JD Sports Results Presentation Deck

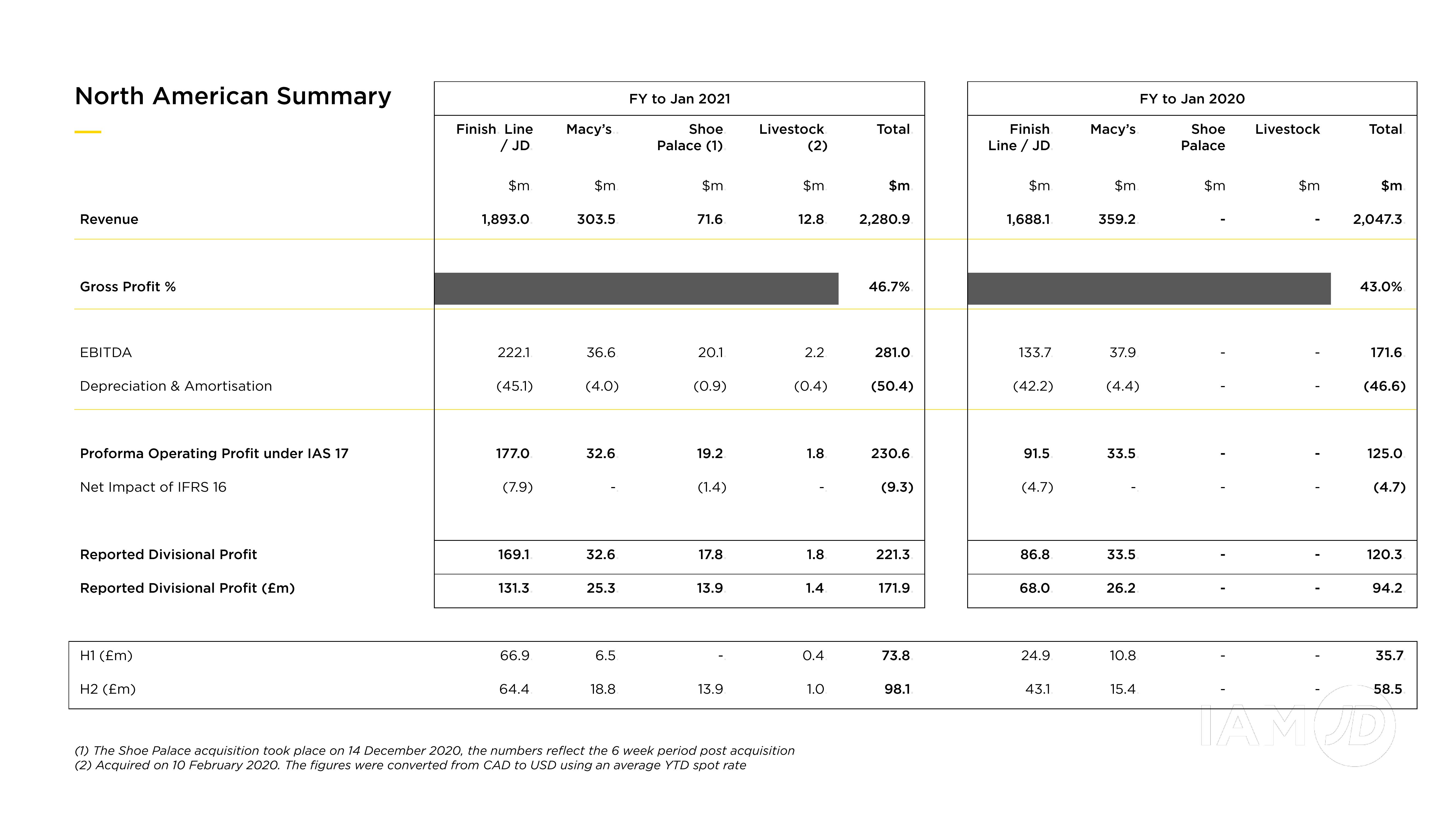

North American Summary

Revenue

Gross Profit %

EBITDA

Depreciation & Amortisation

Proforma Operating Profit under IAS 17

Net Impact of IFRS 16

Reported Divisional Profit

Reported Divisional Profit (£m)

H1 (Em)

H2 (£m)

Finish Line

/JD

$m

1,893.0

222.1.

(45.1)

177.0

(7.9)

169.1

131.3

66.9

64.4

Macy's

$m.

303.5

36.6

(4.0)

32.6

32.6

25.3

6.5

18.8

FY to Jan 2021

Shoe

Palace (1)

$m

71.6

20.1

(0.9)

19.2

(1.4)

17.8

13.9

13.9

Livestock

(2)

$m

(1) The Shoe Palace acquisition took place on 14 December 2020, the numbers reflect the 6 week period post acquisition

(2) Acquired on 10 February 2020. The figures were converted from CAD to USD using an average YTD spot rate

12.8

2.2

(0.4)

1.8

1.8

1.4

0.4

1.0

Total

$m

2,280.9

46.7%

281.0

(50.4)

230.6

(9.3)

221.3

171.9

73.8

98.1

Finish

Line / JD

$m

1,688.1

133.7

(42.2)

91.5

(4.7)

86.8

68.0

24.9

43.1

Macy's

$m.

359.2

37.9

(4.4)

33.5

33.5

26.2

10.8

FY to Jan 2020

15.4

Shoe Livestock

Palace

$m

$m

Total

$m

2,047.3

43.0%

171.6

(46.6)

125.0

(4.7)

120.3

94.2

35.7

58.5

MODYView entire presentation