IGI SPAC Presentation Deck

High ROAE

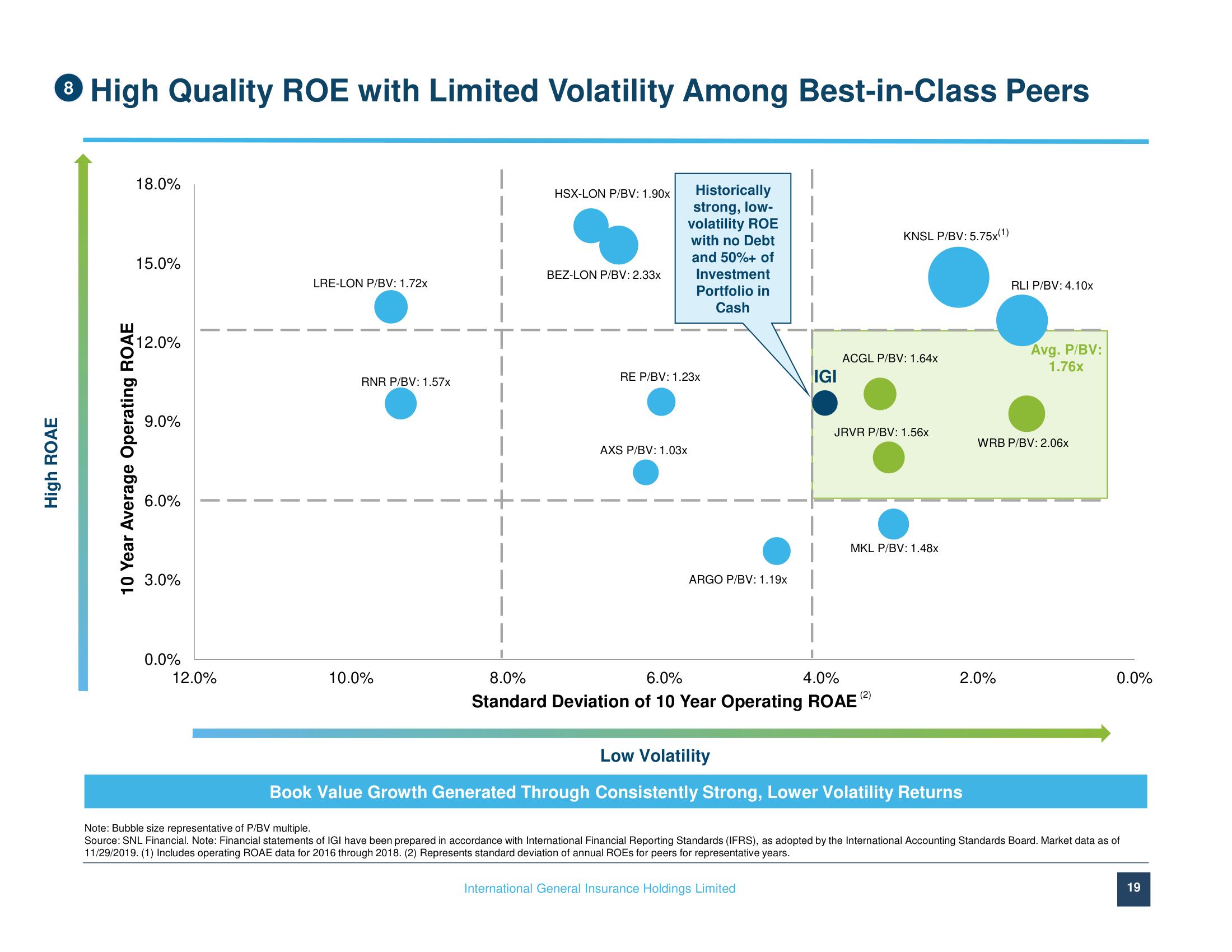

8 High Quality ROE with Limited Volatility Among Best-in-Class Peers

18.0%

15.0%

10 Year Average Operating ROAE

12.0%

9.0%

6.0%

3.0%

0.0%

12.0%

LRE-LON P/BV: 1.72x

RNR P/BV: 1.57x

10.0%

HSX-LON P/BV: 1.90x

BEZ-LON P/BV: 2.33x

Historically

strong, low-

volatility ROE

with no Debt

and 50%+ of

Investment

Portfolio in

Cash

RE P/BV: 1.23x

AXS P/BV: 1.03x

ARGO P/BV: 1.19x

IGI

I

International General Insurance Holdings Limited

ACGL P/BV: 1.64x

KNSL P/BV: 5.75x(1)

JRVR P/BV: 1.56x

8.0%

6.0%

4.0%

Standard Deviation of 10 Year Operating ROAE

MKL P/BV: 1.48x

(2)

RLI P/BV: 4.10x

2.0%

Avg. P/BV:

1.76x

WRB P/BV: 2.06x

0.0%

Low Volatility

Book Value Growth Generated Through Consistently Strong, Lower Volatility Returns

Note: Bubble size representative of P/BV multiple.

Source: SNL Financial. Note: Financial statements of IGI have been prepared in accordance with International Financial Reporting Standards (IFRS), as adopted by the International Accounting Standards Board. Market data as of

11/29/2019. (1) Includes operating ROAE data for 2016 through 2018. (2) Represents standard deviation of annual ROES for peers for representative years.

19View entire presentation