Deutsche Bank Fixed Income Presentation Deck

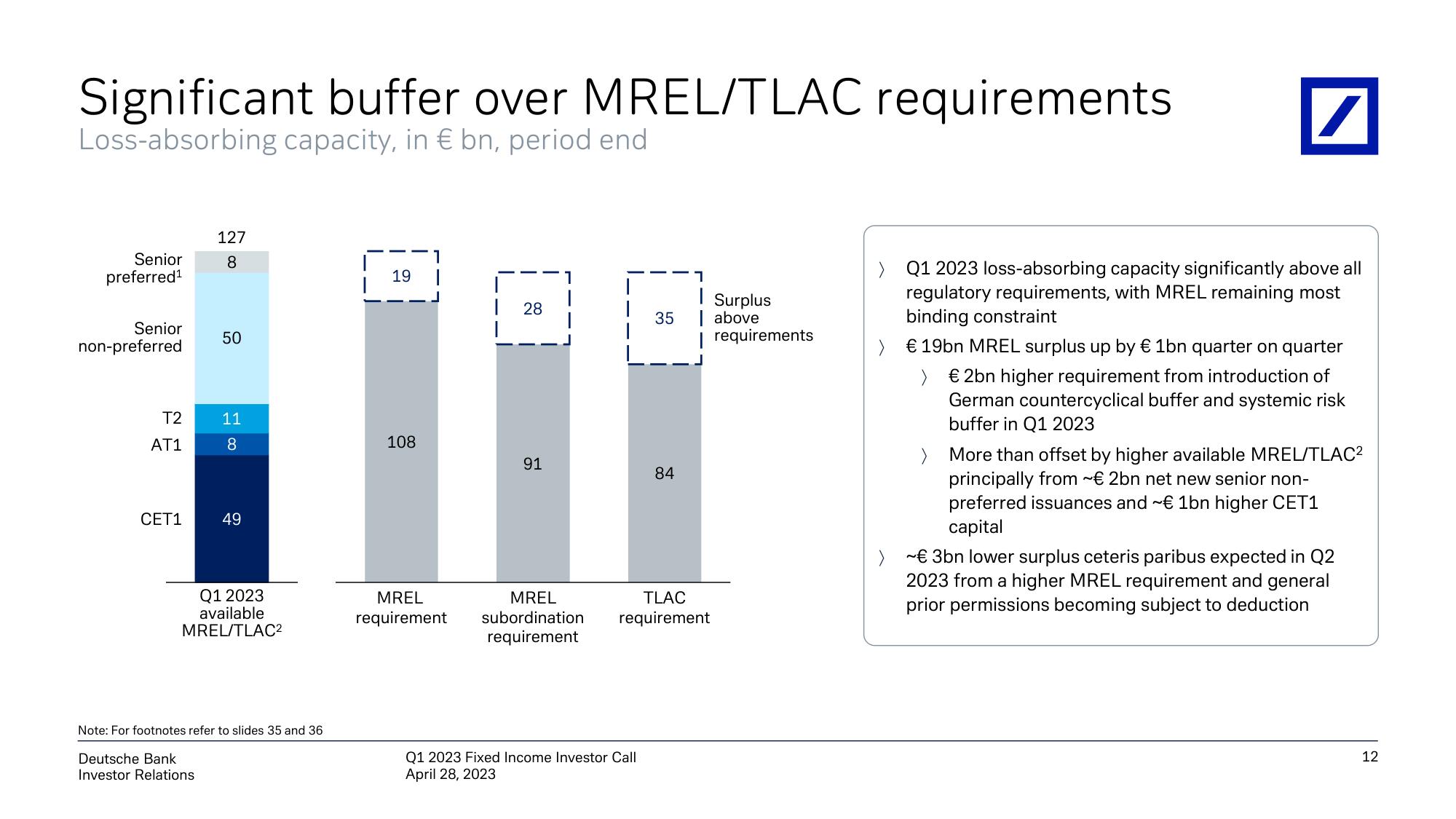

Significant buffer over MREL/TLAC requirements

Loss-absorbing capacity, in € bn, period end

Senior

preferred¹

Senior

non-preferred

T2

AT1

CET1

127

8

50

11

8

49

Q1 2023

available

MREL/TLAC²

Note: For footnotes refer to slides 35 and 36

Deutsche Bank

Investor Relations

19

108

MREL

requirement

28

91

MREL

subordination

requirement

35

Q1 2023 Fixed Income Investor Call

April 28, 2023

84

1

TLAC

requirement

Surplus

above

requirements

/

> Q1 2023 loss-absorbing capacity significantly above all

regulatory requirements, with MREL remaining most

binding constraint

> € 19bn MREL surplus up by € 1bn quarter on quarter

>

€ 2bn higher requirement from introduction of

German countercyclical buffer and systemic risk

buffer in Q1 2023

>

More than offset by higher available MREL/TLAC²

principally from ~€ 2bn net new senior non-

preferred issuances and ~€ 1bn higher CET1

capital

> € 3bn lower surplus ceteris paribus expected in Q2

2023 from a higher MREL requirement and general

prior permissions becoming subject to deduction

12View entire presentation