Zoominfo Investor Day Presentation Deck

2022 ANALYST DAY> FINANCIAL PROFILE

Financial Profile

Current

Leverage

Target

Capitalization

Liquidity

Capital

Allocation

Z zoominfo

1.

2.

3.

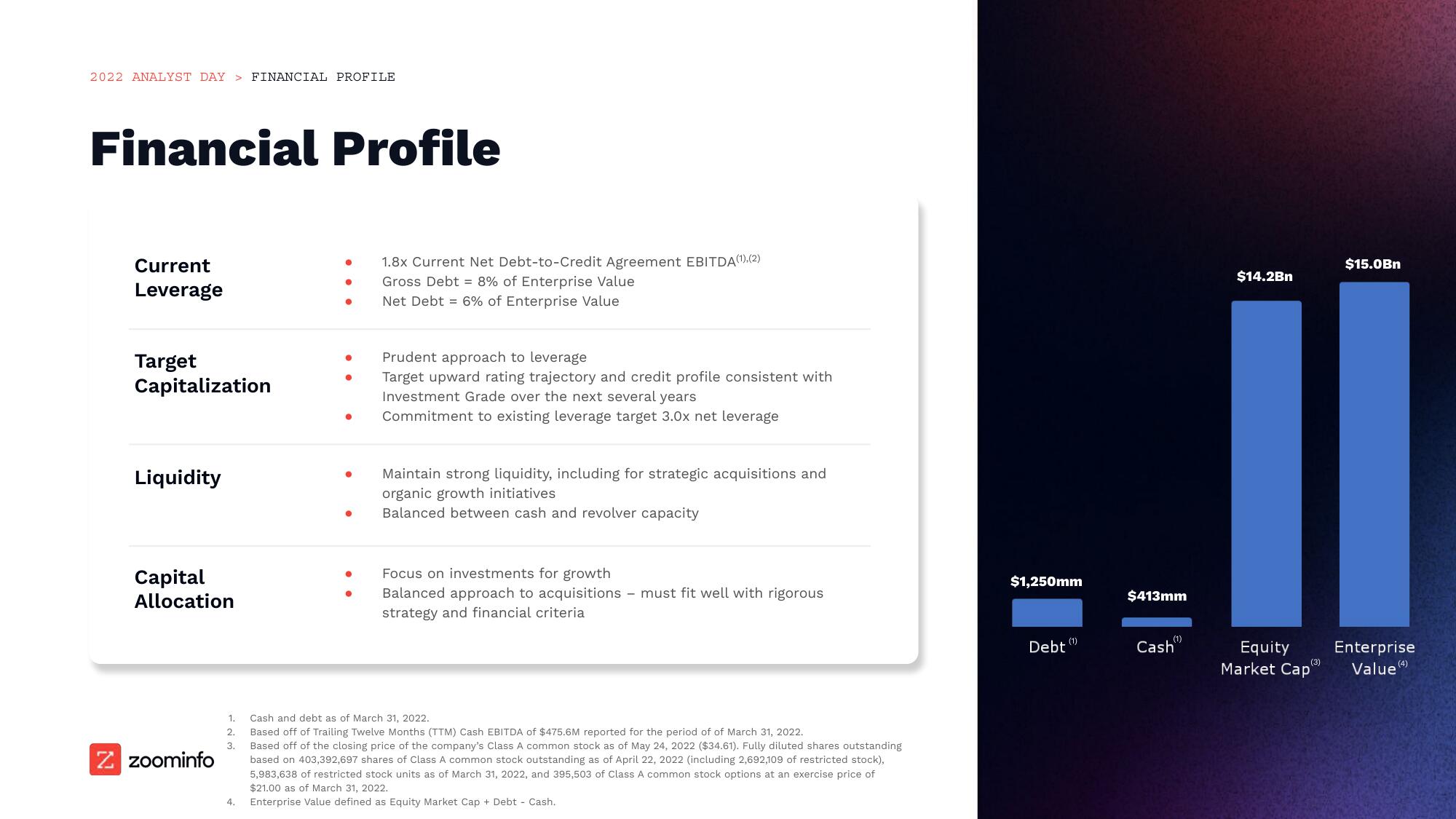

1.8x Current Net Debt-to-Credit Agreement EBITDA (1), (2)

Gross Debt = 8% of Enterprise Value

● Net Debt = 6% of Enterprise Value

3

●

Prudent approach to leverage

Target upward rating trajectory and credit profile consistent with

Investment Grade over the next several years

Commitment to existing leverage target 3.0x net leverage

Maintain strong liquidity, including for strategic acquisitions and

organic growth initiatives

● Balanced between cash and revolver capacity

Cash and debt as of March 31, 2022.

Based off of Trailing Twelve Months (TTM) Cash EBITDA of $475.6M reported for the period of of March 31, 2022.

Based off of the closing price of the company's Class A common stock as of May 24, 2022 ($34.61). Fully diluted shares outstanding

based on 403,392,697 shares of Class A common stock outstanding as of April 22, 2022 (including 2,692,109 of restricted stock),

5,983,638 of restricted stock units as of March 31, 2022, and 395,503 of Class A common stock options at an exercise price of

$21.00 as of March 31, 2022.

4. Enterprise Value defined as Equity Market Cap + Debt - Cash.

Focus on investments for growth

● Balanced approach to acquisitions - must fit well with rigorous

strategy and financial criteria

$1,250mm

Debt (¹)

$413mm

Cash"

$14.2Bn

Equity

(3)

Market Cap

$15.0Bn

Enterprise

Value (4)View entire presentation