Liberty Global Results Presentation Deck

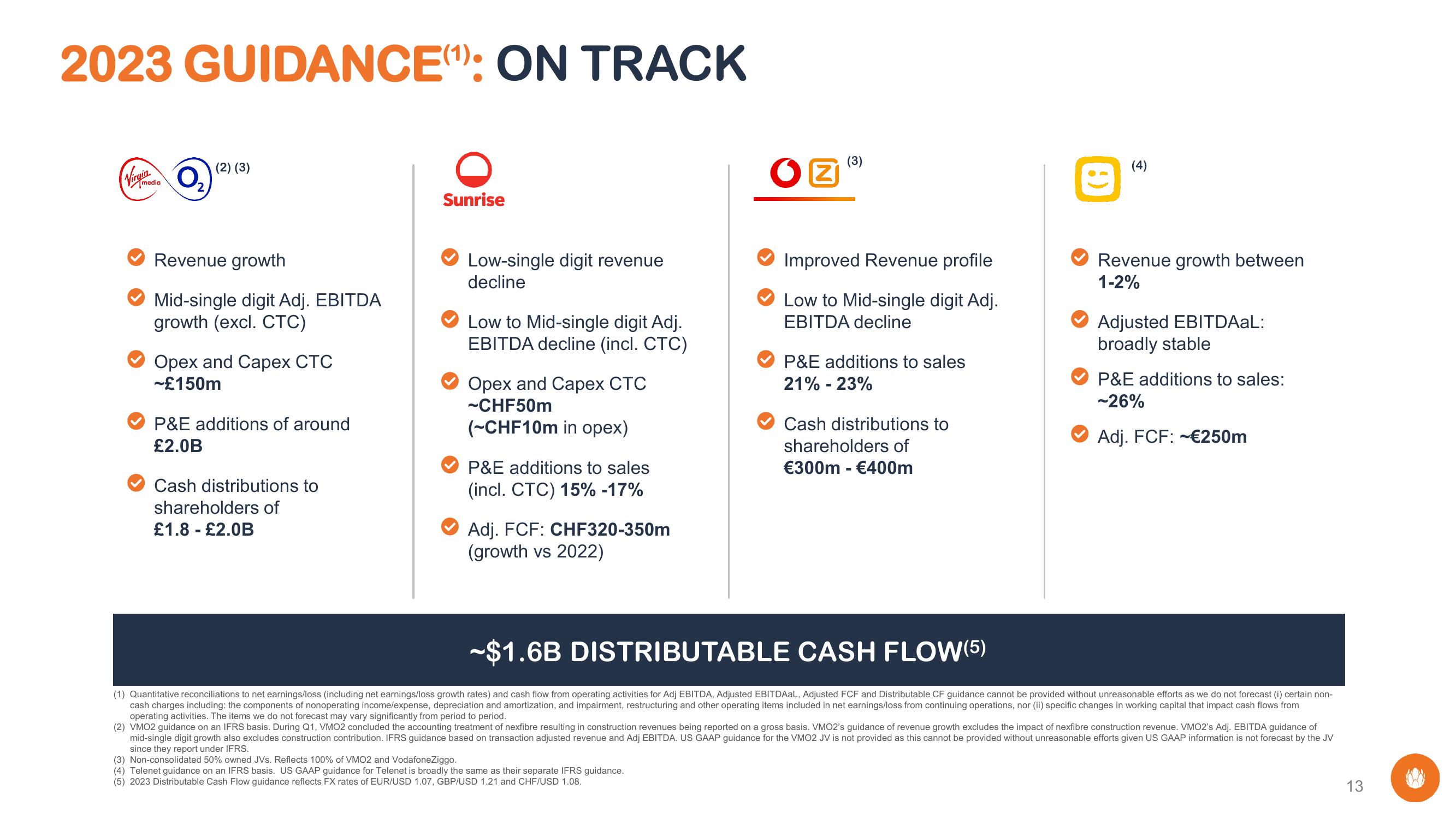

2023 GUIDANCE(): ON TRACK

media

(2) (3)

Revenue growth

Mid-single digit Adj. EBITDA

growth (excl. CTC)

Opex and Capex CTC

-£150m

P&E additions of around

£2.0B

Cash distributions to

shareholders of

£1.8 - £2.0B

Sunrise

Low-single digit revenue

decline

Low to Mid-single digit Adj.

EBITDA decline (incl. CTC)

Opex and Capex CTC

~CHF50m

(~CHF10m in opex)

P&E additions to sales

(incl. CTC) 15% -17%

Adj. FCF: CHF320-350m

(growth vs 2022)

OZ

Improved Revenue profile

Low to Mid-single digit Adj.

EBITDA decline

P&E additions to sales

21% -23%

Cash distributions to

shareholders of

€300m - €400m

(4)

Revenue growth between

1-2%

Adjusted EBITDAAL:

broadly stable

P&E additions to sales:

-26%

Adj. FCF: €250m

~$1.6B DISTRIBUTABLE CASH FLOW(5)

(1) Quantitative reconciliations to net earnings/loss (including net earnings/loss growth rates) and cash flow from operating activities for Adj EBITDA, Adjusted EBITDAAL, Adjusted FCF and Distributable CF guidance cannot be provided without unreasonable efforts as we do not forecast (i) certain non-

cash charges including: the components of nonoperating income/expense, depreciation and amortization, and impairment, restructuring and other operating items included in net earnings/loss from continuing operations, nor (ii) specific changes in working capital that impact cash flows from

operating activities. The items we do not forecast may vary significantly from period to period.

(2) VMO2 guidance on an IFRS basis. During Q1, VMO2 concluded the accounting treatment of nexfibre resulting in construction revenues being reported on a gross basis. VMO2's guidance of revenue growth excludes the impact of nexfibre construction revenue. VMO2's Adj. EBITDA guidance of

mid-single digit growth also excludes construction contribution. IFRS guidance based on transaction adjusted revenue and Adj EBITDA. US GAAP guidance for the VMO2 JV is not provided as this cannot be provided without unreasonable efforts given US GAAP information is not forecast by the JV

since they report under IFRS.

(3) Non-consolidated 50% owned JVs. Reflects 100% of VMO2 and VodafoneZiggo.

(4) Telenet guidance on an IFRS basis. US GAAP guidance for Telenet is broadly the same as their separate IFRS guidance.

(5) 2023 Distributable Cash Flow guidance reflects FX rates of EUR/USD 1.07, GBP/USD 1.21 and CHF/USD 1.08.

13View entire presentation