dLocal Results Presentation Deck

Diluted

EPS¹

32

3Q22

0.10

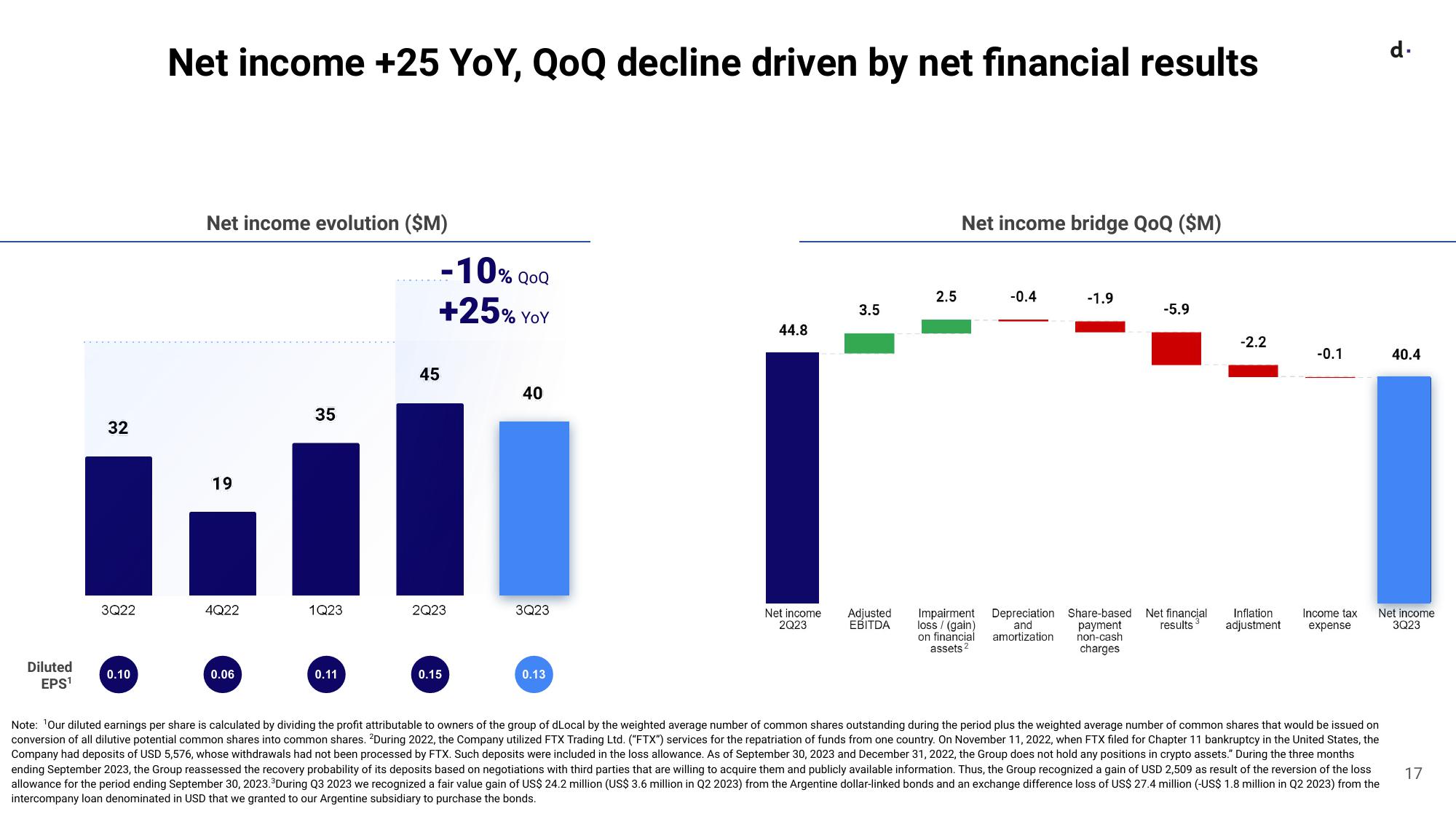

Net income +25 YOY, QoQ decline driven by net financial results

Net income evolution ($M)

19

4Q22

0.06

35

1Q23

0.11

45

-10% QOQ

+25% YOY

2Q23

0.15

40

3Q23

0.13

44.8

3.5

Net income Adjusted

2Q23

EBITDA

2.5

Net income bridge QoQ ($M)

-0.4

-1.9

Impairment Depreciation Share-based

loss/ (gain)

and

on financi amortization

assets 2

payment

non-cash

charges

-5.9

Net financial

results

-2.2

Inflation

adjustment

-0.1

Income tax

expense

d.

Note: ¹Our diluted earnings per share is calculated by dividing the profit attributable to owners of the group of dLocal by the weighted average number of common shares outstanding during the period plus the weighted average number of common shares that would be issued on

conversion of all dilutive potential common shares into common shares. During 2022, the Company utilized FTX Trading Ltd. ("FTX") services for the repatriation of funds from one country. On November 11, 2022, when FTX filed for Chapter 11 bankruptcy in the United States, the

Company had deposits of USD 5,576, whose withdrawals had not been processed by FTX. Such deposits were included in the loss allowance. As of September 30, 2023 and December 31, 2022, the Group does not hold any positions in crypto assets." During the three months

ending September 2023, the Group reassessed the recovery probability of its deposits based on negotiations with third parties that are willing to acquire them and publicly available information. Thus, the Group recognized a gain of USD 2,509 as result of the reversion of the loss

allowance for the period ending September 30, 2023. ³During Q3 2023 we recognized a fair value gain of US$ 24.2 million (US$ 3.6 million in Q2 2023) from the Argentine dollar-linked bonds and an exchange difference loss of US$ 27.4 million (-US$ 1.8 million in Q2 2023) from the

intercompany loan denominated in USD that we granted to our Argentine subsidiary to purchase the bonds.

40.4

Net income

3Q23

17View entire presentation