Vivid Seats Results Presentation Deck

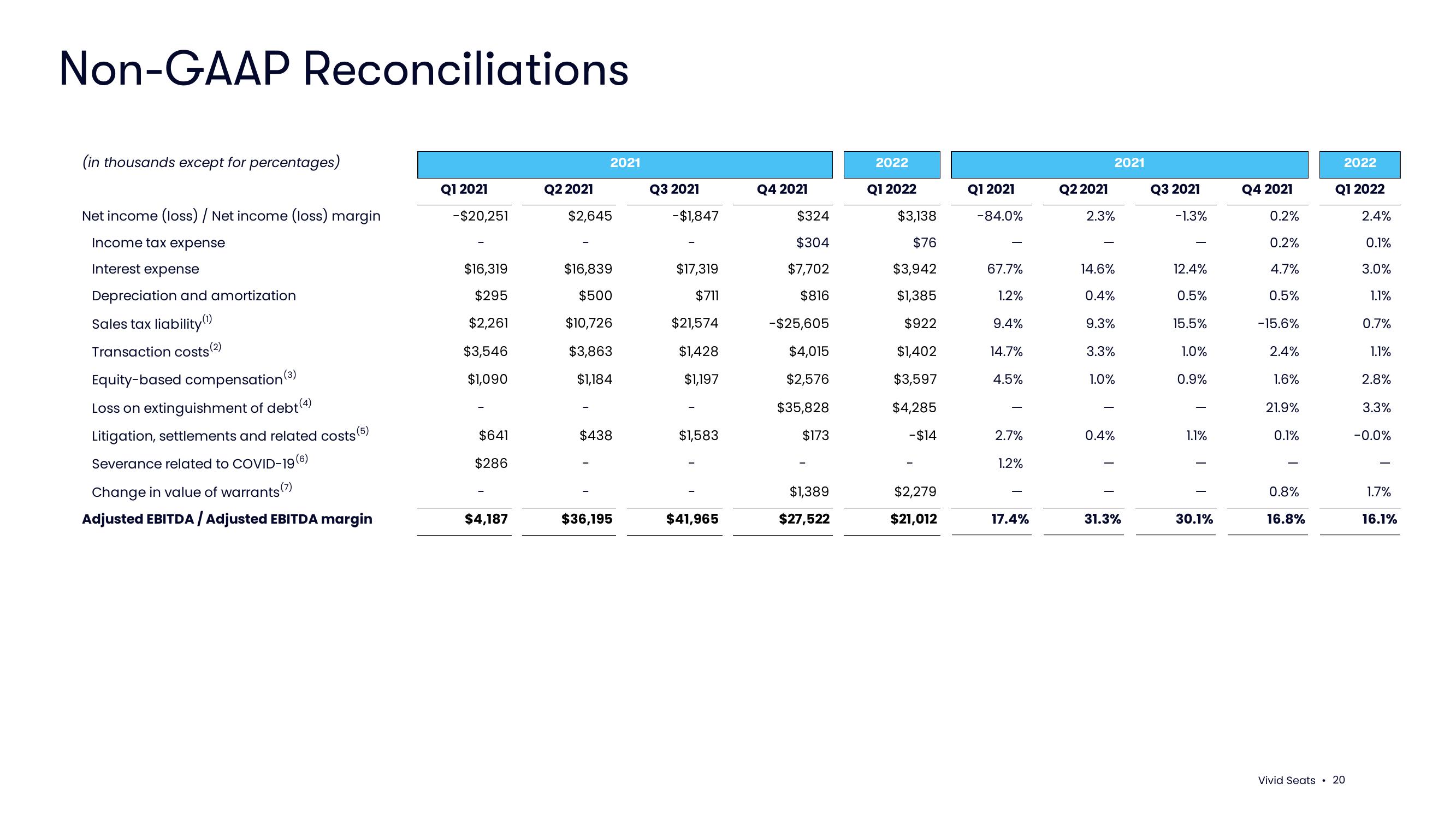

Non-GAAP Reconciliations

(in thousands except for percentages)

Net income (loss) / Net income (loss) margin

Income tax expense

Interest expense

Depreciation and amortization

Sales tax liability

Transaction costs (2)

Equity-based compensation (3)

Loss on extinguishment of debt (4)

Litigation, settlements and related costs (5)

Severance related to COVID-19 (6

(7)

Change in value of warrants

Adjusted EBITDA / Adjusted EBITDA margin

Q1 2021

-$20,251

$16,319

$295

$2,261

$3,546

$1,090

$641

$286

$4,187

2021

Q2 2021

$2,645

$16,839

$500

$10,726

$3,863

$1,184

$438

$36,195

Q3 2021

-$1,847

$17,319

$711

$21,574

$1,428

$1,197

$1,583

$41,965

Q4 2021

$324

$304

$7,702

$816

-$25,605

$4,015

$2,576

$35,828

$173

$1,389

$27,522

2022

Q1 2022

$3,138

$76

$3,942

$1,385

$922

$1,402

$3,597

$4,285

-$14

$2,279

$21,012

Q1 2021

-84.0%

67.7%

1.2%

9.4%

14.7%

4.5%

2.7%

1.2%

17.4%

2021

Q2 2021

2.3%

14.6%

0.4%

9.3%

3.3%

1.0%

0.4%

-

31.3%

Q3 2021

-1.3%

12.4%

0.5%

15.5%

1.0%

0.9%

1.1%

I

30.1%

Q4 2021

0.2%

0.2%

4.7%

0.5%

-15.6%

2.4%

1.6%

21.9%

0.1%

0.8%

16.8%

2022

Q1 2022

Vivid Seats 20

2.4%

0.1%

3.0%

1.1%

0.7%

1.1%

2.8%

3.3%

-0.0%

1.7%

16.1%View entire presentation