HashiCorp Investor Day Presentation Deck

36

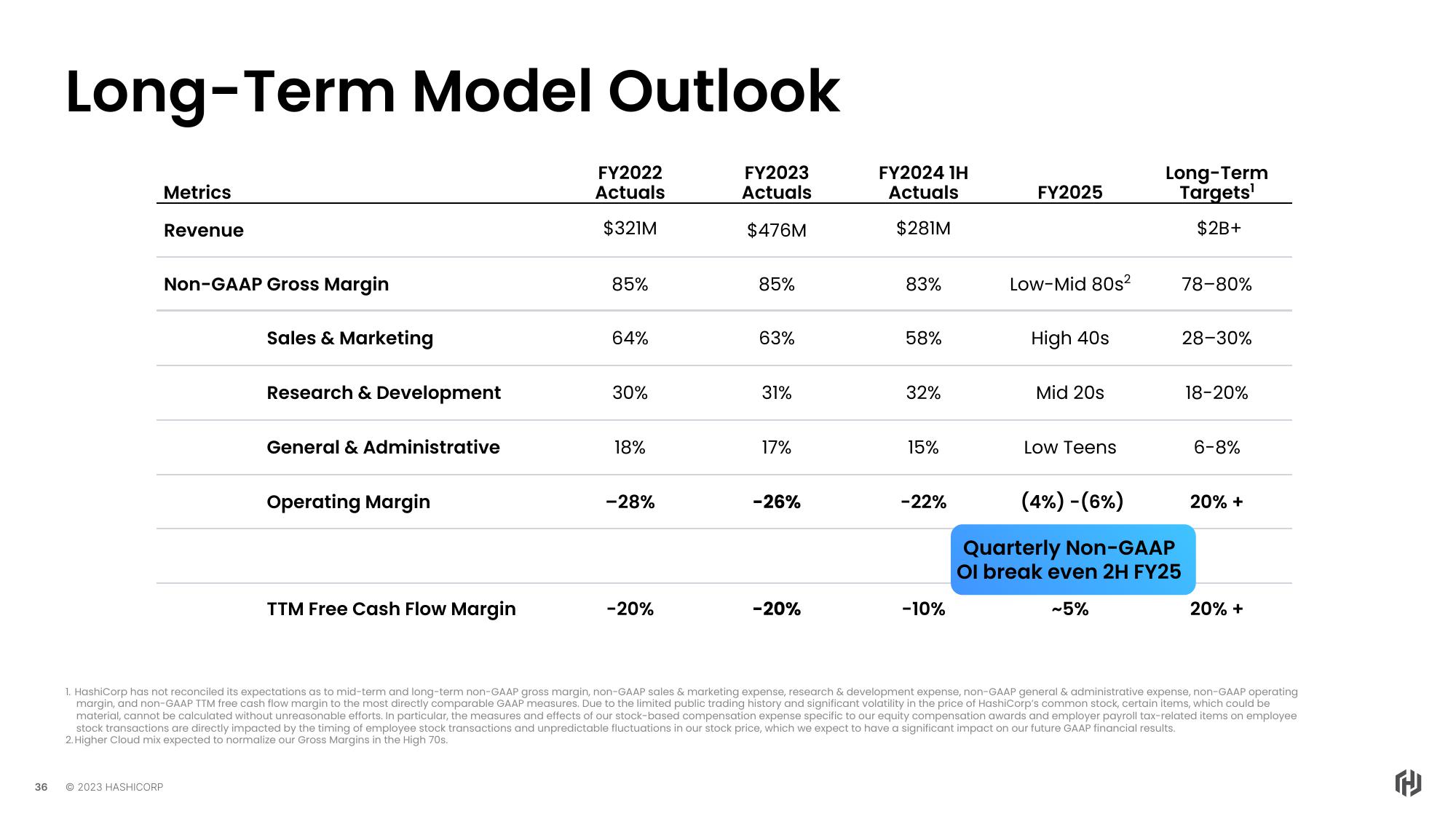

Long-Term Model Outlook

Metrics

Revenue

Non-GAAP Gross Margin

Sales & Marketing

© 2023 HASHICORP

Research & Development

General & Administrative

Operating Margin

TTM Free Cash Flow Margin

FY2022

Actuals

$321M

85%

64%

30%

18%

-28%

-20%

FY2023

Actuals

$476M

85%

63%

31%

17%

-26%

-20%

FY2024 1H

Actuals

$281M

83%

58%

32%

15%

-22%

-10%

FY2025

Low-Mid 80s²

High 40s

Mid 20s

Low Teens

Long-Term

Targets¹

$2B+

(4%) -(6%)

Quarterly Non-GAAP

Ol break even 2H FY25

~5%

78-80%

28-30%

18-20%

6-8%

20% +

20% +

1. HashiCorp has not reconciled its expectations as to mid-term and long-term non-GAAP gross margin, non-GAAP sales & marketing expense, research & development expense, non-GAAP general & administrative expense, non-GAAP operating

margin, and non-GAAP TTM free cash flow margin to the most directly comparable GAAP measures. Due to the limited public trading history and significant volatility in the price of HashiCorp's common stock, certain items, which could be

material, cannot be calculated without unreasonable efforts. In particular, the measures and effects of our stock-based compensation expense specific to our equity compensation awards and employer payroll tax-related items on employee

stock transactions are directly impacted by the timing of employee stock transactions and unpredictable fluctuations in our stock price, which we expect to have a significant impact on our future GAAP financial results.

2. Higher Cloud mix expected to normalize our Gross Margins in the High 70s.

HView entire presentation