Aston Martin Lagonda Results Presentation Deck

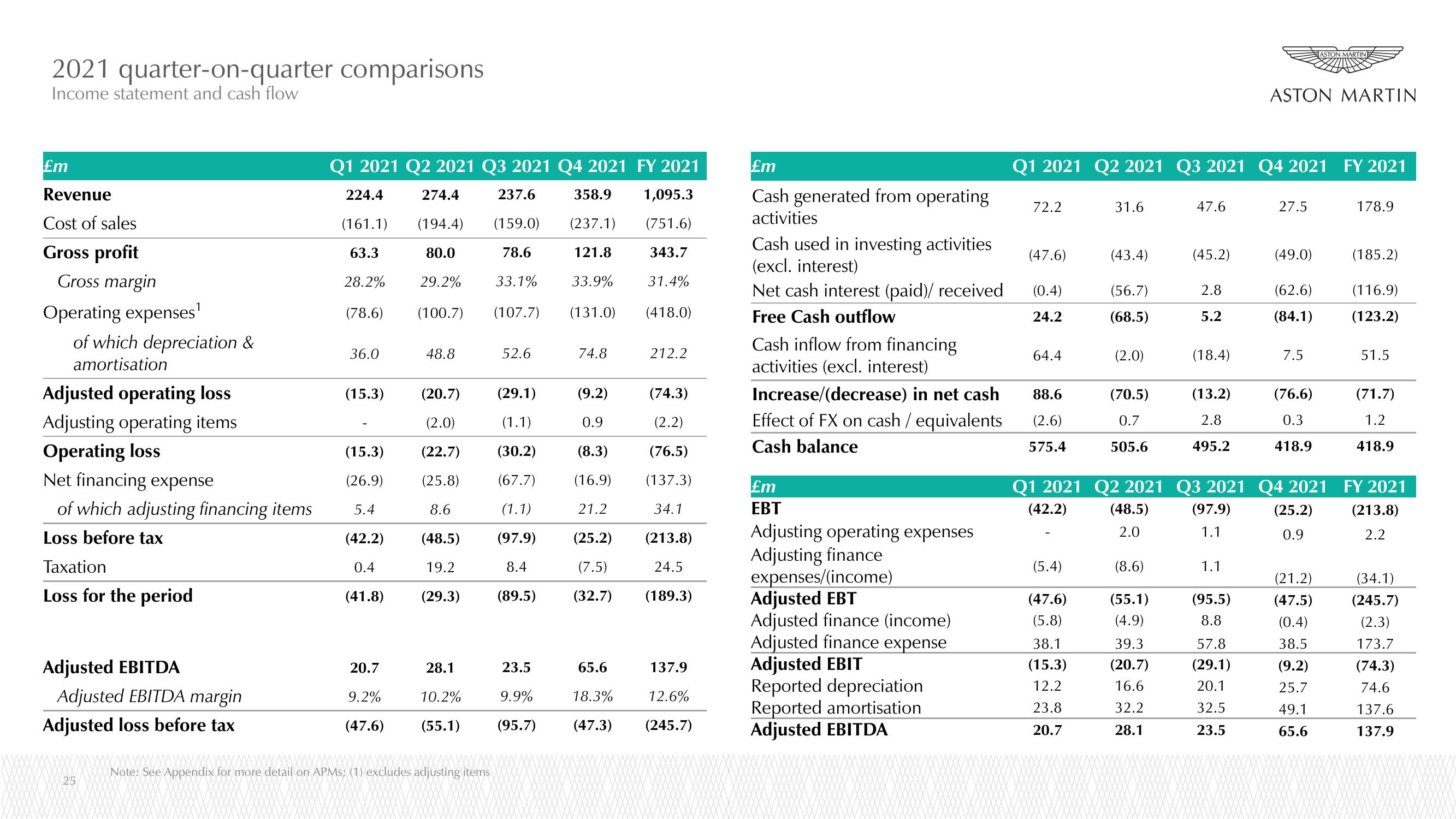

2021 quarter-on-quarter comparisons

Income statement and cash flow

£m

Revenue

Cost of sales

Gross profit

Gross margin

Operating expenses¹

of which depreciation &

amortisation

Adjusted operating loss

Adjusting operating items

Operating loss

Net financing expense

of which adjusting financing items

Loss before tax

Taxation

Loss for the period

Adjusted EBITDA

Adjusted EBITDA margin

Adjusted loss before tax

25

Q1 2021 Q2 2021 Q3 2021 Q4 2021 FY 2021

224.4

(161.1)

63.3

28.2%

274.4

(194.4)

80.0

29.2%

237.6

(159.0)

78.

33.1%

358.9

(237.1)

121.8

33.9%

(131.0)

1,095.3

(751.6)

343.7

31.4%

(418.0)

(78.6)

(100.7) (107.7)

36.0

(15.3)

(15.3)

(26.9)

5.4

(42.2)

0.4

(41.8)

20.7

9.2%

(47.6)

48.8

(20.7)

(2.0)

(22.7)

(25.8)

8.6

(48.5)

19.2

(29.3)

28.1

10.2%

(55.1)

Note: See Appendix for more detail on APMs; (1) excludes adjusting items

52.6

(29.1)

(1.1)

(30.2)

(67.7)

(1.1)

(97.9)

8.4

(89.5)

23.5

9.9%

(95.7)

74.8

(9.2)

0.9

(8.3)

(16.9)

21.2

(25.2)

(7.5)

(32.7)

65.6

18.3%

(47.3)

212.2

(74.3)

(2.2)

(76.5)

(137.3)

34.1

(213.8)

24.5

(189.3)

137.9

12.6%

(245.7)

£m

Cash generated from operating

activities

Cash used in investing activities

(excl. interest)

Net cash interest (paid)/ received

Free Cash outflow

Cash inflow from financing

activities (excl. interest)

Increase/(decrease) in net cash

Effect of FX on cash / equivalents

Cash balance

£m

EBT

Adjusting operating expenses

Adjusting finance

expenses/(income)

Adjusted EBT

Adjusted finance (income)

Adjusted finance expense

Adjusted EBIT

Reported depreciation

Reported amortisation

Adjusted EBITDA

72.2

Q1 2021 Q2 2021 Q3 2021 Q4 2021

(47.6)

(0.4)

24.2

64.4

88.6

(2.6)

575.4

(5.4)

(47.6)

(5.8)

31.6

38.1

(15.3)

12.2

23.8

20.7

(43.4)

(56.7)

(68.5)

(2.0)

(70.5)

0.7

505.6

(8.6)

(55.1)

(4.9)

47.6

39.3

(20.7)

16.6

32.2

28.1

(45.2)

2.8

5.2

(18.4)

(13.2)

2.8

495.2

1.1

(95.5)

8.8

ASTON MARTIN

Q1 2021 Q2 2021 Q3 2021 Q4 2021

(42.2)

(48.5)

(97.9)

(25.2)

2.0

1.1

0.9

57.8

(29.1)

20.1

32.5

23.5

27.5

(49.0)

(62.6)

(84.1)

7.5

(76.6)

0.3

418.9

ASTON MARTIN

(21.2)

(47.5)

(0.4)

38.5

(9.2)

25.7

49.1

65.6

FY 2021

178.9

(185.2)

(116.9)

(123.2)

51.5

(71.7)

1.2

418.9

FY 2021

(213.8)

2.2

(34.1)

(245.7)

(2.3)

173.7

(74.3)

74.6

137.6

137.9View entire presentation