Goldman Sachs Investment Banking Pitch Book

Goldman

Sachs

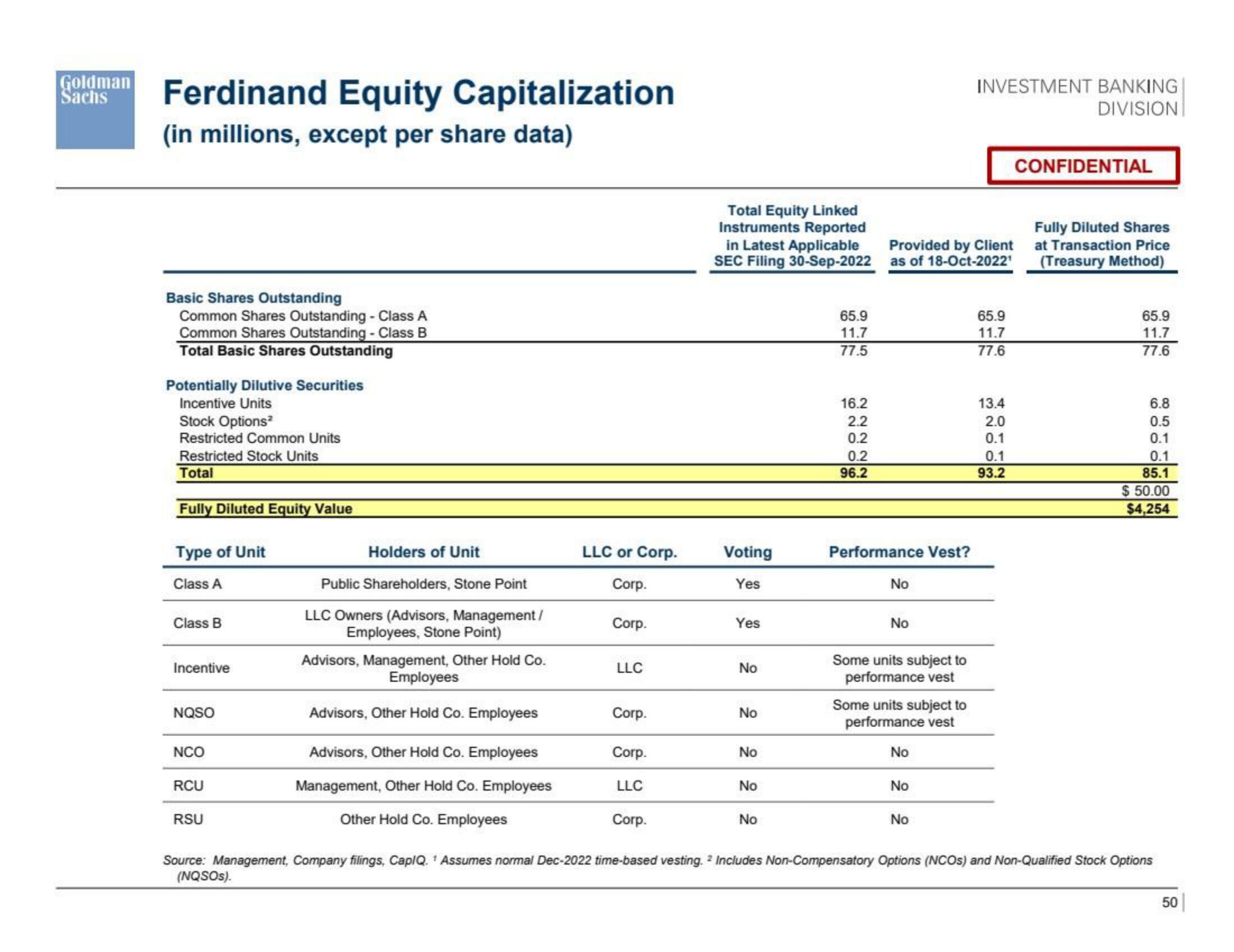

Ferdinand Equity Capitalization

(in millions, except per share data)

Basic Shares Outstanding

Common Shares Outstanding - Class A

Common Shares Outstanding - Class B

Total Basic Shares Outstanding

Potentially Dilutive Securities

Incentive Units

Stock Options²

Restricted Common Units

Restricted Stock Units

Total

Fully Diluted Equity Value

Type of Unit

Class A

Class B

Incentive

NQSO

NCO

RCU

RSU

Holders of Unit

Public Shareholders, Stone Point

LLC Owners (Advisors, Management/

Employees, Stone Point)

Advisors, Management, Other Hold Co.

Employees

Advisors, Other Hold Co. Employees

Advisors, Other Hold Co. Employees

Management, Other Hold Co. Employees

Other Hold Co. Employees

LLC or Corp.

Corp.

Corp.

LLC

Corp.

Corp.

LLC

Corp.

Total Equity Linked

Instruments Reported

in Latest Applicable

SEC Filing 30-Sep-2022

Voting

Yes

Yes

No

No

2 22

65.9

11.7

77.5

16.2

2.2

0.2

0.2

96.2

Provided by Client

as of 18-Oct-2022¹

Performance Vest?

No

No

Some units subject to

performance vest

Some units subject to

performance vest

No

No

INVESTMENT BANKING

DIVISION

No

65.9

11.7

77.6

13.4

2.0

0.1

0.1

93.2

CONFIDENTIAL

Fully Diluted Shares

at Transaction Price

(Treasury Method)

65.9

11.7

77.6

6.8

0.5

0.1

0.1

85.1

$ 50.00

$4,254

Source: Management, Company filings, Cap/Q. ¹ Assumes normal Dec-2022 time-based vesting. 2 Includes Non-Compensatory Options (NCOS) and Non-Qualified Stock Options

(NQSOS).

50View entire presentation