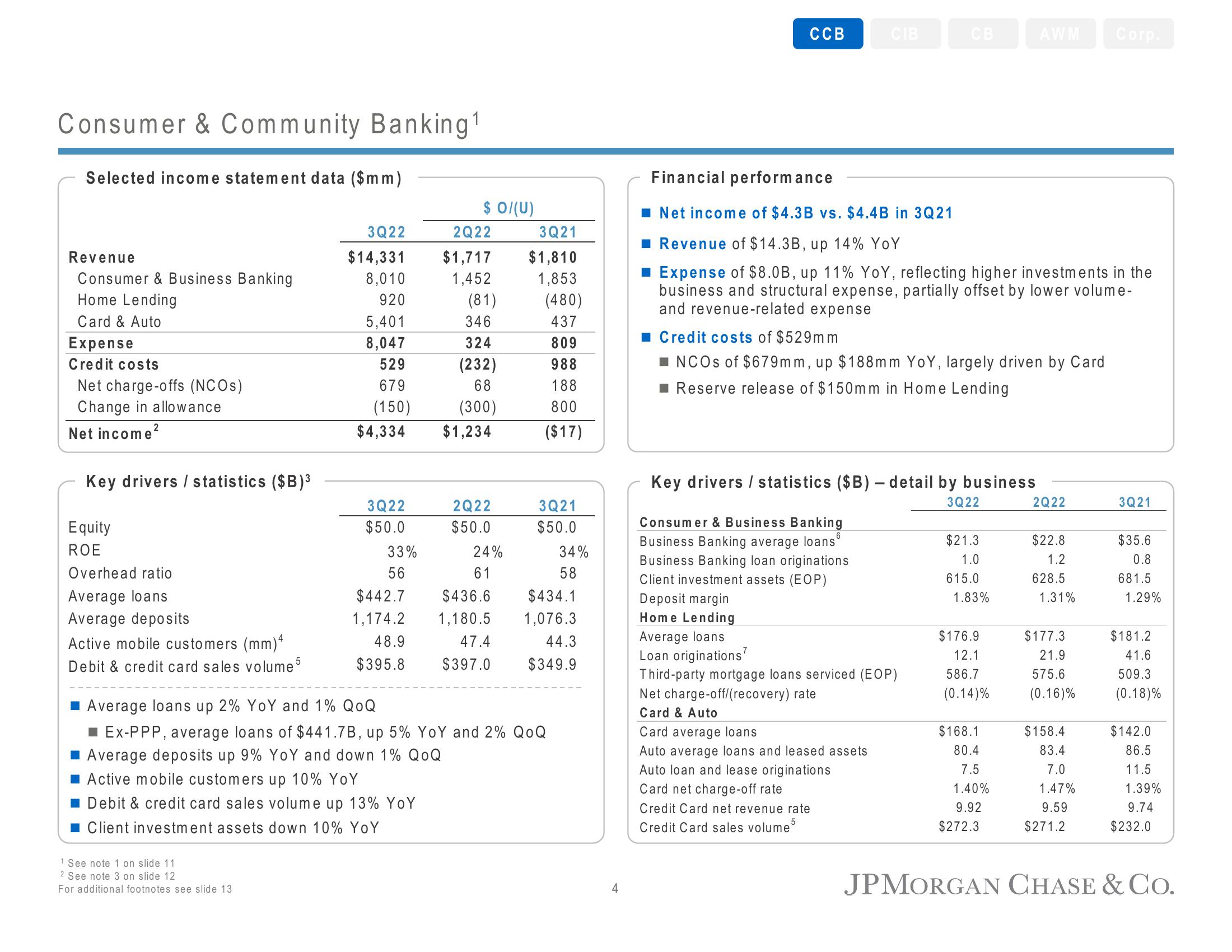

Selected income statement data ($mm)

Revenue

Consumer & Business Banking

Home Lending

Card & Auto

Expense

Credit costs

Net charge-offs (NCOs)

Change in allowance

Net income²

Key drivers / statistics ($B)³

Equity

ROE

Overhead ratio

Average loans

Average deposits

Active mobile customers (mm)4

Debit & credit card sales volume 5

3Q22

$14,331

8,010

920

5,401

8,047

529

679

(150)

1 See note 1 on slide 11

2 See note 3 on slide 12

For additional footnotes see slide 13.

$4,334

3Q22

$50.0

33%

56

$442.7

1,174.2

48.9

$395.8

$ 0/(U)

2Q22

$1,717

1,452

(81)

346

324

(232)

68

(300)

$1,234

2Q22

$50.0

24%

61

$436.6

1,180.5

47.4

$397.0

3Q21

$1,810

1,853

(480)

437

809

988

188

800

($17)

3Q21

$50.0

34%

58

$434.1

1,076.3

44.3

$349.9

Average loans up 2% YoY and 1% QOQ

■ Ex-PPP, average loans of $441.7B, up 5% YoY and 2% QOQ

Average deposits up 9% YoY and down 1% QOQ

Active mobile customers up 10% YoY

Debit & credit card sales volume up 13% YoY

■ Client investment assets down 10% YoY

4

CCB

CIB

Financial performance

■ Net income of $4.3B vs. $4.4B in 3Q21

■ Revenue of $14.3B, up 14% YoY

■ Expense of $8.0B, up 11% YoY, reflecting higher investments in the

business and structural expense, partially offset by lower volume-

and revenue-related expense

Consumer & Business Banking

6

Business Banking average loans

Business Banking loan originations

Client investment assets (EOP)

Deposit margin

Home Lending

Average loans

Loan originations

■ Credit costs of $529mm

■NCOs of $679mm, up $188mm YoY, largely driven by Card

■ Reserve release of $150mm in Home Lending

Key drivers / statistics ($B) - detail by business

3Q22

CB

Third-party mortgage loans serviced (EOP)

Net charge-off/(recovery) rate

Card & Auto

Card average loans

Auto average loans and leased assets

Auto loan and lease originations

Card net charge-off rate

Credit Card net revenue rate

Credit Card sales volume 5

$21.3

1.0

615.0

1.83%

AWM Corp.

$176.9

12.1

586.7

(0.14)%

$168.1

80.4

7.5

1.40%

9.92

$272.3

2Q22

$22.8

1.2

628.5

1.31%

$177.3

21.9

575.6

(0.16)%

$158.4

83.4

7.0

1.47%

9.59

$271.2

3Q21

$35.6

0.8

681.5

1.29%

$181.2

41.6

509.3

(0.18)%

$142.0

86.5

11.5

1.39%

9.74

$232.0

JPMORGAN CHASE & Co.View entire presentation