AMC Investor Presentation Deck

Transaction Overview: Odeon & UCI

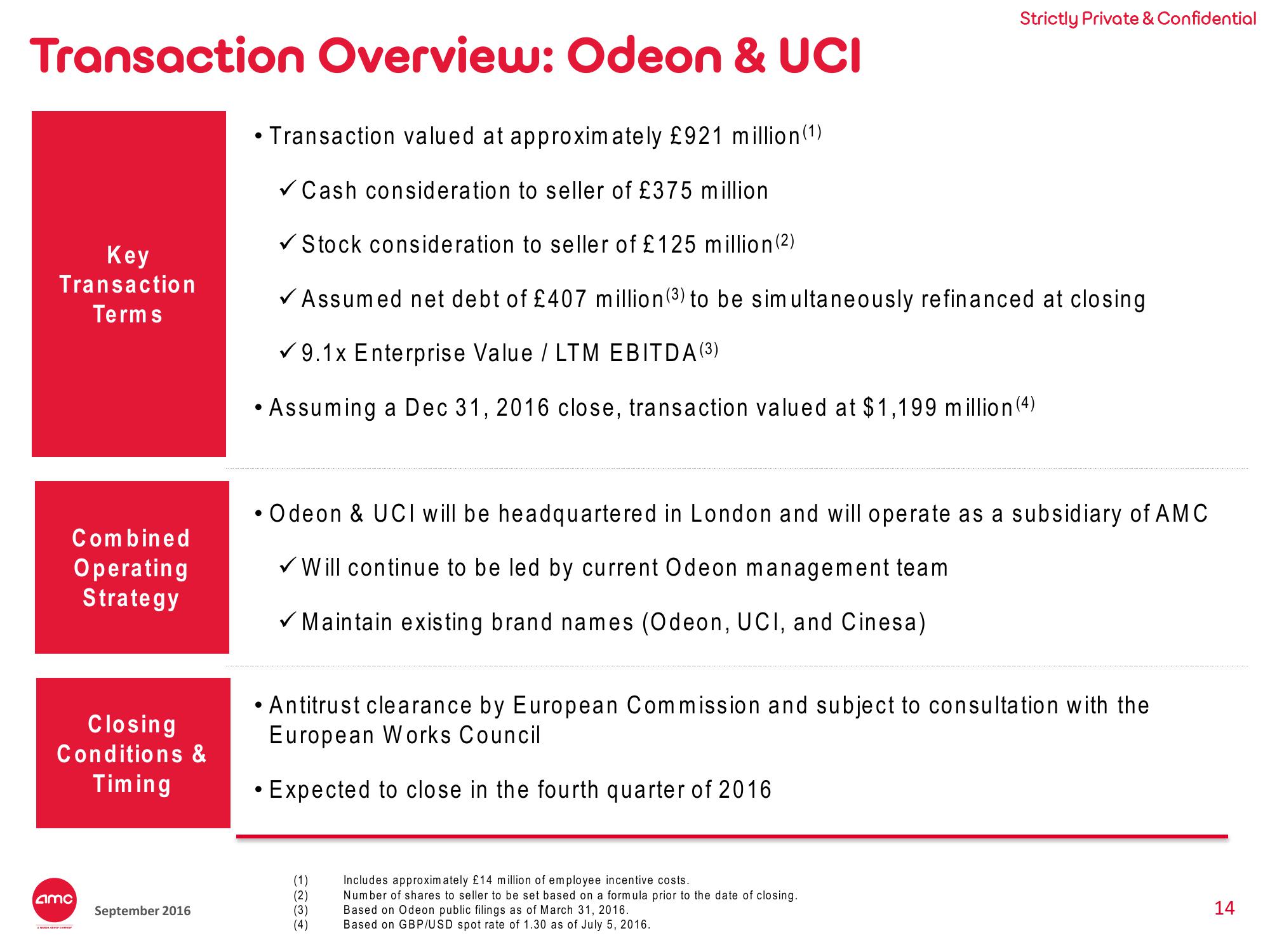

Key

Transaction

Terms

Combined

Operating

Strategy

Closing

Conditions &

Timing

amc

September 2016

• Transaction valued at approximately £921 million (1)

●

✓ Cash consideration to seller of £375 million

✓ Stock consideration to seller of £125 million (2)

✓ Assumed net debt of £407 million (3) to be simultaneously refinanced at closing

✓9.1x Enterprise Value / LTM EBITDA (3)

• Assuming a Dec 31, 2016 close, transaction valued at $1,199 million (4)

Strictly Private & Confidential

• Odeon & UCI will be headquartered in London and will operate as a subsidiary of AMC

✓Will continue to be led by current Odeon management team

✓ Maintain existing brand names (Odeon, UCI, and Cinesa)

• Antitrust clearance by European Commission and subject to consultation with the

European Works Council

• Expected to close in the fourth quarter of 2016

(1)

(3)

(4)

Includes approximately £14 million of employee incentive costs.

Number of shares to seller to be set based on a formula prior to the date of closing.

Based on Odeon public filings as of March 31, 2016.

Based on GBP/USD spot rate of 1.30 as of July 5, 2016.

14View entire presentation